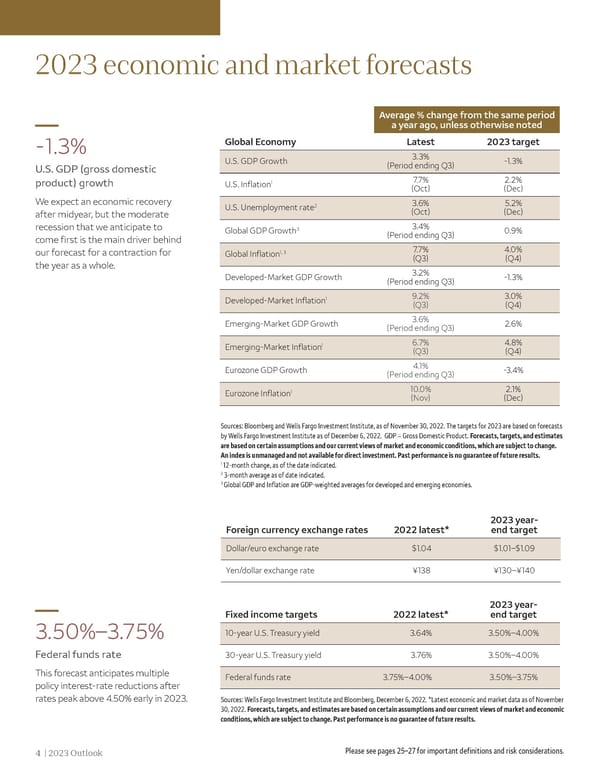

2023 economic and market forecasts Average % change from the same period a year ago, unless otherwise noted -1.3% Global Economy Latest 2023 target U.S. GDP Growth 3.3% -1.3% U.S. GDP (gross domestic (Period ending Q3) product) growth 1 7.7% 2.2% U.S. Inflation (Oct) (Dec) We expect an economic recovery U.S. Unemployment rate2 3.6% 5.2% after midyear, but the moderate (Oct) (Dec) recession that we anticipate to Global GDP Growth3 3.4% 0.9% come first is the main driver behind (Period ending Q3) our forecast for a contraction for 1, 3 7.7% 4.0% Global Inflation (Q3) (Q4) the year as a whole. 3.2% Developed-Market GDP Growth (Period ending Q3) -1.3% 1 9.2% 3.0% Developed-Market Inflation (Q3) (Q4) Emerging-Market GDP Growth 3.6% 2.6% (Period ending Q3) 1 6.7% 4.8% Emerging-Market Inflation (Q3) (Q4) Eurozone GDP Growth 4.1% -3.4% (Period ending Q3) 1 10.0% 2.1% Eurozone Inflation (Nov) (Dec) Sources: Bloomberg and Wells Fargo Investment Institute, as of November 30, 2022. The targets for 2023 are based on forecasts by Wells Fargo Investment Institute as of December 6, 2022. GDP = Gross Domestic Product. Forecasts, targets, and estimates are based on certain assumptions and our current views of market and economic conditions, which are subject to change. An index is unmanaged and not available for direct investment. Past performance is no guarantee of future results. 1 12-month change, as of the date indicated. 2 3-month average as of date indicated. 3 Global GDP and Inflation are GDP-weighted averages for developed and emerging economies. 2023 year- Foreign currency exchange rates 2022 latest* end target Dollar/euro exchange rate $1.04 $1.01–$1.09 Yen/dollar exchange rate ¥138 ¥130–¥140 2023 year- Fixed income targets 2022 latest* end target 3.50%–3.75% 10-year U.S. Treasury yield 3.64% 3.50%–4.00% Federal funds rate 30-year U.S. Treasury yield 3.76% 3.50%–4.00% This forecast anticipates multiple Federal funds rate 3.75%–4.00% 3.50%–3.75% policy interest-rate reductions after rates peak above 4.50% early in 2023. Sources: Wells Fargo Investment Institute and Bloomberg, December 6, 2022. *Latest economic and market data as of November 30, 2022. Forecasts, targets, and estimates are based on certain assumptions and our current views of market and economic conditions, which are subject to change. Past performance is no guarantee of future results. 4 | 2023 Outlook Please see pages 25–27 for important definitions and risk considerations.

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 3 Page 5

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 3 Page 5