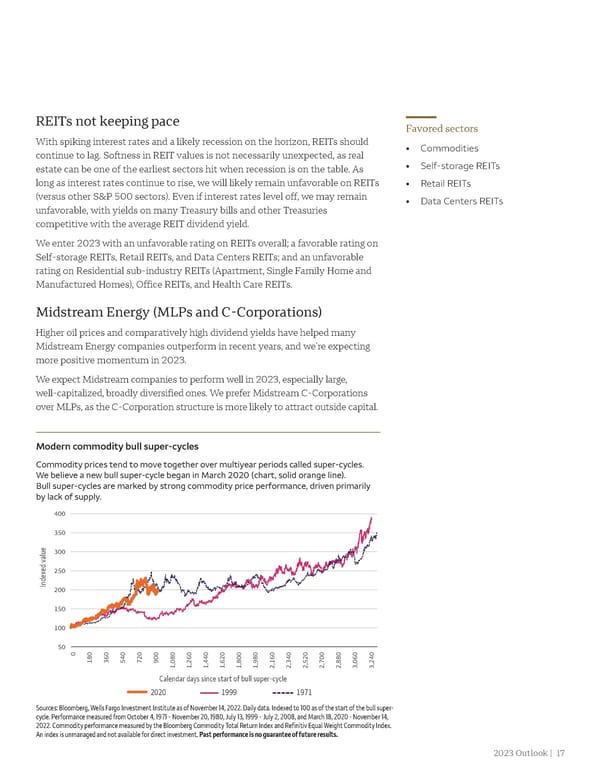

REITs not keeping pace Favored sectors With spiking interest rates and a likely recession on the horizon, REITs should • Commodities continue to lag. Softness in REIT values is not necessarily unexpected, as real estate can be one of the earliest sectors hit when recession is on the table. As • Self-storage REITs long as interest rates continue to rise, we will likely remain unfavorable on REITs • Retail REITs (versus other S&P 500 sectors). Even if interest rates level off, we may remain • Data Centers REITs unfavorable, with yields on many Treasury bills and other Treasuries competitive with the average REIT dividend yield. We enter 2023 with an unfavorable rating on REITs overall; a favorable rating on Self-storage REITs, Retail REITs, and Data Centers REITs; and an unfavorable rating on Residential sub-industry REITs (Apartment, Single Family Home and Manufactured Homes), Office REITs, and Health Care REITs. Midstream Energy (MLPs and C-Corporations) Higher oil prices and comparatively high dividend yields have helped many Midstream Energy companies outperform in recent years, and we’re expecting more positive momentum in 2023. We expect Midstream companies to perform well in 2023, especially large, well-capitalized, broadly diversified ones. We prefer Midstream C-Corporations over MLPs, as the C-Corporation structure is more likely to attract outside capital. Modern commodity bull super-cycles Commodity prices tend to move together over multiyear periods called super-cycles. We believe a new bull super-cycle began in March 2020 (chart, solid orange line). Bull super-cycles are marked by strong commodity price performance, driven primarily by lack of supply. 400 350 300 250 Indexed value200 150 100 50 0 180 360 540720 900 1,0801,2601,4401,6201,8001,9802,1602,3402,5202,7002,8803,0603,240 Calendar days since start of bull super-cycle 2020 1999 1971 Sources: Bloomberg, Wells Fargo Investment Institute as of November 14, 2022. Daily data. Indexed to 100 as of the start of the bull super- cycle. Performance measured from October 4, 1971 - November 20, 1980, July 13, 1999 - July 2, 2008, and March 18, 2020 - November 14, 2022. Commodity performance measured by the Bloomberg Commodity Total Return Index and Refinitiv Equal Weight Commodity Index. An index is unmanaged and not available for direct investment. Past performance is no guarantee of future results. 2023 Outlook | 17

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 16 Page 18

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 16 Page 18