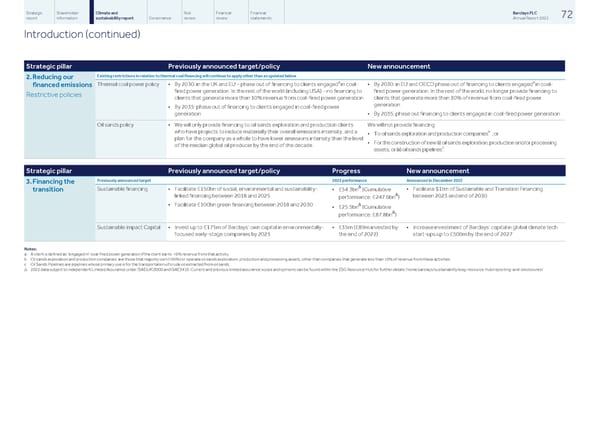

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 72 report information sustainability report Governance review review statements Annual Report 2022 Introduction (continued) Strategic pillar Previously announced target/policy New announcement Existing restrictions in relation to thermal coal financing will continue to apply other than as updated below 2.Reducing our a a Thermal coal power policy • By 2030: in the UK and EU – phase out of financing to clients engaged in coal- • By 2030: in EU and OECD phase out of financing to clients engaged in coal- financed emissions fired power generation. In the rest of the world (including USA) – no financing to fired power generation. In the rest of the world, no longer provide financing to Restrictive policies clients that generate more than 10% revenue from coal-fired power generation clients that generate more than 10% of revenue from coal-fired power generation • By 2035: phase out of financing to clients engaged in coal-fired power generation • By 2035: phase out financing to clients engaged in coal-fired power generation Oil sands policy • We will only provide financing to oil sands exploration and production clients We will not provide financing: b who have projects to reduce materially their overall emissions intensity, and a • To oil sands exploration and production companies ; or plan for the company as a whole to have lower emissions intensity than the level • For the construction of new (i) oil sands exploration, production and/or processing of the median global oil producer by the end of the decade. c assets; or (ii) oil sands pipelines . Strategic pillar Previously announced target/policy Progress New announcement Previously announced target 2022 performance Announced in December 2022 3.Financing the Δ Sustainable financing • Facilitate £150bn of social, environmental and sustainability- • Facilitate $1trn of Sustainable and Transition Financing • £54.3bn (Cumulative transition Δ linked financing between 2018 and 2025 between 2023 and end of 2030 performance: £247.6bn ) Δ • Facilitate £100bn green financing between 2018 and 2030 • £25.5bn (Cumulative Δ performance: £87.8bn ) Sustainable Impact Capital • Invest up to £175m of Barclays’ own capital in environmentally- • £35m (£89m invested by • Increase investment of Barclays’ capital in global climate tech focused early-stage companies by 2025 the end of 2022) start-ups up to £500m by the end of 2027 Notes: a A client is defined as "engaged in" coal-fired power generation if the client earns >5% revenue from that activity. b Oil sands exploration and production companies are those that majority own (>50%) or operate oil sands exploration, production and processing assets, other than companies that generate less than 10% of revenue from these activities. c Oil Sands Pipelines are pipelines whose primary use is for the transportation of crude oil extracted from oil sands. Δ 2022 data subject to independent Limited Assurance under ISAE(UK)3000 and ISAE3410. Current and previous limited assurance scope and opinions can be found within the ESG Resource Hub for further details: home.barclays/sustainability/esg-resource-hub/reporting-and-disclosures/

Barclays PLC - Annual Report - 2022 Page 73 Page 75

Barclays PLC - Annual Report - 2022 Page 73 Page 75