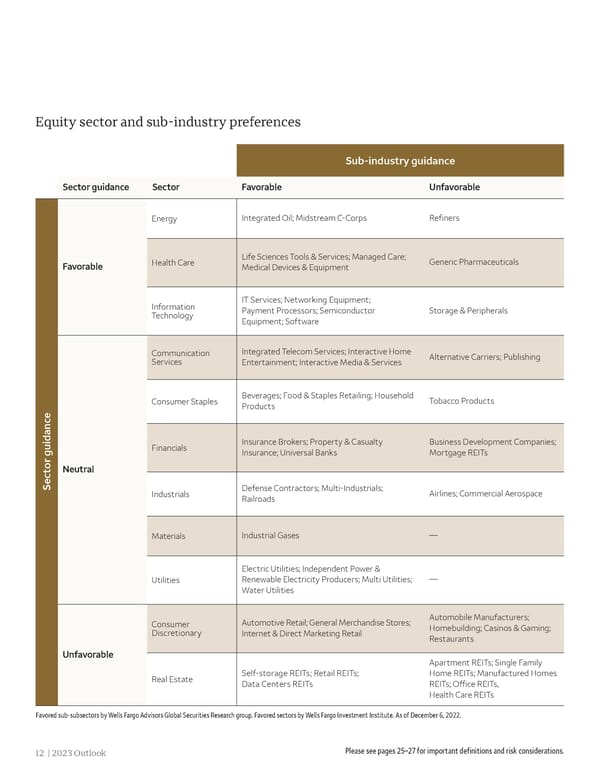

Equity sector and sub-industry preferences Sub-industry guidance Sector guidance Sector Favorable Unfavorable Energy Integrated Oil; Midstream C-Corps Refiners Health Care Life Sciences Tools & Services; Managed Care; Generic Pharmaceuticals Favorable Medical Devices & Equipment Information IT Services; Networking Equipment; Technology Payment Processors; Semiconductor Storage & Peripherals Equipment; Software Communication Integrated Telecom Services; Interactive Home Alternative Carriers; Publishing Services Entertainment; Interactive Media & Services Consumer Staples Beverages; Food & Staples Retailing; Household Tobacco Products Products Financials Insurance Brokers; Property & Casualty Business Development Companies; Insurance; Universal Banks Mortgage REITs Neutral Sector guidance Industrials Defense Contractors; Multi-Industrials; Airlines; Commercial Aerospace Railroads Materials Industrial Gases — Electric Utilities; Independent Power & Utilities Renewable Electricity Producers; Multi Utilities; — Water Utilities Consumer Automotive Retail; General Merchandise Stores; Automobile Manufacturers; Discretionary Internet & Direct Marketing Retail Homebuilding; Casinos & Gaming; Restaurants Unfavorable Apartment REITs; Single Family Real Estate Self-storage REITs; Retail REITs; Home REITs; Manufactured Homes Data Centers REITs REITs; Office REITs, Health Care REITs Favored sub-subsectors by Wells Fargo Advisors Global Securities Research group. Favored sectors by Wells Fargo Investment Institute. As of December 6, 2022. 12 | 2023 Outlook Please see pages 25–27 for important definitions and risk considerations.

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 11 Page 13

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 11 Page 13