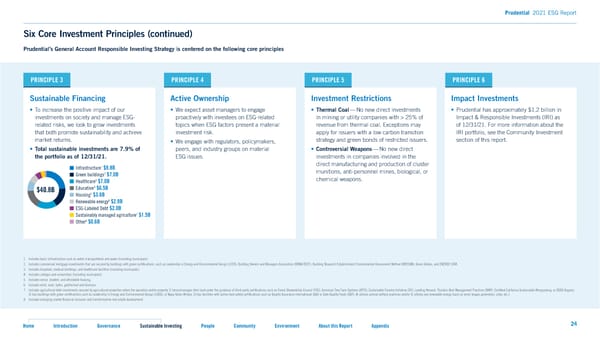

Prudential 2021 ESG Report Six Core Investment Principles (continued) Prudential’s General Account Responsible Investing Strategy is centered on the following core principles PRINCIPLE 3 PRINCIPLE 4 PRINCIPLE 5 PRINCIPLE 6 Sustainable Financing Active Ownership Investment Restrictions Impact Investments • To increase the positive impact of our • We expect asset managers to engage • Thermal Coal — No new direct investments • Prudential has approximately $1.2 billion in investments on society and manage ESG- proactively with investees on ESG-related in mining or utility companies with > 25% of Impact & Responsible Investments (IRI) as related risks, we look to grow investments topics when ESG factors present a material revenue from thermal coal. Exceptions may of 12/31/21. For more information about the that both promote sustainability and achieve investment risk. apply for issuers with a low carbon transition IRI portfolio, see the Community Investment market returns. • We engage with regulators, policymakers, strategy and green bonds of restricted issuers. section of this report. • Total sustainable investments are 7.9% of peers, and industry groups on material • Controversial Weapons —No new direct the portfolio as of 12/31/21. ESG issues. investments in companies involved in the 1 direct manufacturing and production of cluster Infrastructure $9.8B munitions, anti-personnel mines, biological, or 2 Green buildings $7.0B chemical weapons. 3 Healthcare $7.0B 4 $40.8B Education $6.5B 5 Housing $3.6B 6 Renewable energy $2.9B ESG-Labeled Debt $2.0B 7 Sustainably managed agriculture $1.5B 8 Other $0.6B 1. Includes basic infrastructure such as water, transportation and power (including municipals). 2. Includes commercial mortgage investments that are secured by buildings with green certi昀椀cations, such as Leadership in Energy and Environmental Design (LEED), Building Owners and Managers Association (BOMA BEST), Building Research Establishment Environmental Assessment Method (BREEAM), Green Globes, and ENERGY STAR. 3. Includes hospitals, medical buildings, and healthcare facilities (including municipals). 4. Includes colleges and universities (including municipals). 5. Includes senior, student, and affordable housing. 6. Includes wind, solar, hydro, geothermal and biomass. 7. Includes agricultural debt investments secured by agricultural properties where the operation and/or property 1) farms/manages their land under the guidance of third-party certi昀椀cations such as Forest Stewardship Council (FSC), American Tree Farm Systems (ATFS), Sustainable Forestry Initiative (SFI), Leading Harvest, Florida’s Best Management Practices (BMP), Certi昀椀ed California Sustainable Winegrowing, or USDA Organic; 2) has buildings with green certi昀椀cations such as Leadership in Energy and Environmental Design (LEED), or Napa Green Winery; 3) has facilities with active food safety certi昀椀cations such as Quality Assurance International (QAI) or Safe Quality Foods (SQF); 4) utilizes animal welfare practices and/or 5) utilizes any renewable energy (such as wind, biogas generation, solar, etc.). 8. Includes emerging market 昀椀nancial inclusion and transformative real estate development. Home Introduction Governance Sustainable Investing People Community Environment About this Report Appendix 24

2021 ESG Report Page 23 Page 25

2021 ESG Report Page 23 Page 25