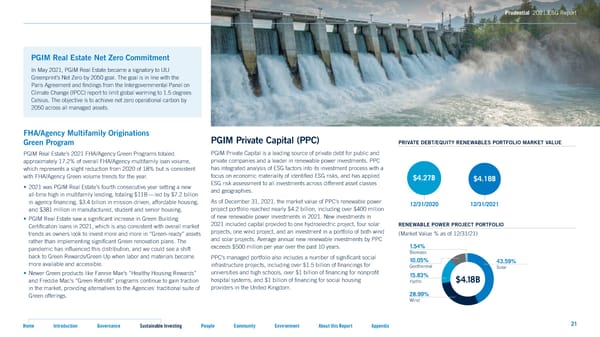

PPrruuddeennttiialal 2200221 E1 ESSG RG Reeppoorrtt PGIM Real Estate Net Zero Commitment In May 2021, PGIM Real Estate became a signatory to ULI Greenprint’s Net Zero by 2050 goal. The goal is in line with the Paris Agreement and 昀椀ndings from the Intergovernmental Panel on Climate Change (IPCC) report to limit global warming to 1.5 degrees Celsius. The objective is to achieve net zero operational carbon by 2050 across all managed assets. FHA/Agency Multifamily Originations PGIM Private Capital (PPC) Green Program PRIVATE DEBT/EQUITY RENEWABLES PORTFOLIO MARKET VALUE PGIM Real Estate’s 2021 FHA/Agency Green Programs totaled PGIM Private Capital is a leading source of private debt for public and approximately 17.2% of overall FHA/Agency multifamily loan volume, private companies and a leader in renewable power investments. PPC which represents a slight reduction from 2020 of 18% but is consistent has integrated analysis of ESG factors into its investment process with a with FHA/Agency Green volume trends for the year. focus on economic materiality of identi昀椀ed ESG risks, and has applied $4.27B $4.18B • 2021 was PGIM Real Estate’s fourth consecutive year setting a new ESG risk assessment to all investments across different asset classes all-time high in multifamily lending, totaling $11B — led by $7.2 billion and geographies. in agency 昀椀nancing, $3.4 billion in mission-driven, affordable housing, As of December 31, 2021, the market value of PPC’s renewable power 12/31/2020 12/31/2021 and $381 million in manufactured, student and senior housing. project portfolio reached nearly $4.2 billion, including over $400 million • PGIM Real Estate saw a signi昀椀cant increase in Green Building of new renewable power investments in 2021. New investments in Certi昀椀cation loans in 2021, which is also consistent with overall market 2021 included capital provided to one hydroelectric project, four solar RENEWABLE POWER PROJECT PORTFOLIO trends as owners look to invest more and more in “Green-ready” assets projects, one wind project, and an investment in a portfolio of both wind (Market Value % as of 12/31/21) rather than implementing signi昀椀cant Green renovation plans. The and solar projects. Average annual new renewable investments by PPC pandemic has in昀氀uenced this distribution, and we could see a shift exceeds $500 million per year over the past 10 years. 1.54% back to Green Rewards/Green Up when labor and materials become Biomass PPC’s managed portfolio also includes a number of signi昀椀cant social 10.05% 43.59% more available and accessible. infrastructure projects, including over $1.5 billion of 昀椀nancings for Geothermal Solar • Newer Green products like Fannie Mae’s “Healthy Housing Rewards” universities and high schools, over $1 billion of 昀椀nancing for nonpro昀椀t 15.83% and Freddie Mac’s “Green Retro昀椀t” programs continue to gain traction hospital systems, and $1 billion of 昀椀nancing for social housing Hydro $4.18B in the market, providing alternatives to the Agencies' traditional suite of providers in the United Kingdom. Green offerings. 28.99% Wind Home Introduction Governance Sustainable Investing People Community Environment About this Report Appendix 21

2021 ESG Report Page 20 Page 22

2021 ESG Report Page 20 Page 22