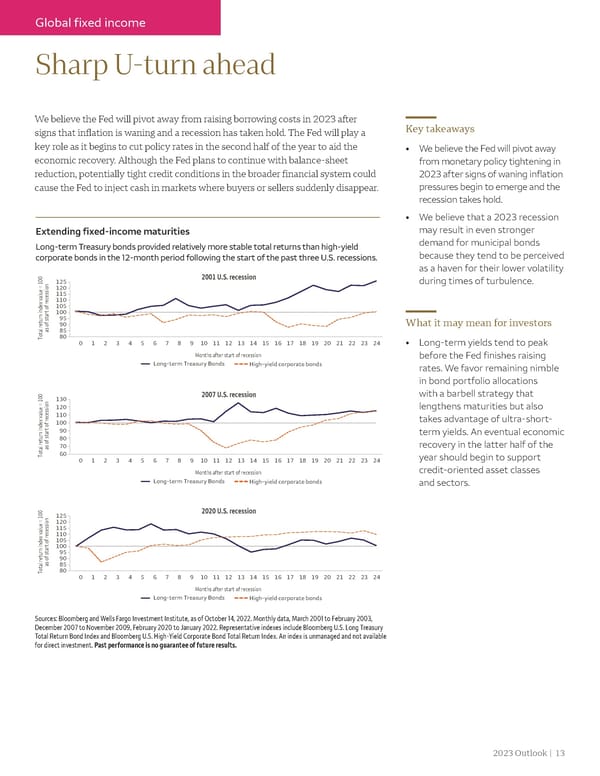

Global fixed income Sharp U-turn ahead We believe the Fed will pivot away from raising borrowing costs in 2023 after signs that inflation is waning and a recession has taken hold. The Fed will play a Key takeaways key role as it begins to cut policy rates in the second half of the year to aid the • We believe the Fed will pivot away economic recovery. Although the Fed plans to continue with balance-sheet from monetary policy tightening in reduction, potentially tight credit conditions in the broader financial system could 2023 after signs of waning inflation cause the Fed to inject cash in markets where buyers or sellers suddenly disappear. pressures begin to emerge and the recession takes hold. • We believe that a 2023 recession Extending fixed-income maturities may result in even stronger Long-term Treasury bonds provided relatively more stable total returns than high-yield demand for municipal bonds corporate bonds in the 12-month period following the start of the past three U.S. recessions. because they tend to be perceived as a haven for their lower volatility 125 2001 U.S. recession during times of turbulence. 120 115 110 105 100 95 What it may mean for investors 90 as of start of recession85 Total return index value = 10080 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 • Long-term yields tend to peak Months after start of recession before the Fed finishes raising Long-term Treasury Bonds High-yield corporate bonds rates. We favor remaining nimble in bond portfolio allocations 130 2007 U.S. recession with a barbell strategy that 120 lengthens maturities but also 110 takes advantage of ultra-short- 100 90 term yields. An eventual economic 80 recovery in the latter half of the as of start of recession70 Total return index value = 10060 year should begin to support 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Months after start of recession credit-oriented asset classes Long-term Treasury Bonds High-yield corporate bonds and sectors. 125 2020 U.S. recession 120 115 110 105 100 95 90 as of start of recession85 Total return index value = 10080 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Months after start of recession Long-term Treasury Bonds High-yield corporate bonds Sources: Bloomberg and Wells Fargo Investment Institute, as of October 14, 2022. Monthly data, March 2001 to February 2003, December 2007 to November 2009, February 2020 to January 2022. Representative indexes include Bloomberg U.S. Long Treasury Total Return Bond Index and Bloomberg U.S. High-Yield Corporate Bond Total Return Index. An index is unmanaged and not available for direct investment. Past performance is no guarantee of future results. 2023 Outlook | 13

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 12 Page 14

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 12 Page 14