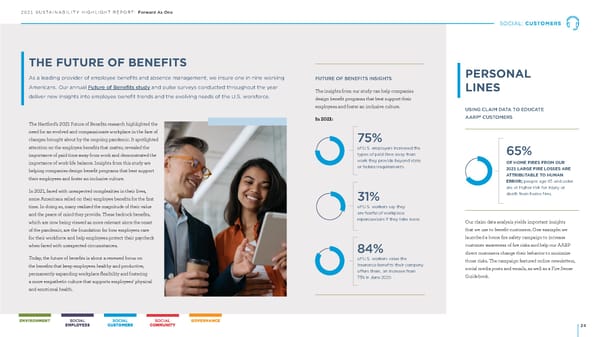

2021 SUSTAINABILITY HIGHLIGHT REPORT: Forward As One SOCIAL: CUSTOMERS 24 As a leading provider of employee benefits and absence management, we insure one in nine working Americans. Our annual Future of Benefits study and pulse surveys conducted throughout the year deliver new insights into employee benefit trends and the evolving needs of the U.S. workforce. THE FUTURE OF BENEFITS The Hartford’s 2021 Future of Benefits research highlighted the need for an evolved and compassionate workplace in the face of changes brought about by the ongoing pandemic It spotlighted attention on the employee benefits that matter, revealed the importance of paid time away from work and demonstrated the importance of work-life balance Insights from this study are helping companies design benefit programs that best support their employees and foster an inclusive culture In 2021, faced with unexpected complexities in their lives, some Americans relied on their employee benefits for the first time In doing so, many realized the magnitude of their value and the peace of mind they provide These bedrock benefits, which are now being viewed as more relevant since the onset of the pandemic, are the foundation for how employers care for their workforce and help employees protect their paycheck when faced with unexpected circumstances Today, the future of benefits is about a renewed focus on the benefits that keep employees healthy and productive, permanently expanding workplace flexibility and fostering a more empathetic culture that supports employees’ physical and emotional health 75 % of U.S. employers increased the types of paid time away from work they provide beyond state or federal requirements. 84 % of U.S. workers value the insurance benefits their company offers them, an increase from 73% in June 2020. 31 % of U.S. workers say they are fearful of workplace repercussions if they take leave. FUTURE OF BENEFITS INSIGHTS The insights from our study can help companies design benefit programs that best support their employees and foster an inclusive culture In 2021: PERSONAL LINES USING CLAIM DATA TO EDUCATE AARP ® CUSTOMERS Our claim data analysis yields important insights that we use to benefit customers One example: we launched a home fire safety campaign to increase customer awareness of fire risks and help our AARP direct customers change their behavior to minimize those risks The campaign featured online newsletters, social media posts and emails, as well as a Fire Sense Guidebook OF HOME FIRES FROM OUR 2021 LARGE FIRE LOSSES ARE ATTRIBUTABLE TO HUMAN ERROR; people age 65 and older are at higher risk for injury or death from home fires. 65 %

The Hartford Financial Sustainability Report Page 23 Page 25

The Hartford Financial Sustainability Report Page 23 Page 25