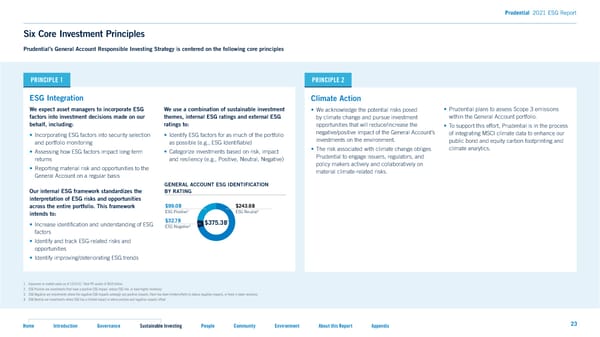

Prudential 2021 ESG Report Six Core Investment Principles Prudential’s General Account Responsible Investing Strategy is centered on the following core principles PRINCIPLE 1 PRINCIPLE 2 ESG Integration Climate Action We expect asset managers to incorporate ESG We use a combination of sustainable investment • We acknowledge the potential risks posed • Prudential plans to assess Scope 3 emissions factors into investment decisions made on our themes, internal ESG ratings and external ESG by climate change and pursue investment within the General Account portfolio. behalf, including: ratings to: opportunities that will reduce/increase the • To support this effort, Prudential is in the process • Incorporating ESG factors into security selection • Identify ESG factors for as much of the portfolio negative/positive impact of the General Account’s of integrating MSCI climate data to enhance our and portfolio monitoring as possible (e.g., ESG Identi昀椀able) investments on the environment. public bond and equity carbon footprinting and • Assessing how ESG factors impact long-term • Categorize investments based on risk, impact • The risk associated with climate change obliges climate analytics. returns and resiliency (e.g., Positive, Neutral, Negative) Prudential to engage issuers, regulators, and • Reporting material risk and opportunities to the policy makers actively and collaboratively on General Account on a regular basis material climate-related risks. GENERAL ACCOUNT ESG IDENTIFICATION Our internal ESG framework standardizes the BY RATING interpretation of ESG risks and opportunities across the entire portfolio. This framework $99.0 B $243.6 B 2 4 intends to: ESG Positive ESG Neutral $32.7B 1 • Increase identi昀椀cation and understanding of ESG ESG Negative3 $375.3 B factors • Identify and track ESG-related risks and opportunities • Identify improving/deteriorating ESG trends 1. Exposures in market value as of 12/31/21. Total PFI assets of $519 billion. 2. ESG Positive are investments that have a positive ESG impact, reduce ESG risk, or have higher resiliency 3. ESG Negative are investments where the negative ESG impacts outweigh any positive impacts, there has been limited efforts to reduce negative impacts, or there is lower resiliency 4. ESG Neutral are investments where ESG has a limited impact or where positive and negative impacts offset. Home Introduction Governance Sustainable Investing People Community Environment About this Report Appendix 23

2021 ESG Report Page 22 Page 24

2021 ESG Report Page 22 Page 24