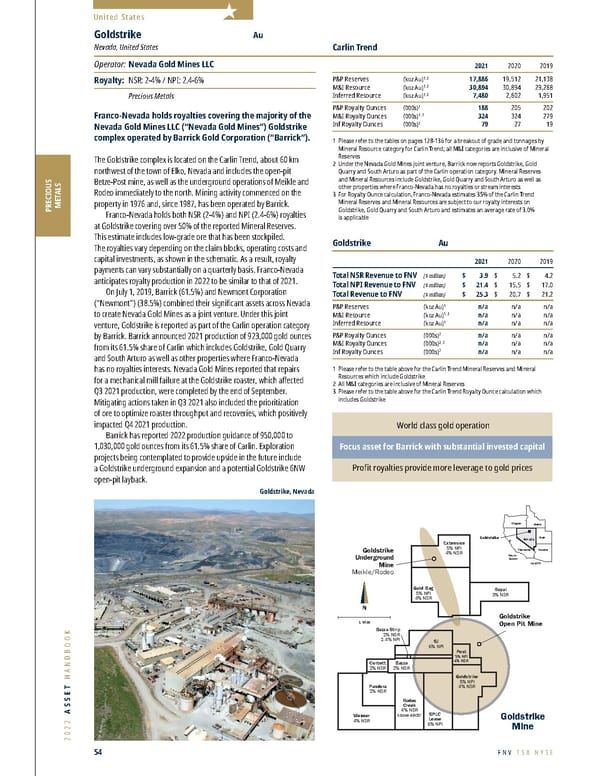

2022 ASSET HANDBOOK 54 FNV TSX NYSE PRECIOUS METALS United States Carlin Trend 2021 2020 2019 P&P Reserves (koz Au) 1, 2 17,886 19,512 21,138 M&I Resource (koz Au) 1, 2 30,894 30,894 29,268 Inferred Resource (koz Au) 1, 2 7,480 2,602 1,951 P&P Royalty Ounces (000s) 3 188 205 202 M&I Royalty Ounces (000s) 1, 3 324 324 279 Inf Royalty Ounces (000s) 3 79 27 19 Goldstrike Au 2021 2020 2019 Total NSR Revenue to FNV ($ million) $ 3.9 $ 5.2 $ 4.2 Total NPI Revenue to FNV ($ million) $ 21.4 $ 15.5 $ 17.0 Total Revenue to FNV ($ million) $ 25.3 $ 20.7 $ 21.2 P&P Reserves (koz Au) 1 n/a n/a n/a M&I Resource (koz Au) 1, 2 n/a n/a n/a Inferred Resource (koz Au) 1 n/a n/a n/a P&P Royalty Ounces (000s) 3 n/a n/a n/a M&I Royalty Ounces (000s) 2, 3 n/a n/a n/a Inf Royalty Ounces (000s) 3 n/a n/a n/a 1 Please r efer to the tables on pages 128-136 for a breakout of grade and tonnages by Mineral Resource category for Carlin Trend; all M&I categories are inclusive of Mineral Reserves 2 Under the Ne vada Gold Mines joint venture, Barrick now reports Goldstrike, Gold Quarry and South Arturo as part of the Carlin operation category. Mineral Reserves and Mineral Resources include Goldstrike, Gold Quarry and South Arturo as well as other properties where Franco-Nevada has no royalties or stream interests 3 For Ro yalty Ounce calculation, Franco-Nevada estimates 35% of the Carlin Trend Mineral Reserves and Mineral Resources are subject to our royalty interests on Goldstrike, Gold Quarry and South Arturo and estimates an average rate of 3.0% is applicable 1 Please r efer to the table above for the Carlin Trend Mineral Reserves and Mineral Resources which include Goldstrike 2 All M&I categories ar e inclusive of Mineral Reserves 3 Please r efer to the table above for the Carlin Trend Royalty Ounce calculation which includes Goldstrike Goldstrike Au Nevada, United States Operator: Nevada Gold Mines LLC Royalty: NSR: 2-4% / NPI: 2.4-6% Precious Metals Franco-Nevada holds royalties covering the majority of the Nevada Gold Mines LLC (“Nevada Gold Mines”) Goldstrike complex operated by Barrick Gold Corporation (“Barrick”). The Goldstrike complex is located on the Carlin Trend, about 60 km northwest of the town of Elko, Nevada and includes the open-pit Betze-Post mine, as well as the underground operations of Meikle and Rodeo immediately to the north. Mining activity commenced on the property in 1976 and, since 1987, has been operated by Barrick. Fr anco-Nevada holds both NSR (2-4%) and NPI (2.4-6%) royalties at Goldstrike covering over 50% of the reported Mineral Reserves. This estimate includes low-grade ore that has been stockpiled. The royalties vary depending on the claim blocks, operating costs and capital investments, as shown in the schematic. As a result, royalty payments can vary substantially on a quarterly basis. Franco-Nevada anticipates royalty production in 2022 to be similar to that of 2021. On July 1, 2019, Barrick (61.5%) and Ne wmont Corporation (“Newmont”) (38.5%) combined their significant assets across Nevada to create Nevada Gold Mines as a joint venture. Under this joint venture, Goldstrike is reported as part of the Carlin operation category by Barrick. Barrick announced 2021 production of 923,000 gold ounces from its 61.5% share of Carlin which includes Goldstrike, Gold Quarry and South Arturo as well as other properties where Franco-Nevada has no royalties interests. Nevada Gold Mines reported that repairs for a mechanical mill failure at the Goldstrike roaster, which affected Q3 2021 production, were completed by the end of September. Mitigating actions taken in Q3 2021 also included the prioritization of ore to optimize roaster throughput and recoveries, which positively impacted Q4 2021 production. Barrick has r eported 2022 production guidance of 950,000 to 1,030,000 gold ounces from its 61.5% share of Carlin. Exploration projects being contemplated to provide upside in the future include a Goldstrike underground expansion and a potential Goldstrike 6NW open-pit layback. World class gold operation Focus asset for Barrick with substantial invested capital Profit royalties provide more leverage to gold prices N Goldstrike Mine Goldstrike Open Pit Mine Goldstrike Underground Mine Meikle/Rodeo SJ 6% NPI SPLC Lease 6% NPI Post 5% NPI 4% NSR Goldstrike 5% NPI 4% NSR Bazza 2% NSR Bazza Strip 2% NSR 2.4% NPI Royal 3% NSR Extension 5% NPI 4% NSR Gold Bug 5% NPI 4% NSR Corbett 2% NSR Pandora 2% NSR Weimer 4% NSR Rodeo Creek 4% NSR Above 4600’ 1 Mile Goldstrike Pacific Ocean Oregon Idaho Utah Nevada California Arizona MEXICO Goldstrike, Nevada

Franco-Nevada 2022 Asset Handbook Page 53 Page 55

Franco-Nevada 2022 Asset Handbook Page 53 Page 55