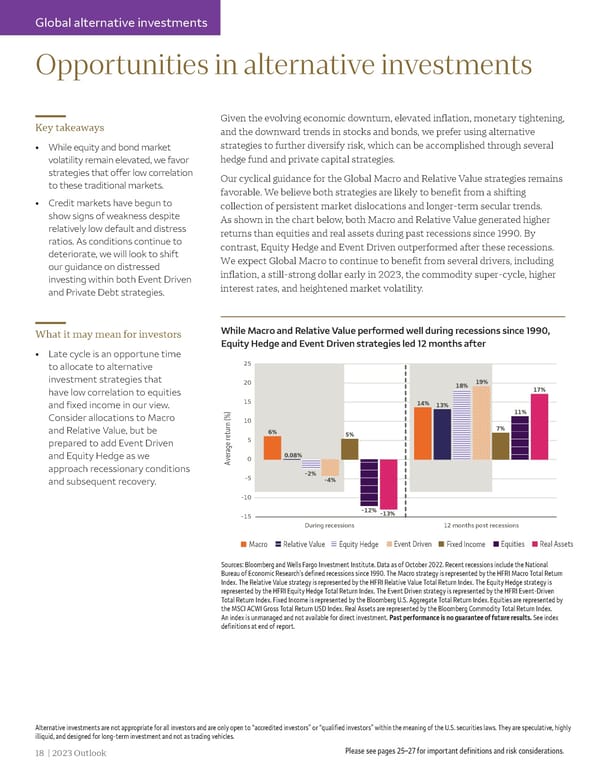

Global alternative investments Opportunities in alternative investments Key takeaways Given the evolving economic downturn, elevated inflation, monetary tightening, and the downward trends in stocks and bonds, we prefer using alternative • While equity and bond market strategies to further diversify risk, which can be accomplished through several volatility remain elevated, we favor hedge fund and private capital strategies. strategies that offer low correlation to these traditional markets. Our cyclical guidance for the Global Macro and Relative Value strategies remains favorable. We believe both strategies are likely to benefit from a shifting • Credit markets have begun to collection of persistent market dislocations and longer-term secular trends. show signs of weakness despite relatively low default and distress As shown in the chart below, both Macro and Relative Value generated higher ratios. As conditions continue to returns than equities and real assets during past recessions since 1990. By deteriorate, we will look to shift contrast, Equity Hedge and Event Driven outperformed after these recessions. our guidance on distressed We expect Global Macro to continue to benefit from several drivers, including investing within both Event Driven inflation, a still-strong dollar early in 2023, the commodity super-cycle, higher and Private Debt strategies. interest rates, and heightened market volatility. What it may mean for investors While Macro and Relative Value performed well during recessions since 1990, Equity Hedge and Event Driven strategies led 12 months after • Late cycle is an opportune time to allocate to alternative 25 investment strategies that 20 18% 19% have low correlation to equities 17% and fixed income in our view. 15 14% 13% Consider allocations to Macro 11% 10 and Relative Value, but be 6% 7% 5 5% prepared to add Event Driven and Equity Hedge as we 0 0.08% approach recessionary conditions Average return (%) -5 -2% and subsequent recovery. -4% -10 -12% -13% -15 During recessions 12 months post recessions Macro Relative Value Equity Hedge Event Driven Fixed Income Equities Real Assets Sources: Bloomberg and Wells Fargo Investment Institute. Data as of October 2022. Recent recessions include the National Bureau of Economic Research’s defined recessions since 1990. The Macro strategy is represented by the HFRI Macro Total Return Index. The Relative Value strategy is represented by the HFRI Relative Value Total Return Index. The Equity Hedge strategy is represented by the HFRI Equity Hedge Total Return Index. The Event Driven strategy is represented by the HFRI Event-Driven Total Return Index. Fixed Income is represented by the Bloomberg U.S. Aggregate Total Return Index. Equities are represented by the MSCI ACWI Gross Total Return USD Index. Real Assets are represented by the Bloomberg Commodity Total Return Index. An index is unmanaged and not available for direct investment. Past performance is no guarantee of future results. See index definitions at end of report. Alternative investments are not appropriate for all investors and are only open to “accredited investors” or “qualified investors” within the meaning of the U.S. securities laws. They are speculative, highly illiquid, and designed for long-term investment and not as trading vehicles. 18 | 2023 Outlook Please see pages 25–27 for important definitions and risk considerations.

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 17 Page 19

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 17 Page 19