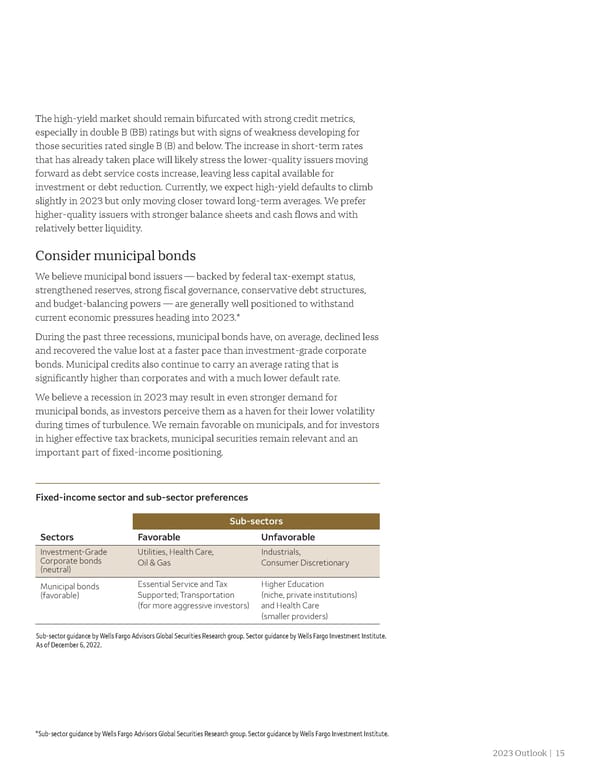

The high-yield market should remain bifurcated with strong credit metrics, especially in double B (BB) ratings but with signs of weakness developing for those securities rated single B (B) and below. The increase in short-term rates that has already taken place will likely stress the lower-quality issuers moving forward as debt service costs increase, leaving less capital available for investment or debt reduction. Currently, we expect high-yield defaults to climb slightly in 2023 but only moving closer toward long-term averages. We prefer higher-quality issuers with stronger balance sheets and cash flows and with relatively better liquidity. Consider municipal bonds We believe municipal bond issuers — backed by federal tax-exempt status, strengthened reserves, strong fiscal governance, conservative debt structures, and budget-balancing powers — are generally well positioned to withstand current economic pressures heading into 2023.* During the past three recessions, municipal bonds have, on average, declined less and recovered the value lost at a faster pace than investment-grade corporate bonds. Municipal credits also continue to carry an average rating that is significantly higher than corporates and with a much lower default rate. We believe a recession in 2023 may result in even stronger demand for municipal bonds, as investors perceive them as a haven for their lower volatility during times of turbulence. We remain favorable on municipals, and for investors in higher effective tax brackets, municipal securities remain relevant and an important part of fixed-income positioning. Fixed-income sector and sub-sector preferences Sub-sectors Sectors Favorable Unfavorable Investment-Grade Utilities, Health Care, Industrials, Corporate bonds Oil & Gas Consumer Discretionary (neutral) Municipal bonds Essential Service and Tax Higher Education (favorable) Supported; Transportation (niche, private institutions) (for more aggressive investors) and Health Care (smaller providers) Sub-sector guidance by Wells Fargo Advisors Global Securities Research group. Sector guidance by Wells Fargo Investment Institute. As of December 6, 2022. *Sub-sector guidance by Wells Fargo Advisors Global Securities Research group. Sector guidance by Wells Fargo Investment Institute. 2023 Outlook | 15

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 14 Page 16

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 14 Page 16