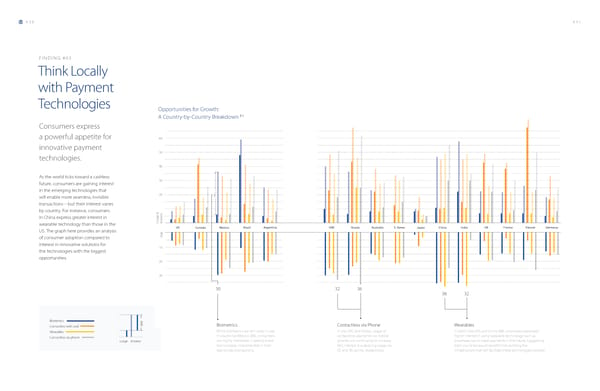

030 031 FINDING #03 Think Locally with Payment Technologies Opportunities for Growth: B.5 A Country-by-Country Breakdown Consumers express 65 65 a powerful appetite for 60 60 60 55 55 innovative payment 50 50 50 technologies. 45 45 40 40 40 35 35 As the world ticks toward a cashless 30 30 future, consumers are gaining interest 30 25 25 in the emerging technologies that G 20 20 ap will enable more seamless, invisible 20 15 15 transactions—but their interest varies 10 10 by country. For instance, consumers & & in China express greater interest in 5est 5 er nt Usage & usage interestI usage interest wearable technology than those in the 0 0 Brazil Argentina Brazil UAE ArgentinaRussia UAEAustralia Russia Australia India UK IndiaFrance UKPoland FranceGermany Poland Germany US. The graph here provides an analysis US Canada US Mexico Canada Mexico S. Korea Japan S. KoreaChina Japan China 0 0 gapap gap of consumer adoption compared to G 5 5 interest in innovative solutions for 10 10 10 the technologies with the biggest 15 15 opportunities. 20 20 20 25 25 30 30 30 35 35 40 40 30 32 36 38 32 Biometrics p Contactless with card ga Biometrics Contactless via Phone Wearables Wearables While biometrics are still rarely in use In the UAE and Russia, usage of In both India (32) and China (38), consumers expressed Contactless via phone in places like Mexico (30), consumers contactless payments via mobile higher interest in using wearable technology such as usage interest are highly interested in seeing these phones are continuing to increase. smartwatches to make payments in the future, suggesting technologies implemented in their Still, interest is outpacing usage by both countries would benefit from building the day-to-day transactions. 32 and 36 points, respectively. infrastructure that will facilitate these technologies soonest.

Visa: Innovations for a Cashless World Page 16 Page 18

Visa: Innovations for a Cashless World Page 16 Page 18