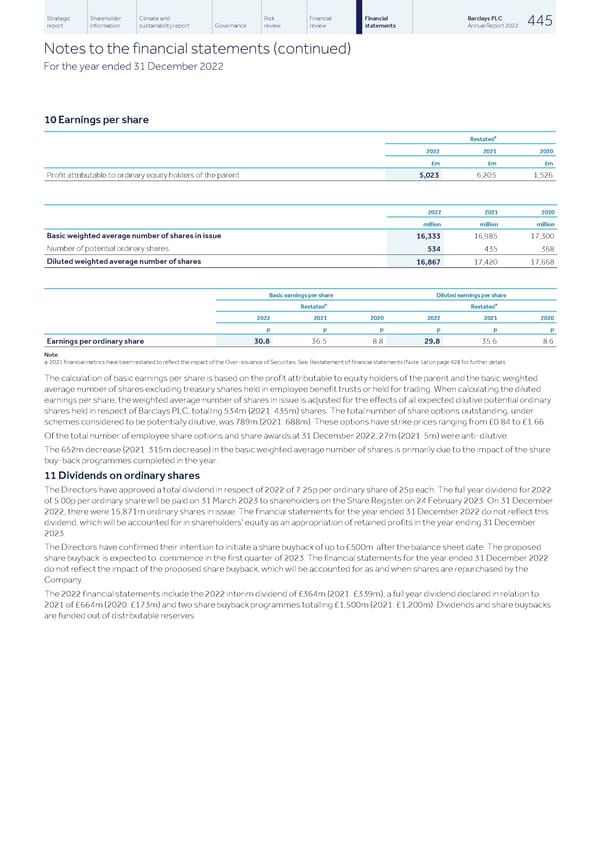

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 445 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) For the year ended 31 December 2022 10 Earnings per share a Restated 2022 2021 2020 £m £m £m Profit attributable to ordinary equity holders of the parent 5,023 6,205 1,526 2022 2021 2020 million million million Basic weighted average number of shares in issue 16,333 16,985 17,300 Number of potential ordinary shares 534 435 368 Diluted weighted average number of shares 16,867 17,420 17,668 Basic earnings per share Diluted earnings per share a a Restated Restated 2022 2021 2020 2022 2021 2020 p p p p p p Earnings per ordinary share 30.8 36.5 8.8 29.8 35.6 8.6 Note a 2021 financial metrics have been restated to reflect the impact of the Over-issuance of Securities. See Restatement of financial statements (Note 1a) on page 428 for further details. The calculation of basic earnings per share is based on the profit attributable to equity holders of the parent and the basic weighted average number of shares excluding treasury shares held in employee benefit trusts or held for trading. When calculating the diluted earnings per share, the weighted average number of shares in issue is adjusted for the effects of all expected dilutive potential ordinary shares held in respect of Barclays PLC, totalling 534m (2021: 435m) shares. The total number of share options outstanding, under schemes considered to be potentially dilutive, was 789m (2021: 688m). These options have strike prices ranging from £0.84 to £1.66. Of the total number of employee share options and share awards at 31 December 2022, 27m (2021: 5m) were anti-dilutive. The 652m decrease (2021: 315m decrease) in the basic weighted average number of shares is primarily due to the impact of the share buy-back programmes completed in the year. 11 Dividends on ordinary shares The Directors have approved a total dividend in respect of 2022 of 7.25p per ordinary share of 25p each. The full year dividend for 2022 of 5.00p per ordinary share will be paid on 31 March 2023 to shareholders on the Share Register on 24 February 2023. On 31 December 2022, there were 15,871m ordinary shares in issue. The financial statements for the year ended 31 December 2022 do not reflect this dividend, which will be accounted for in shareholders’ equity as an appropriation of retained profits in the year ending 31 December 2023. The Directors have confirmed their intention to initiate a share buyback of up to £500m after the balance sheet date. The proposed share buyback is expected to commence in the first quarter of 2023. The financial statements for the year ended 31 December 2022 do not reflect the impact of the proposed share buyback, which will be accounted for as and when shares are repurchased by the Company. The 2022 financial statements include the 2022 interim dividend of £364m (2021: £339m); a full year dividend declared in relation to 2021 of £664m (2020: £173m) and two share buyback programmes totalling £1,500m (2021: £1,200m). Dividends and share buybacks are funded out of distributable reserves.

Barclays PLC - Annual Report - 2022 Page 446 Page 448

Barclays PLC - Annual Report - 2022 Page 446 Page 448