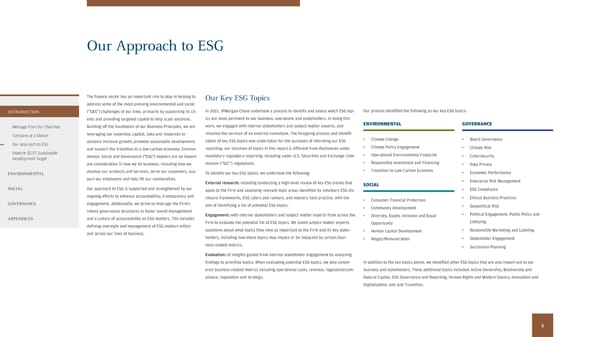

Our Approach to ESG The fnance sector has an important role to play in helping to Our Key ESG Topics address some of the most pressing environmental and social INTRODUCTION (“E&S”) challenges of our time, primarily by supporting its cli- In 2022, JPMorgan Chase undertook a process to identify and assess which ESG top- Our process identifed the following as our key ESG topics: ics are most pertinent to our business, operations and stakeholders. In doing this ents and providing targeted capital to help scale solutions. work, we engaged with internal stakeholders and subject matter experts, and ENVIRONMENTAL GOVERNANCE Message from Our Chairman Building of the foundation of our Business Principles, we are Company at a Glance leveraging our expertise, capital, data and resources to retained the services of an external consultant. The foregoing process and identif- cation of key ESG topics was undertaken for the purposes of informing our ESG • Climate Change • Board Governance Our Approach to ESG advance inclusive growth, promote sustainable development, reporting; our inclusion of topics in this report is diferent from disclosures under • Climate Policy Engagement • Climate Risk and support the transition to a low-carbon economy. Environ- Feature: $2.5T Sustainable mental, Social and Governance ("ESG") matters are an import- mandatory regulatory reporting, including under U.S. Securities and Exchange Com- • Operational Environmental Footprint • Cybersecurity Development Target mission (“SEC”) regulations. • Responsible Investment and Financing ant consideration in how we do business, including how we • Data Privacy ENVIRONMENTAL develop our products and services, serve our customers, sup- To identify our key ESG topics, we undertook the following: • Transition to Low-Carbon Economy • Economic Performance port our employees and help lift our communities. • Enterprise Risk Management External research: including conducting a high-level review of key ESG trends that SOCIAL SOCIAL Our approach to ESG is supported and strengthened by our apply to the Firm and assessing relevant topic areas identifed by voluntary ESG dis- • ESG Compliance ongoing eforts to enhance accountability, transparency and closure frameworks, ESG raters and rankers, and industry best practice, with the • Ethical Business Practices • Consumer Financial Protection GOVERNANCE engagement. Additionally, we strive to leverage the Firm’s aim of identifying a list of potential ESG topics. • Geopolitical Risk robust governance structures to foster sound management • Community Development Engagement: with internal stakeholders and subject matter experts from across the • Political Engagement, Public Policy and • Diversity, Equity, Inclusion and Equal APPENDICES and a culture of accountability on ESG matters. This includes Firm to evaluate the potential list of ESG topics. We asked subject matter experts Lobbying defning oversight and management of ESG matters within Opportunity and across our lines of business. questions about what topics they view as important to the Firm and its key stake- • Human Capital Development • Responsible Marketing and Labeling holders, including how these topics may impact or be impacted by certain busi- • Wages/Remuneration • Stakeholder Engagement ness-related metrics. • Succession Planning Evaluation: of insights gained from internal stakeholder engagement by analyzing fndings to prioritize topics. When evaluating potential ESG topics, we also consid- In addition to the key topics above, we identifed other ESG topics that are also import-ant to our ered business-related metrics including operational costs, revenue, regulation/com- business and stakeholders. These additional topics included: Active Ownership, Biodiversity and pliance, reputation and strategy. Natural Capital, ESG Governance and Reporting, Human Rights and Modern Slavery, Innovation and Digitalization, and Just Transition. 5

2022 Environmental Social Governance Report Page 6 Page 8

2022 Environmental Social Governance Report Page 6 Page 8