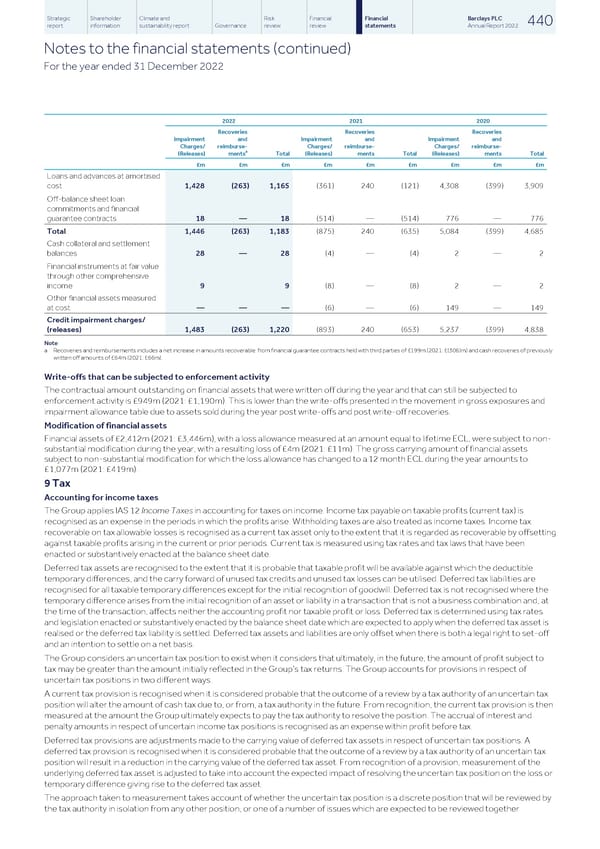

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 440 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) For the year ended 31 December 2022 2022 2021 2020 Recoveries Recoveries Recoveries Impairment and Impairment and Impairment and Charges/ reimburse- Charges/ reimburse- Charges/ reimburse- a (Releases) ments Total (Releases) ments Total (Releases) ments Total £m £m £m £m £m £m £m £m £m Loans and advances at amortised cost 1,428 (263) 1,165 (361) 240 (121) 4,308 (399) 3,909 Off-balance sheet loan commitments and financial guarantee contracts 18 — 18 (514) — (514) 776 — 776 Total 1,446 (263) 1,183 (875) 240 (635) 5,084 (399) 4,685 Cash collateral and settlement balances 28 — 28 (4) — (4) 2 — 2 Financial instruments at fair value through other comprehensive income 9 9 (8) — (8) 2 — 2 Other financial assets measured at cost — — — (6) — (6) 149 — 149 Credit impairment charges/ (releases) 1,483 (263) 1,220 (893) 240 (653) 5,237 (399) 4,838 Note a Recoveries and reimbursements includes a net increase in amounts recoverable from financial guarantee contracts held with third parties of £199m (2021: £(306)m) and cash recoveries of previously written off amounts of £64m (2021: £66m). Write-offs that can be subjected to enforcement activity The contractual amount outstanding on financial assets that were written off during the year and that can still be subjected to enforcement activity is £949m (2021: £1,190m). This is lower than the write-offs presented in the movement in gross exposures and impairment allowance table due to assets sold during the year post write-offs and post write-off recoveries. Modification of financial assets Financial assets of £2,412m (2021: £3,446m), with a loss allowance measured at an amount equal to lifetime ECL, were subject to non- substantial modification during the year, with a resulting loss of £4m (2021: £11m). The gross carrying amount of financial assets subject to non-substantial modification for which the loss allowance has changed to a 12 month ECL during the year amounts to £1,077m (2021: £419m). 9 Tax Accounting for income taxes The Group applies IAS 12 Income Taxes in accounting for taxes on income. Income tax payable on taxable profits (current tax) is recognised as an expense in the periods in which the profits arise. Withholding taxes are also treated as income taxes. Income tax recoverable on tax allowable losses is recognised as a current tax asset only to the extent that it is regarded as recoverable by offsetting against taxable profits arising in the current or prior periods. Current tax is measured using tax rates and tax laws that have been enacted or substantively enacted at the balance sheet date. Deferred tax assets are recognised to the extent that it is probable that taxable profit will be available against which the deductible temporary differences, and the carry forward of unused tax credits and unused tax losses can be utilised. Deferred tax liabilities are recognised for all taxable temporary differences except for the initial recognition of goodwill. Deferred tax is not recognised where the temporary difference arises from the initial recognition of an asset or liability in a transaction that is not a business combination and, at the time of the transaction, affects neither the accounting profit nor taxable profit or loss. Deferred tax is determined using tax rates and legislation enacted or substantively enacted by the balance sheet date which are expected to apply when the deferred tax asset is realised or the deferred tax liability is settled. Deferred tax assets and liabilities are only offset when there is both a legal right to set-off and an intention to settle on a net basis. The Group considers an uncertain tax position to exist when it considers that ultimately, in the future, the amount of profit subject to tax may be greater than the amount initially reflected in the Group’s tax returns. The Group accounts for provisions in respect of uncertain tax positions in two different ways. A current tax provision is recognised when it is considered probable that the outcome of a review by a tax authority of an uncertain tax position will alter the amount of cash tax due to, or from, a tax authority in the future. From recognition, the current tax provision is then measured at the amount the Group ultimately expects to pay the tax authority to resolve the position. The accrual of interest and penalty amounts in respect of uncertain income tax positions is recognised as an expense within profit before tax. Deferred tax provisions are adjustments made to the carrying value of deferred tax assets in respect of uncertain tax positions. A deferred tax provision is recognised when it is considered probable that the outcome of a review by a tax authority of an uncertain tax position will result in a reduction in the carrying value of the deferred tax asset. From recognition of a provision, measurement of the underlying deferred tax asset is adjusted to take into account the expected impact of resolving the uncertain tax position on the loss or temporary difference giving rise to the deferred tax asset. The approach taken to measurement takes account of whether the uncertain tax position is a discrete position that will be reviewed by the tax authority in isolation from any other position, or one of a number of issues which are expected to be reviewed together

Barclays PLC - Annual Report - 2022 Page 441 Page 443

Barclays PLC - Annual Report - 2022 Page 441 Page 443