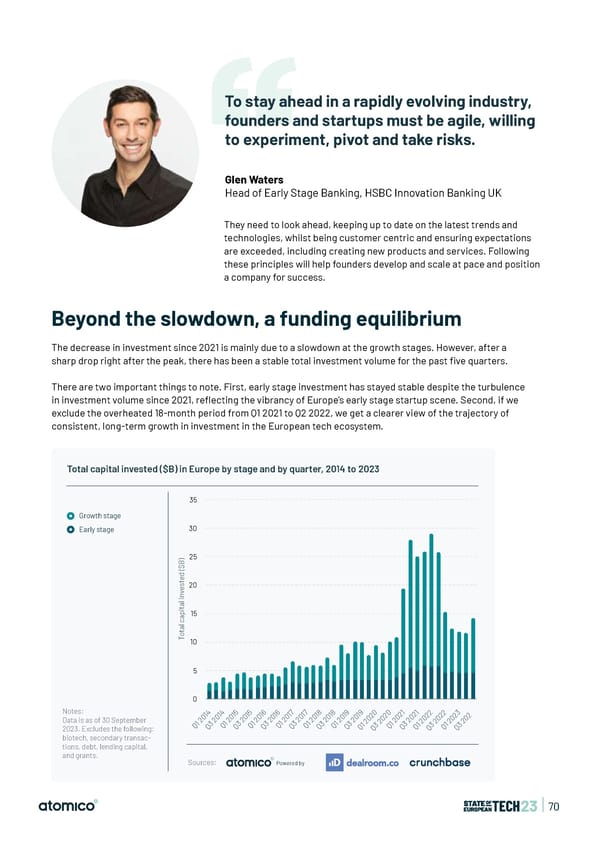

To stay ahead in a rapidly evolving industry, founders and startups must be agile, willing to experiment, pivot and take risks. Glen Waters Head of Early Stage Banking, HSBC Innovation Banking UK They need to look ahead, keeping up to date on the latest trends and technologies, whilst being customer centric and ensuring expectations are exceeded, including creating new products and services. Following these principles will help founders develop and scale at pace and position a company for success. Beyond the slowdown, a funding equilibrium The decrease in investment since 2021 is mainly due to a slowdown at the growth stages. However, after a sharp drop right after the peak, there has been a stable total investment volume for the past 昀椀ve quarters. There are two important things to note. First, early stage investment has stayed stable despite the turbulence in investment volume since 2021, re昀氀ecting the vibrancy of Europe’s early stage startup scene. Second, if we exclude the overheated 18-month period from Q1 2021 to Q2 2022, we get a clearer view of the trajectory of consistent, long-term growth in investment in the European tech ecosystem. Total capital invested ($B) in Europe by stage and by quarter, 2014 to 2023 35 Growth stage Early stage 30 ) 25 B $ ( d e t s 20 e v n i l a t i p 15 a c l a t o T 10 5 0 Notes: 4 4 15 5 6 6 17 17 8 8 9 9 0 0 1 1 2 2 3 1 1 0 1 1 1 0 0 1 1 1 1 2 2 2 2 2 2 2 2 Data is as of 30 September 0 0 2 0 0 0 2 2 0 0 0 0 0 0 0 0 0 0 0 0 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 1 3 Q1 3 Q1 3 Q1 3 1 3 1 3 1 3 1 3 1 3 1 3 2023. Excludes the following: Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q biotech, secondary transac- tions, debt, lending capital, and grants. Sources: Powered by | 70

State of European Tech | 2023 Page 69 Page 71

State of European Tech | 2023 Page 69 Page 71