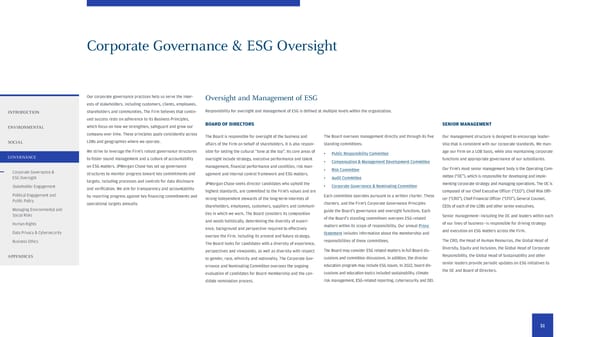

Corporate Governance & ESG Oversight Our corporate governance practices help us serve the inter- Oversight and Management of ESG ests of stakeholders, including customers, clients, employees, INTRODUCTION shareholders and communities. The Firm believes that contin- Responsibility for oversight and management of ESG is defned at multiple levels within the organization. ued success rests on adherence to its Business Principles, ENVIRONMENTAL which focus on how we strengthen, safeguard and grow our BOARD OF DIRECTORS SENIOR MANAGEMENT company over time. These principles apply consistently across The Board is responsible for oversight of the business and The Board oversees management directly and through its fve Our management structure is designed to encourage leader- SOCIAL LOBs and geographies where we operate. afairs of the Firm on behalf of shareholders. It is also respon- standing committees: ship that is consistent with our corporate standards. We man- We strive to leverage the Firm’s robust governance structures sible for setting the cultural “tone at the top”. Its core areas of • Public Responsibility Committee age our Firm on a LOB basis, while also maintaining corporate GOVERNANCE to foster sound management and a culture of accountability oversight include strategy, executive performance and talent functions and appropriate governance of our subsidiaries. • Compensation & Management Development Committee on ESG matters. JPMorgan Chase has set up governance management, fnancial performance and condition, risk man- • Risk Committee Our Firm’s most senior management body is the Operating Com- Corporate Governance & structures to monitor progress toward key commitments and agement and internal control framework and ESG matters. ESG Oversight • Audit Committee mittee (“OC”), which is responsible for developing and imple- targets, including processes and controls for data disclosure JPMorgan Chase seeks director candidates who uphold the menting corporate strategy and managing operations. The OC is Stakeholder Engagement and verifcation. We aim for transparency and accountability • Corporate Governance & Nominating Committee highest standards, are committed to the Firm’s values and are composed of our Chief Executive Ofcer (“CEO”), Chief Risk Of- Political Engagement and by reporting progress against key fnancing commitments and strong independent stewards of the long-term interests of Each committee operates pursuant to a written charter. These cer (“CRO”), Chief Financial Ofcer (“CFO”), General Counsel, Public Policy operational targets annually. charters, and the Firm’s Corporate Governance Principles shareholders, employees, customers, suppliers and communi- CEOs of each of the LOBs and other senior executives. Managing Environmental and guide the Board’s governance and oversight functions. Each Social Risks ties in which we work. The Board considers its composition Senior management—including the OC and leaders within each and needs holistically, determining the diversity of experi- of the Board’s standing committees oversees ESG-related Human Rights matters within its scope of responsibility. Our annual Proxy of our lines of business—is responsible for driving strategy ence, background and perspective required to efectively and execution on ESG matters across the Firm. Data Privacy & Cybersecurity oversee the Firm, including its present and future strategy. Statement includes information about the membership and Business Ethics The Board looks for candidates with a diversity of experience, responsibilities of these committees. The CRO, the Head of Human Resources, the Global Head of perspectives and viewpoints, as well as diversity with respect The Board may consider ESG related matters in full Board dis- Diversity, Equity and Inclusion, the Global Head of Corporate APPENDICES to gender, race, ethnicity and nationality. The Corporate Gov- cussions and committee discussions. In addition, the director Responsibility, the Global Head of Sustainability and other ernance and Nominating Committee oversees the ongoing education program may include ESG issues. In 2022, board dis- senior leaders provide periodic updates on ESG initiatives to evaluation of candidates for Board membership and the can- cussions and education topics included sustainability, climate the OC and Board of Directors. didate nomination process. risk management, ESG-related reporting, cybersecurity and DEI. 51

2022 Environmental Social Governance Report Page 52 Page 54

2022 Environmental Social Governance Report Page 52 Page 54