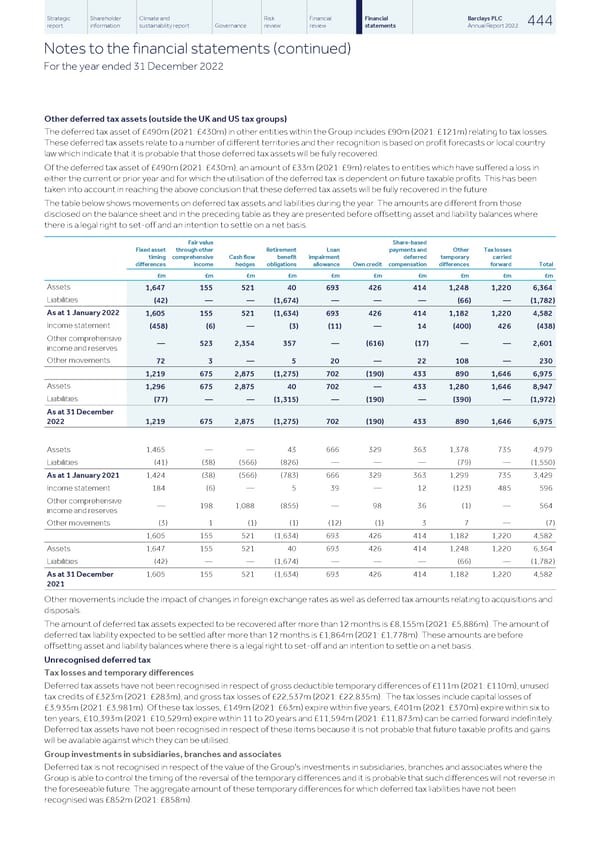

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 444 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) For the year ended 31 December 2022 Other deferred tax assets (outside the UK and US tax groups) The deferred tax asset of £490m (2021: £430m) in other entities within the Group includes £90m (2021: £121m) relating to tax losses. These deferred tax assets relate to a number of different territories and their recognition is based on profit forecasts or local country law which indicate that it is probable that those deferred tax assets will be fully recovered. Of the deferred tax asset of £490m (2021: £430m), an amount of £33m (2021: £9m) relates to entities which have suffered a loss in either the current or prior year and for which the utilisation of the deferred tax is dependent on future taxable profits. This has been taken into account in reaching the above conclusion that these deferred tax assets will be fully recovered in the future. The table below shows movements on deferred tax assets and liabilities during the year. The amounts are different from those disclosed on the balance sheet and in the preceding table as they are presented before offsetting asset and liability balances where there is a legal right to set-off and an intention to settle on a net basis. Fair value Share-based Fixed asset through other Retirement Loan payments and Other Tax losses timing comprehensive Cash flow benefit impairment deferred temporary carried differences income hedges obligations allowance Own credit compensation differences forward Total £m £m £m £m £m £m £m £m £m £m Assets 1,647 155 521 40 693 426 414 1,248 1,220 6,364 Liabilities (42) — — (1,674) — — — (66) — (1,782) As at 1 January 2022 1,605 155 521 (1,634) 693 426 414 1,182 1,220 4,582 Income statement (458) (6) — (3) (11) — 14 (400) 426 (438) Other comprehensive — 523 2,354 357 — (616) (17) — — 2,601 income and reserves Other movements 72 3 — 5 20 — 22 108 — 230 1,219 675 2,875 (1,275) 702 (190) 433 890 1,646 6,975 Assets 1,296 675 2,875 40 702 — 433 1,280 1,646 8,947 Liabilities (77) — — (1,315) — (190) — (390) — (1,972) As at 31 December 2022 1,219 675 2,875 (1,275) 702 (190) 433 890 1,646 6,975 Assets 1,465 — — 43 666 329 363 1,378 735 4,979 Liabilities (41) (38) (566) (826) — — — (79) — (1,550) As at 1 January 2021 1,424 (38) (566) (783) 666 329 363 1,299 735 3,429 Income statement 184 (6) — 5 39 — 12 (123) 485 596 Other comprehensive — 198 1,088 (855) — 98 36 (1) — 564 income and reserves Other movements (3) 1 (1) (1) (12) (1) 3 7 — (7) 1,605 155 521 (1,634) 693 426 414 1,182 1,220 4,582 Assets 1,647 155 521 40 693 426 414 1,248 1,220 6,364 Liabilities (42) — — (1,674) — — — (66) — (1,782) As at 31 December 1,605 155 521 (1,634) 693 426 414 1,182 1,220 4,582 2021 Other movements include the impact of changes in foreign exchange rates as well as deferred tax amounts relating to acquisitions and disposals. The amount of deferred tax assets expected to be recovered after more than 12 months is £8,155m (2021: £5,886m). The amount of deferred tax liability expected to be settled after more than 12 months is £1,864m (2021: £1,778m). These amounts are before offsetting asset and liability balances where there is a legal right to set-off and an intention to settle on a net basis. Unrecognised deferred tax Tax losses and temporary differences Deferred tax assets have not been recognised in respect of gross deductible temporary differences of £111m (2021: £110m), unused tax credits of £323m (2021: £283m), and gross tax losses of £22,537m (2021: £22,835m). The tax losses include capital losses of £3,935m (2021: £3,981m). Of these tax losses, £149m (2021: £63m) expire within five years, £401m (2021: £370m) expire within six to ten years, £10,393m (2021: £10,529m) expire within 11 to 20 years and £11,594m (2021: £11,873m) can be carried forward indefinitely. Deferred tax assets have not been recognised in respect of these items because it is not probable that future taxable profits and gains will be available against which they can be utilised. Group investments in subsidiaries, branches and associates Deferred tax is not recognised in respect of the value of the Group's investments in subsidiaries, branches and associates where the Group is able to control the timing of the reversal of the temporary differences and it is probable that such differences will not reverse in the foreseeable future. The aggregate amount of these temporary differences for which deferred tax liabilities have not been recognised was £852m (2021: £858m).

Barclays PLC - Annual Report - 2022 Page 445 Page 447

Barclays PLC - Annual Report - 2022 Page 445 Page 447