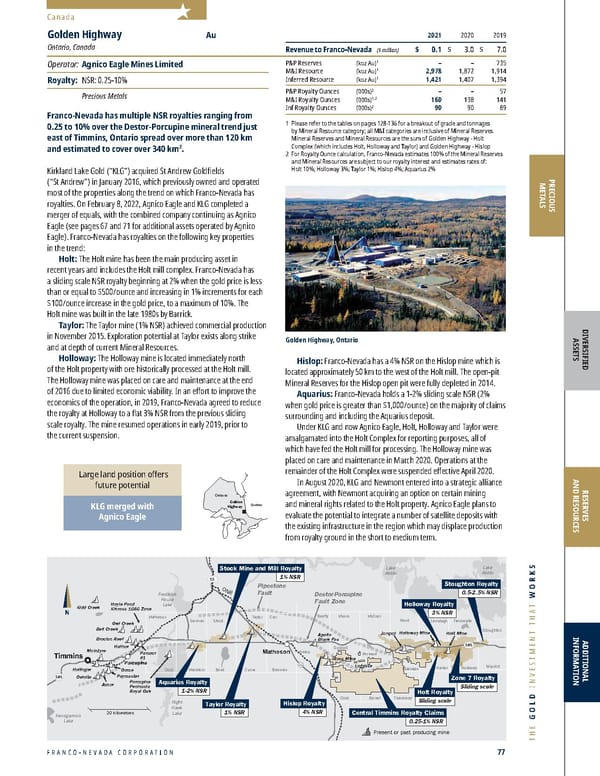

FRANCO-NEVADA CORPORATION 77 THE GOLD INVESTMENT THAT WORKS Canada PRECIOUS METALS DIVERSIFIED ASSETS RESERVES AND RESOURCES ADDITIONAL INFORMATION Large land position offers future potential KLG merged with Agnico Eagle 2021 2020 2019 Revenue to Franco-Nevada ($ million) $ 0.1 $ 3.0 $ 7.0 P&P Reserves (koz Au) 1 – – 735 M&I Resource (koz Au) 1 2,978 1,872 1,914 Inferred Resource (koz Au) 1 1,421 1,407 1,394 P&P Royalty Ounces (000s) 2 – – 57 M&I Royalty Ounces (000s) 1, 2 160 138 141 Inf Royalty Ounces (000s) 2 90 90 89 1 Please r efer to the tables on pages 128-136 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves. Mineral Reserves and Mineral Resources are the sum of Golden Highway - Holt Complex (which includes Holt, Holloway and Taylor) and Golden Highway - Hislop 2 For Ro yalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Reserves and Mineral Resources are subject to our royalty interest and estimates rates of: Holt 10%; Holloway 3%; Taylor 1%; Hislop 4%; Aquarius 2% Golden Highway Au Ontario, Canada Operator: Agnico Eagle Mines Limited Royalty: NSR: 0.25-10% Precious Metals Franco-Nevada has multiple NSR royalties ranging from 0.25 to 10% over the Destor-Porcupine mineral trend just east of Timmins, Ontario spread over more than 120 km and estimated to cover over 340 km 2 . Kirkland Lake Gold (“KLG”) acquired St Andrew Goldfields (“St Andrew”) in January 2016, which previously owned and operated most of the properties along the trend on which Franco-Nevada has royalties. On February 8, 2022, Agnico Eagle and KLG completed a merger of equals, with the combined company continuing as Agnico Eagle (see pages 67 and 71 for additional assets operated by Agnico Eagle). Franco-Nevada has royalties on the following key properties in the trend: Holt: The Holt mine has been the main producing asset in recent years and includes the Holt mill complex. Franco-Nevada has a sliding scale NSR royalty beginning at 2% when the gold price is less than or equal to $500/ounce and increasing in 1% increments for each $100/ounce increase in the gold price, to a maximum of 10%. The Holt mine was built in the late 1980s by Barrick. Taylor: The Taylor mine (1% NSR) achieved commercial production in November 2015. Exploration potential at Taylor exists along strike and at depth of current Mineral Resources. Holloway: The Holloway mine is located immediately north of the Holt property with ore historically processed at the Holt mill. The Holloway mine was placed on care and maintenance at the end of 2016 due to limited economic viability. In an effort to improve the economics of the operation, in 2019, Franco-Nevada agreed to reduce the royalty at Holloway to a flat 3% NSR from the previous sliding scale royalty. The mine resumed operations in early 2019, prior to the current suspension. 1% NSR 1-2% NSR 1% NSR 4% NSR 0.25-1% NSR 101 20 kilometres Present or past producing mine Stoughton Stock Mine and Mill Royalty Matheson Porcupine Timmins Lake Abitibi Frederick House Lake Night Hawk Lake Kenogamisis Lake Holloway Mine Holt Mine Jonpol Ross Mine Apollo Black Fox Taylor Royalty Ludgate Kidd Creek Porcupine Peninsula Royal Oak Bell Creek Owl Creek Hoyle Pond Kinross 1060 Zone Broulan Reef Delnite Aunor Paymaster Dome McIntyre Hollinger Hallnor Pamour #1 Matheson German Stock Taylor Cody Macklem Bond Currie Carr Beatty Bowman Hislop Guibord 11 ONR Destor-Porcupine Fault Zone Pipestone Fault Cook Barnet Thackeray Harker Garrison Rand Michaud Munro McCool Aquarius Royalty Hislop Royalty Frecheville Holt Royalty Lamplugh Lake Abitibi 101 11 Marriot Central Timmins Royalty Claims Holloway Royalty Sliding scale 3% NSR Zone 7 Royalty Sliding scale Holloway 0.5-2.5% NSR Stoughton Royalty N Golden Highway Quebec Ontario Hislop: Franco-Nevada has a 4% NSR on the Hislop mine which is located approximately 50 km to the west of the Holt mill. The open-pit Mineral Reserves for the Hislop open pit were fully depleted in 2014. Aquarius: Franco-Nevada holds a 1-2% sliding scale NSR (2% when gold price is greater than $1,000/ounce) on the majority of claims surrounding and including the Aquarius deposit. Under KL G and now Agnico Eagle, Holt, Holloway and Taylor were amalgamated into the Holt Complex for reporting purposes, all of which have fed the Holt mill for processing. The Holloway mine was placed on care and maintenance in March 2020. Operations at the remainder of the Holt Complex were suspended effective April 2020. In August 2020, KL G and Newmont entered into a strategic alliance agreement, with Newmont acquiring an option on certain mining and mineral rights related to the Holt property. Agnico Eagle plans to evaluate the potential to integrate a number of satellite deposits with the existing infrastructure in the region which may displace production from royalty ground in the short to medium term. Golden Highway, Ontario

Franco-Nevada 2022 Asset Handbook Page 76 Page 78

Franco-Nevada 2022 Asset Handbook Page 76 Page 78