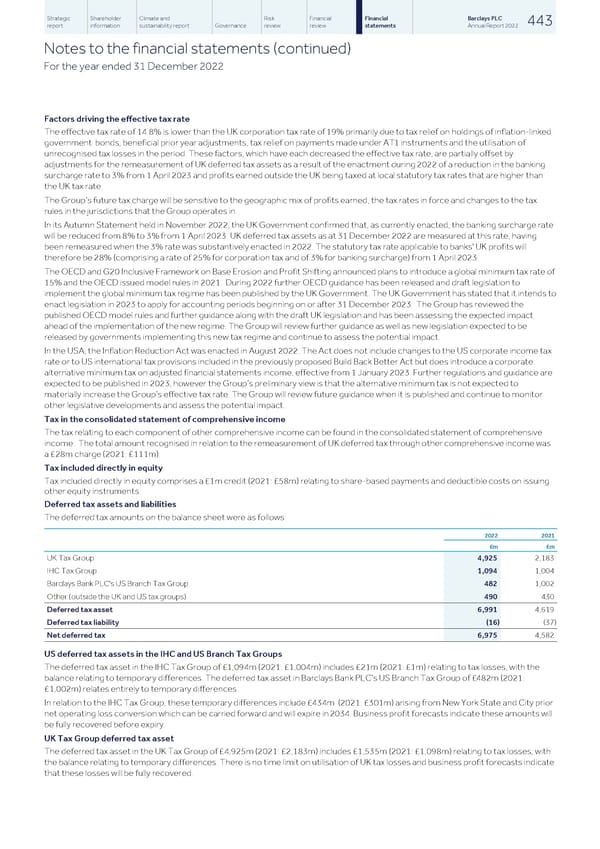

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 443 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) For the year ended 31 December 2022 Factors driving the effective tax rate The effective tax rate of 14.8% is lower than the UK corporation tax rate of 19% primarily due to tax relief on holdings of inflation-linked government bonds, beneficial prior year adjustments, tax relief on payments made under AT1 instruments and the utilisation of unrecognised tax losses in the period. These factors, which have each decreased the effective tax rate, are partially offset by adjustments for the remeasurement of UK deferred tax assets as a result of the enactment during 2022 of a reduction in the banking surcharge rate to 3% from 1 April 2023 and profits earned outside the UK being taxed at local statutory tax rates that are higher than the UK tax rate. The Group’s future tax charge will be sensitive to the geographic mix of profits earned, the tax rates in force and changes to the tax rules in the jurisdictions that the Group operates in. In its Autumn Statement held in November 2022, the UK Government confirmed that, as currently enacted, the banking surcharge rate will be reduced from 8% to 3% from 1 April 2023. UK deferred tax assets as at 31 December 2022 are measured at this rate, having been remeasured when the 3% rate was substantively enacted in 2022. The statutory tax rate applicable to banks' UK profits will therefore be 28% (comprising a rate of 25% for corporation tax and of 3% for banking surcharge) from 1 April 2023. The OECD and G20 Inclusive Framework on Base Erosion and Profit Shifting announced plans to introduce a global minimum tax rate of 15% and the OECD issued model rules in 2021. During 2022 further OECD guidance has been released and draft legislation to implement the global minimum tax regime has been published by the UK Government. The UK Government has stated that it intends to enact legislation in 2023 to apply for accounting periods beginning on or after 31 December 2023. The Group has reviewed the published OECD model rules and further guidance along with the draft UK legislation and has been assessing the expected impact ahead of the implementation of the new regime. The Group will review further guidance as well as new legislation expected to be released by governments implementing this new tax regime and continue to assess the potential impact. In the USA, the Inflation Reduction Act was enacted in August 2022. The Act does not include changes to the US corporate income tax rate or to US international tax provisions included in the previously proposed Build Back Better Act but does introduce a corporate alternative minimum tax on adjusted financial statements income, effective from 1 January 2023. Further regulations and guidance are expected to be published in 2023, however the Group’s preliminary view is that the alternative minimum tax is not expected to materially increase the Group’s effective tax rate. The Group will review future guidance when it is published and continue to monitor other legislative developments and assess the potential impact. Tax in the consolidated statement of comprehensive income The tax relating to each component of other comprehensive income can be found in the consolidated statement of comprehensive income . The total amount recognised in relation to the remeasurement of UK deferred tax through other comprehensive income was a £28m charge (2021: £111m). Tax included directly in equity Tax included directly in equity comprises a £1m credit (2021: £58m) relating to share-based payments and deductible costs on issuing other equity instruments. Deferred tax assets and liabilities The deferred tax amounts on the balance sheet were as follows: 2022 2021 £m £m UK Tax Group 4,925 2,183 IHC Tax Group 1,094 1,004 Barclays Bank PLC's US Branch Tax Group 482 1,002 Other (outside the UK and US tax groups) 490 430 Deferred tax asset 6,991 4,619 Deferred tax liability (16) (37) Net deferred tax 6,975 4,582 US deferred tax assets in the IHC and US Branch Tax Groups The deferred tax asset in the IHC Tax Group of £1,094m (2021: £1,004m) includes £21m (2021: £1m) relating to tax losses, with the balance relating to temporary differences. The deferred tax asset in Barclays Bank PLC’s US Branch Tax Group of £482m (2021: £1,002m) relates entirely to temporary differences. In relation to the IHC Tax Group, these temporary differences include £434m (2021: £301m) arising from New York State and City prior net operating loss conversion which can be carried forward and will expire in 2034. Business profit forecasts indicate these amounts will be fully recovered before expiry. UK Tax Group deferred tax asset The deferred tax asset in the UK Tax Group of £4,925m (2021: £2,183m) includes £1,535m (2021: £1,098m) relating to tax losses, with the balance relating to temporary differences. There is no time limit on utilisation of UK tax losses and business profit forecasts indicate that these losses will be fully recovered.

Barclays PLC - Annual Report - 2022 Page 444 Page 446

Barclays PLC - Annual Report - 2022 Page 444 Page 446