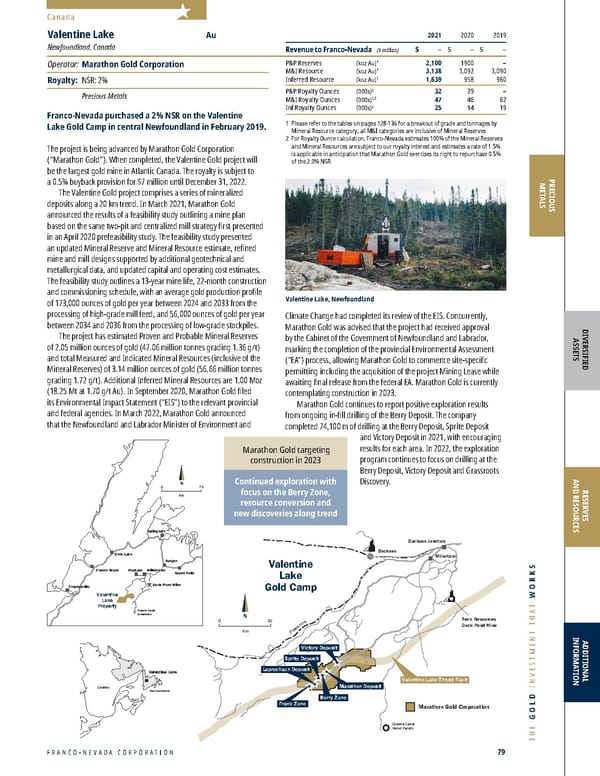

FRANCO-NEVADA CORPORATION 79 THE GOLD INVESTMENT THAT WORKS N Km O 75 Deer Lake Corner Brook Springdale Grand Falls Badger Stephenville Valentine Lake Property Buchans Millertown Duck Pond Mine Granite Canal Substation Teck Resources Duck Pond Mine Millertown Buchans Buchans Junction Valentine Lake Thrust Fault Marathon Deposit Leprechaun Deposit Victory Deposit Sprite Deposit Frank Zone N Km O 20 Valentine Lake Gold Camp Powerline Granite Canal Hydro Facility Marathon Gold Corporation Berry Zone N Km O 75 Deer Lake Corner Brook Springdale Grand Falls Badger Stephenville Valentine Lake Property Buchans Millertown Duck Pond Mine Granite Canal Substation Teck Resources Duck Pond Mine Millertown Buchans Buchans Junction Valentine Lake Thrust Fault Marathon Deposit Leprechaun Deposit Victory Deposit Sprite Deposit Frank Zone N Km O 20 Valentine Lake Gold Camp Powerline Granite Canal Hydro Facility Marathon Gold Corporation Berry Zone Valentine Lake Quebec Ontario Newfoundland Canada PRECIOUS METALS DIVERSIFIED ASSETS RESERVES AND RESOURCES ADDITIONAL INFORMATION 2021 2020 2019 Revenue to Franco-Nevada ($ million) $ – $ – $ – P&P Reserves (koz Au) 1 2,100 1900 – M&I Resource (koz Au) 1 3,138 3,092 3,090 Inferred Resource (koz Au) 1 1,639 958 960 P&P Royalty Ounces (000s) 2 32 29 – M&I Royalty Ounces (000s) 1,2 47 46 62 Inf Royalty Ounces (000s) 2 25 14 19 1 Please r efer to the tables on pages 128-136 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Ro yalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Reserves and Mineral Resources are subject to our royalty interest and estimates a rate of 1.5% is applicable in anticipation that Marathon Gold exercises its right to repurchase 0.5% of the 2.0% NSR Valentine Lake Au Newfoundland, Canada Operator: Marathon Gold Corporation Royalty: NSR: 2% Precious Metals Franco-Nevada purchased a 2% NSR on the Valentine Lake Gold Camp in central Newfoundland in February 2019. The project is being advanced by Marathon Gold Corporation (“Marathon Gold”). When completed, the Valentine Gold project will be the largest gold mine in Atlantic Canada. The royalty is subject to a 0.5% buyback provision for $7 million until December 31, 2022. The V alentine Gold project comprises a series of mineralized deposits along a 20 km trend. In March 2021, Marathon Gold announced the results of a feasibility study outlining a mine plan based on the same two-pit and centralized mill strategy first presented in an April 2020 prefeasibility study. The feasibility study presented an updated Mineral Reserve and Mineral Resource estimate, refined mine and mill designs supported by additional geotechnical and metallurgical data, and updated capital and operating cost estimates. The feasibility study outlines a 13-year mine life, 22-month construction and commissioning schedule, with an average gold production profile of 173,000 ounces of gold per year between 2024 and 2033 from the processing of high-grade mill feed, and 56,000 ounces of gold per year between 2034 and 2036 from the processing of low-grade stockpiles. The pr oject has estimated Proven and Probable Mineral Reserves of 2.05 million ounces of gold (47.06 million tonnes grading 1.36 g/t) and total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.14 million ounces of gold (56.66 million tonnes grading 1.72 g/t). Additional Inferred Mineral Resources are 1.00 Moz (18.25 Mt at 1.70 g/t Au). In September 2020, Marathon Gold filed its Environmental Impact Statement (“EIS”) to the relevant provincial and federal agencies. In March 2022, Marathon Gold announced that the Newfoundland and Labrador Minister of Environment and Climate Change had completed its review of the EIS. Concurrently, Marathon Gold was advised that the project had received approval by the Cabinet of the Government of Newfoundland and Labrador, marking the completion of the provincial Environmental Assessment (“EA”) process, allowing Marathon Gold to commence site-specific permitting including the acquisition of the project Mining Lease while awaiting final release from the federal EA. Marathon Gold is currently contemplating construction in 2023. Mar athon Gold continues to report positive exploration results from ongoing in-fill drilling of the Berry Deposit. The company completed 74,100 m of drilling at the Berry Deposit, Sprite Deposit and Victory Deposit in 2021, with encouraging results for each area. In 2022, the exploration program continues to focus on drilling at the Berry Deposit, Victory Deposit and Grassroots Discovery. Marathon Gold targeting construction in 2023 Continued exploration with focus on the Berry Zone, resource conversion and new discoveries along trend Valentine Lake, Newfoundland

Franco-Nevada 2022 Asset Handbook Page 78 Page 80

Franco-Nevada 2022 Asset Handbook Page 78 Page 80