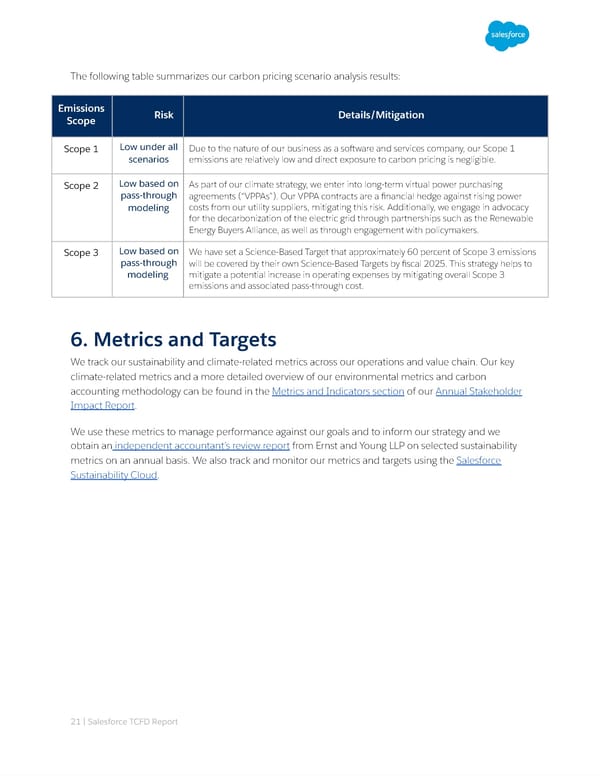

The following table summarizes our carbon pricing scenario analysis results: Emissions Risk Details/Mitigation Scope Low under all Due to the nature of our business as a software and services company, our Scope 1 Scope 1 scenarios emissions are relatively low and direct exposure to carbon pricing is negligible. Low based on As part of our climate strategy, we enter into long-term virtual power purchasing Scope 2 pass-through agreements (“VPPAs”). Our VPPA contracts are a financial hedge against rising power costs from our utility suppliers, mitigating this risk. Additionally, we engage in advocacy modeling for the decarbonization of the electric grid through partnerships such as the Renewable Energy Buyers Alliance, as well as through engagement with policymakers. Low based on We have set a Science-Based Target that approximately 60 percent of Scope 3 emissions Scope 3 pass-through will be covered by their own Science-Based Targets by fiscal 2025. This strategy helps to modeling mitigate a potential increase in operating expenses by mitigating overall Scope 3 emissions and associated pass-through cost. 6. Metrics and Targets We track our sustainability and climate-related metrics across our operations and value chain. Our key climate-related metrics and a more detailed overview of our environmental metrics and carbon accounting methodology can be found in the M etrics and Indicators section of our A nnual Stakeholder Impact Report. We use these metrics to manage performance against our goals and to inform our strategy and we obtain an independent accountant’s review report from Ernst and Young LLP on selected sustainability metrics on an annual basis. We also track and monitor our metrics and targets using the S alesforce Sustainability Cloud . 21 | Salesforce TCFD Report

Salesforce TCFD Report Page 20 Page 22

Salesforce TCFD Report Page 20 Page 22