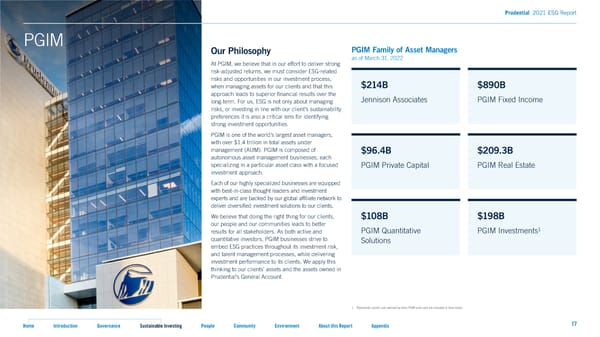

Prudential 2021 ESG Report PGIM Our Philosophy PGIM Family of Asset Managers as of March 31, 2022 At PGIM, we believe that in our effort to deliver strong risk-adjusted returns, we must consider ESG-related risks and opportunities in our investment process, $214B $890B when managing assets for our clients and that this approach leads to superior 昀椀nancial results over the Jennison Associates PGIM Fixed Income long-term. For us, ESG is not only about managing risks, or investing in line with our client’s sustainability preferences it is also a critical lens for identifying strong investment opportunities. PGIM is one of the world’s largest asset managers, with over $1.4 trillion in total assets under management (AUM). PGIM is composed of $96.4B $209.3B autonomous asset management businesses, each specializing in a particular asset class with a focused PGIM Private Capital PGIM Real Estate investment approach. Each of our highly specialized businesses are equipped with best-in-class thought leaders and investment experts and are backed by our global af昀椀liate network to deliver diversi昀椀ed investment solutions to our clients. We believe that doing the right thing for our clients, $108B $198B our people and our communities leads to better results for all stakeholders. As both active and PGIM Quantitative PGIM Investments1 quantitative investors, PGIM businesses strive to Solutions embed ESG practices throughout its investment risk, and talent management processes, while delivering investment performance to its clients. We apply this thinking to our clients’ assets and the assets owned in Prudential’s General Account. 1. Represents assets sub-advised by other PGIM units and are included in their totals. Home Introduction Governance Sustainable Investing People Community Environment About this Report Appendix 17

2021 ESG Report Page 16 Page 18

2021 ESG Report Page 16 Page 18