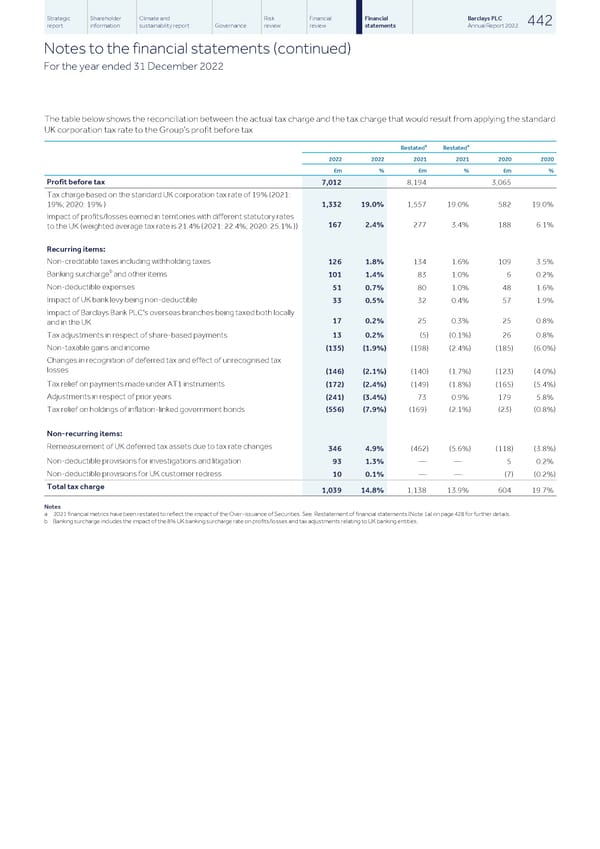

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 442 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) For the year ended 31 December 2022 The table below shows the reconciliation between the actual tax charge and the tax charge that would result from applying the standard UK corporation tax rate to the Group’s profit before tax. a a Restated Restated 2022 2022 2021 2021 2020 2020 £m % £m % £m % Profit before tax 7,012 8,194 3,065 Tax charge based on the standard UK corporation tax rate of 19% (2021: 19%; 2020: 19% ) 1,332 19.0% 1,557 19.0% 582 19.0% Impact of profits/losses earned in territories with different statutory rates 167 2.4% 277 3.4% 188 6.1% to the UK (weighted average tax rate is 21.4% (2021: 22.4%; 2020: 25.1% )) Recurring items: Non-creditable taxes including withholding taxes 126 1.8% 134 1.6% 109 3.5% b Banking surcharge and other items 101 1.4% 83 1.0% 6 0.2% Non-deductible expenses 51 0.7% 80 1.0% 48 1.6% Impact of UK bank levy being non-deductible 33 0.5% 32 0.4% 57 1.9% Impact of Barclays Bank PLC's overseas branches being taxed both locally 17 0.2% 25 0.3% 25 0.8% and in the UK Tax adjustments in respect of share-based payments 13 0.2% (5) (0.1%) 26 0.8% Non-taxable gains and income (135) (1.9%) (198) (2.4%) (185) (6.0%) Changes in recognition of deferred tax and effect of unrecognised tax losses (146) (2.1%) (140) (1.7%) (123) (4.0%) Tax relief on payments made under AT1 instruments (172) (2.4%) (149) (1.8%) (165) (5.4%) Adjustments in respect of prior years (241) (3.4%) 73 0.9% 179 5.8% (556) (7.9%) Tax relief on holdings of inflation-linked government bonds (169) (2.1%) (23) (0.8%) Non-recurring items: Remeasurement of UK deferred tax assets due to tax rate changes 346 4.9% (462) (5.6%) (118) (3.8%) Non-deductible provisions for investigations and litigation 93 1.3% — — 5 0.2% Non-deductible provisions for UK customer redress 10 0.1% — — (7) (0.2%) Total tax charge 1,039 14.8% 1,138 13.9% 604 19.7% Notes a 2021 financial metrics have been restated to reflect the impact of the Over-issuance of Securities. See Restatement of financial statements (Note 1a) on page 428 for further details. b Banking surcharge includes the impact of the 8% UK banking surcharge rate on profits/losses and tax adjustments relating to UK banking entities.

Barclays PLC - Annual Report - 2022 Page 443 Page 445

Barclays PLC - Annual Report - 2022 Page 443 Page 445