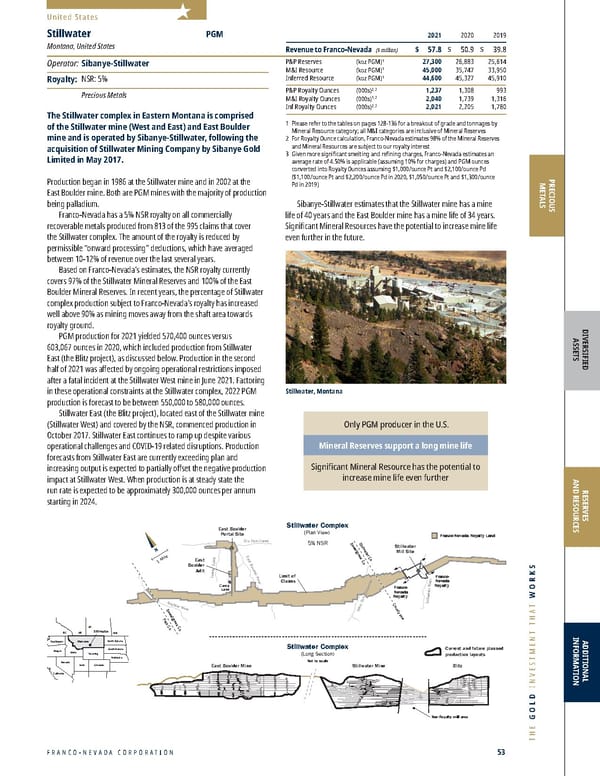

FRANCO-NEVADA CORPORATION 53 THE GOLD INVESTMENT THAT WORKS N Stillwater Complex (Plan View) 5% NSR Franco-Nevada Royalty Land Franco- Nevada Royalty Franco- Nevada Royalty East Boulder Portal Site East Boulder Adit Stillwater Mill Site Camp Lake Boulder River East Boulder River Dr y Fork Creek Lewis Gulch West Fork Stillwater Stillwater River Limit of Claims Sweetgrass Co. Park Co. Stillwater Co. Sweetgrass Co. 1 Mile County line Stillwater Complex (Long Section) Not to scale Current and future planned production layouts Non-Royalty mill area Blitz Stillwater Mine East Boulder Mine Stillwater Wyoming Washington BC AB SK MB North Dakota Nebraska Nevada Oregon Idaho Utah California Colorado Montana South Dakota Millmerran Red October Henty Mt Keith Duketon Yandal (Bronzewing/Julius) King Vol Bowen Basin South Kalgoorlie (Mt Martin) Flying Fox Sterling Robinson Fire Creek Bald Mountain Marigold Midas Goldstrike Gold Quarry South Arturo Hollister Nevada Australia Subika (Ahafo) Tasiast Sabodala Edikan MWS Perama Hill Kiziltepe Karma Sissingue Pandora Castle Mountain Mesquite Nevada Stibnite Gold Franco-Nevada Australia Office Agate Creek White Dam Séguéla Edna May Higginsville (Lake Cowan) Aphrodite Matilda (Wiluna) Agnew (Vivien) South Kalgoorlie (New Celebration/ Mt Marion Lithium) Cue Gold (Day Dawn) Agi Dagi ̆ ̆ Producing Advanced Producing (Energy) Stillwater Granite Creek (Pinson) Producing Advanced PRECIOUS METALS DIVERSIFIED ASSETS RESERVES AND RESOURCES ADDITIONAL INFORMATION United States 2021 2020 2019 Revenue to Franco-Nevada ($ million) $ 57.8 $ 50.9 $ 39.8 P&P Reserves (koz PGM) 1 27,300 26,883 25,614 M&I Resource (koz PGM) 1 45,000 35,747 33,950 Inferred Resource (koz PGM) 1 44,600 45,327 45,910 P&P Royalty Ounces (000s) 2, 3 1,237 1,308 993 M&I Royalty Ounces (000s) 1, 3 2,040 1,739 1,316 Inf Royalty Ounces (000s) 2, 3 2,021 2,205 1,780 1 Please r efer to the tables on pages 128-136 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Ro yalty Ounce calculation, Franco-Nevada estimates 98% of the Mineral Reserves and Mineral Resources are subject to our royalty interest 3 Given mor e significant smelting and refining charges, Franco-Nevada estimates an average rate of 4.50% is applicable (assuming 10% for charges) and PGM ounces converted into Royalty Ounces assuming $1,000/ounce Pt and $2,100/ounce Pd ($1,100/ounce Pt and $2,200/ounce Pd in 2020, $1,050/ounce Pt and $1,300/ounce Pd in 2019) The Stillwater complex in Eastern Montana is comprised of the Stillwater mine (West and East) and East Boulder mine and is operated by Sibanye-Stillwater, following the acquisition of Stillwater Mining Company by Sibanye Gold Limited in May 2017. Production began in 1986 at the Stillwater mine and in 2002 at the East Boulder mine. Both are PGM mines with the majority of production being palladium. Fr anco-Nevada has a 5% NSR royalty on all commercially recoverable metals produced from 813 of the 995 claims that cover the Stillwater complex. The amount of the royalty is reduced by permissible “onward processing” deductions, which have averaged between 10-12% of revenue over the last several years. Based on Fr anco-Nevada’s estimates, the NSR royalty currently covers 97% of the Stillwater Mineral Reserves and 100% of the East Boulder Mineral Reserves. In recent years, the percentage of Stillwater complex production subject to Franco-Nevada’s royalty has increased well above 90% as mining moves away from the shaft area towards royalty ground. PGM pr oduction for 2021 yielded 570,400 ounces versus 603,067 ounces in 2020, which included production from Stillwater East (the Blitz project), as discussed below. Production in the second half of 2021 was affected by ongoing operational restrictions imposed after a fatal incident at the Stillwater West mine in June 2021. Factoring in these operational constraints at the Stillwater complex, 2022 PGM production is forecast to be between 550,000 to 580,000 ounces. Stillwater East (the Blitz pr oject), located east of the Stillwater mine (Stillwater West) and covered by the NSR, commenced production in October 2017. Stillwater East continues to ramp up despite various operational challenges and COVID-19 related disruptions. Production forecasts from Stillwater East are currently exceeding plan and increasing output is expected to partially offset the negative production impact at Stillwater West. When production is at steady state the run rate is expected to be approximately 300,000 ounces per annum starting in 2024. Sibanye-Stillwater estimates that the Stillwater mine has a mine life of 40 years and the East Boulder mine has a mine life of 34 years. Significant Mineral Resources have the potential to increase mine life even further in the future. Only PGM producer in the U.S. Mineral Reserves support a long mine life Significant Mineral Resource has the potential to increase mine life even further Stillwater PGM Montana, United States Operator: Sibanye-Stillwater Royalty: NSR: 5% Precious Metals Stillwater, Montana

Franco-Nevada 2022 Asset Handbook Page 52 Page 54

Franco-Nevada 2022 Asset Handbook Page 52 Page 54