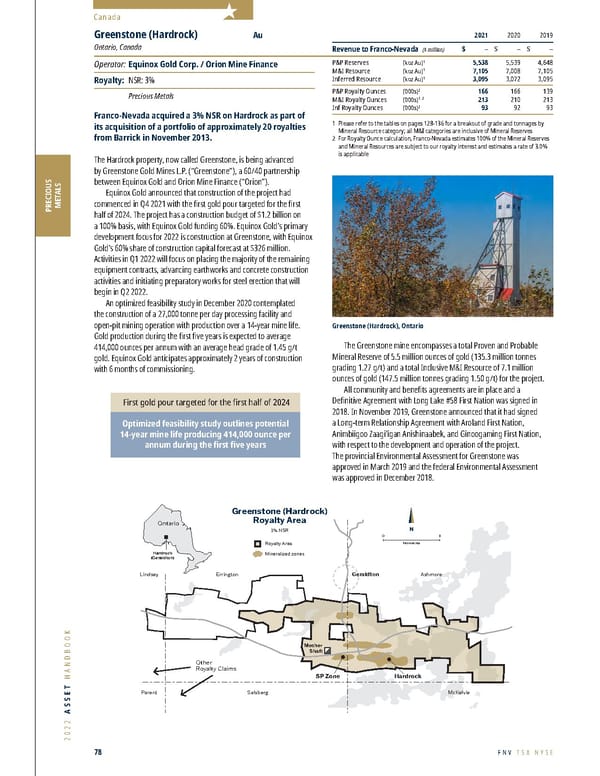

2022 ASSET HANDBOOK 78 FNV TSX NYSE 2021 2020 2019 Revenue to Franco-Nevada ($ million) $ – $ – $ – P&P Reserves (koz Au) 1 5,538 5,539 4,648 M&I Resource (koz Au) 1 7,105 7,008 7,105 Inferred Resource (koz Au) 1 3,095 3,072 3,095 P&P Royalty Ounces (000s) 2 166 166 139 M&I Royalty Ounces (000s) 1, 2 213 210 213 Inf Royalty Ounces (000s) 2 93 92 93 1 Please r efer to the tables on pages 128-136 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Ro yalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Reserves and Mineral Resources are subject to our royalty interest and estimates a rate of 3.0% is applicable Greenstone (Hardrock) Au Ontario, Canada Operator: Equinox Gold Corp. / Orion Mine Finance Royalty: NSR: 3% Precious Metals Franco-Nevada acquired a 3% NSR on Hardrock as part of its acquisition of a portfolio of approximately 20 royalties from Barrick in November 2013. The Hardrock property, now called Greenstone, is being advanced by Greenstone Gold Mines L.P. (“Greenstone”), a 60/40 partnership between Equinox Gold and Orion Mine Finance (“Orion”). Equino x Gold announced that construction of the project had commenced in Q4 2021 with the first gold pour targeted for the first half of 2024. The project has a construction budget of $1.2 billion on a 100% basis, with Equinox Gold funding 60%. Equinox Gold’s primary development focus for 2022 is construction at Greenstone, with Equinox Gold’s 60% share of construction capital forecast at $326 million. Activities in Q1 2022 will focus on placing the majority of the remaining equipment contracts, advancing earthworks and concrete construction activities and initiating preparatory works for steel erection that will begin in Q2 2022. An optimized feasibility study in December 2020 contemplated the construction of a 27,000 tonne per day processing facility and open-pit mining operation with production over a 14-year mine life. Gold production during the first five years is expected to average 414,000 ounces per annum with an average head grade of 1.45 g/t gold. Equinox Gold anticipates approximately 2 years of construction with 6 months of commissioning. Canada First gold pour targeted for the first half of 2024 Optimized feasibility study outlines potential 14-year mine life producing 414,000 ounce per annum during the first five years PRECIOUS METALS Salsberg Ashmore Greenstone (Hardrock) Royalty Area 3% NSR McKelvie Lindsey Parent N Kilometres 0 3 Errington Ontario Hardrock (Geraldton) Royalty Area Mineralized zones Mosher Sha SP Zone Hardrock Geraldton Other Royalty Claims The Gr eenstone mine encompasses a total Proven and Probable Mineral Reserve of 5.5 million ounces of gold (135.3 million tonnes grading 1.27 g/t) and a total Inclusive M&I Resource of 7.1 million ounces of gold (147.5 million tonnes grading 1.50 g/t) for the project. All community and benefits agr eements are in place and a Definitive Agreement with Long Lake #58 First Nation was signed in 2018. In November 2019, Greenstone announced that it had signed a Long-term Relationship Agreement with Aroland First Nation, Animbiigoo Zaagi’igan Anishinaabek, and Ginoogaming First Nation, with respect to the development and operation of the project. The provincial Environmental Assessment for Greenstone was approved in March 2019 and the federal Environmental Assessment was approved in December 2018. Greenstone (Hardrock), Ontario

Franco-Nevada 2022 Asset Handbook Page 77 Page 79

Franco-Nevada 2022 Asset Handbook Page 77 Page 79