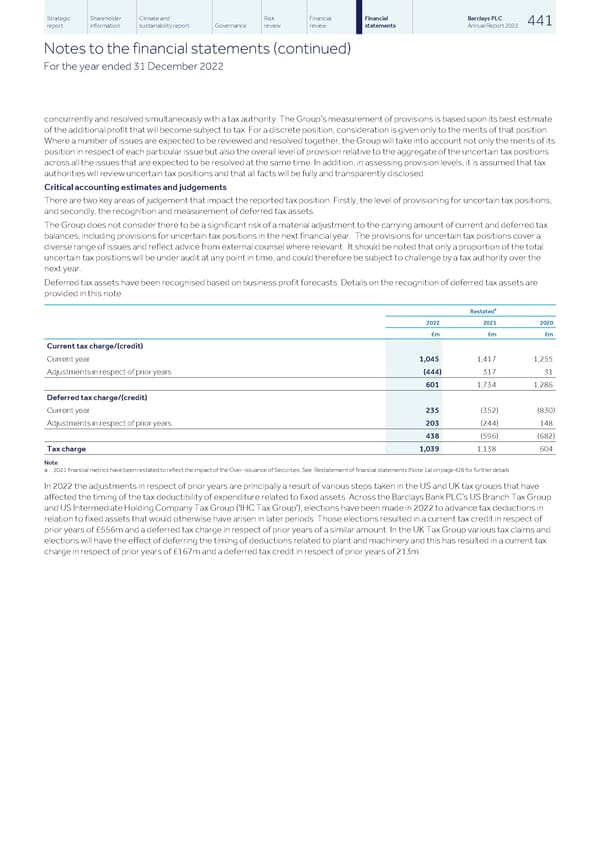

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 441 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) For the year ended 31 December 2022 concurrently and resolved simultaneously with a tax authority. The Group’s measurement of provisions is based upon its best estimate of the additional profit that will become subject to tax. For a discrete position, consideration is given only to the merits of that position. Where a number of issues are expected to be reviewed and resolved together, the Group will take into account not only the merits of its position in respect of each particular issue but also the overall level of provision relative to the aggregate of the uncertain tax positions across all the issues that are expected to be resolved at the same time. In addition, in assessing provision levels, it is assumed that tax authorities will review uncertain tax positions and that all facts will be fully and transparently disclosed. Critical accounting estimates and judgements There are two key areas of judgement that impact the reported tax position. Firstly, the level of provisioning for uncertain tax positions; and secondly, the recognition and measurement of deferred tax assets. The Group does not consider there to be a significant risk of a material adjustment to the carrying amount of current and deferred tax balances, including provisions for uncertain tax positions in the next financial year. The provisions for uncertain tax positions cover a diverse range of issues and reflect advice from external counsel where relevant. It should be noted that only a proportion of the total uncertain tax positions will be under audit at any point in time, and could therefore be subject to challenge by a tax authority over the next year. Deferred tax assets have been recognised based on business profit forecasts. Details on the recognition of deferred tax assets are provided in this note. a Restated 2022 2021 2020 £m £m £m Current tax charge/(credit) Current year 1,045 1,417 1,255 Adjustments in respect of prior years (444) 317 31 601 1,734 1,286 Deferred tax charge/(credit) Current year 235 (352) (830) Adjustments in respect of prior years 203 (244) 148 438 (596) (682) Tax charge 1,039 1,138 604 Note a 2021 financial metrics have been restated to reflect the impact of the Over-issuance of Securities. See Restatement of financial statements (Note 1a) on page 428 for further details. In 2022 the adjustments in respect of prior years are principally a result of various steps taken in the US and UK tax groups that have affected the timing of the tax deductibility of expenditure related to fixed assets. Across the Barclays Bank PLC’s US Branch Tax Group and US Intermediate Holding Company Tax Group ('IHC Tax Group'), elections have been made in 2022 to advance tax deductions in relation to fixed assets that would otherwise have arisen in later periods. Those elections resulted in a current tax credit in respect of prior years of £556m and a deferred tax charge in respect of prior years of a similar amount. In the UK Tax Group various tax claims and elections will have the effect of deferring the timing of deductions related to plant and machinery and this has resulted in a current tax charge in respect of prior years of £167m and a deferred tax credit in respect of prior years of 213m.

Barclays PLC - Annual Report - 2022 Page 442 Page 444

Barclays PLC - Annual Report - 2022 Page 442 Page 444