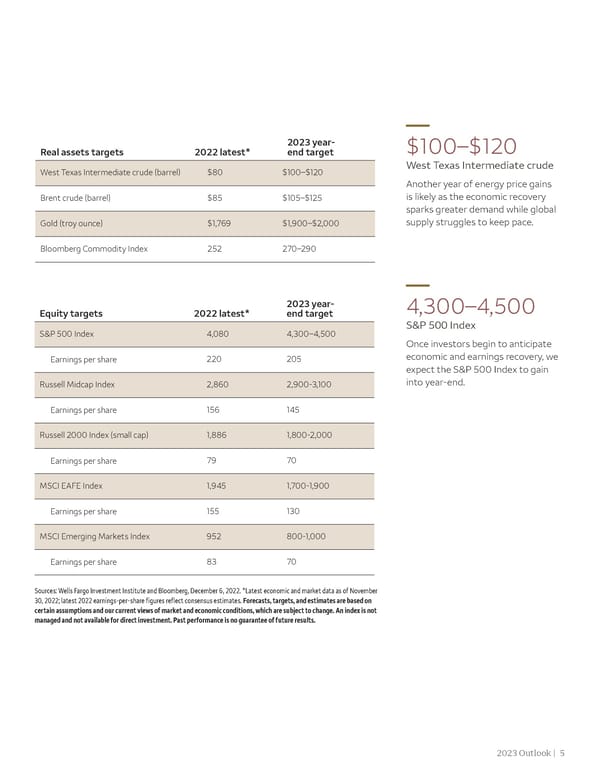

2023 year- $100–$120 Real assets targets 2022 latest* end target West Texas Intermediate crude (barrel) $80 $100–$120 West Texas Intermediate crude Another year of energy price gains Brent crude (barrel) $85 $105–$125 is likely as the economic recovery sparks greater demand while global Gold (troy ounce) $1,769 $1,900–$2,000 supply struggles to keep pace. Bloomberg Commodity Index 252 270–290 2023 year- 4,300–4,500 Equity targets 2022 latest* end target S&P 500 Index S&P 500 Index 4,080 4,300–4,500 Once investors begin to anticipate Earnings per share 220 205 economic and earnings recovery, we expect the S&P 500 Index to gain Russell Midcap Index 2,860 2,900-3,100 into year-end. Earnings per share 156 145 Russell 2000 Index (small cap) 1,886 1,800-2,000 Earnings per share 79 70 MSCI EAFE Index 1,945 1,700-1,900 Earnings per share 155 130 MSCI Emerging Markets Index 952 800-1,000 Earnings per share 83 70 Sources: Wells Fargo Investment Institute and Bloomberg, December 6, 2022. *Latest economic and market data as of November 30, 2022; latest 2022 earnings-per-share figures reflect consensus estimates. Forecasts, targets, and estimates are based on certain assumptions and our current views of market and economic conditions, which are subject to change. An index is not managed and not available for direct investment. Past performance is no guarantee of future results. 2023 Outlook | 5

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 4 Page 6

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 4 Page 6