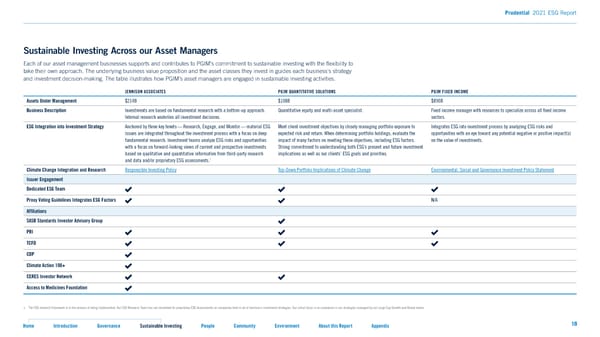

Prudential 2021 ESG Report Sustainable Investing Across our Asset Managers Each of our asset management businesses supports and contributes to PGIM’s commitment to sustainable investing with the 昀氀exibility to take their own approach. The underlying business value proposition and the asset classes they invest in guides each business's strategy and investment decision-making. The table illustrates how PGIM’s asset managers are engaged in sustainable investing activities. JENNISON ASSOCIATES PGIM QUANTITATIVE SOLUTIONS PGIM FIXED INCOME Assets Under Management $214B $108B $890B Business Description Investments are based on fundamental research with a bottom-up approach. Quantitative equity and multi-asset specialist. Fixed income manager with resources to specialize across all 昀椀xed income Internal research underlies all investment decisions. sectors. ESG Integration into Investment Strategy Anchored by three key tenets — Research, Engage, and Monitor — material ESG Meet client investment objectives by closely managing portfolio exposure to Integrates ESG into investment process by analyzing ESG risks and issues are integrated throughout the investment process with a focus on deep expected risk and return. When determining portfolio holdings, evaluate the opportunities with an eye toward any potential negative or positive impact(s) fundamental research. Investment teams analyze ESG risks and opportunities impact of many factors on meeting these objectives, including ESG factors. on the value of investments. with a focus on forward-looking views of current and prospective investments Strong commitment to understanding both ESG’s present and future investment based on qualitative and quantitative information from third-party research implications as well as our clients’ ESG goals and priorities. 1 and data and/or proprietary ESG assessments. Climate Change Integration and Research Responsible Investing Policy Top-Down Portfolio Implications of Climate Change Environmental, Social and Governance Investment Policy Statement Issuer Engagement Dedicated ESG Team Proxy Voting Guidelines Integrates ESG Factors N/A Af昀椀liations SASB Standards Investor Advisory Group PRI TCFD CDP Climate Action 100+ CERES Investor Network Access to Medicines Foundation 1. The ESG research framework is in the process of being implemented. Our ESG Research Team has not completed its proprietary ESG Assessments on companies held in all of Jennison’s investment strategies. Our initial focus is on companies in our strategies managed by our Large Cap Growth and Global teams. Home Introduction Governance Sustainable Investing People Community Environment About this Report Appendix 18

2021 ESG Report Page 17 Page 19

2021 ESG Report Page 17 Page 19