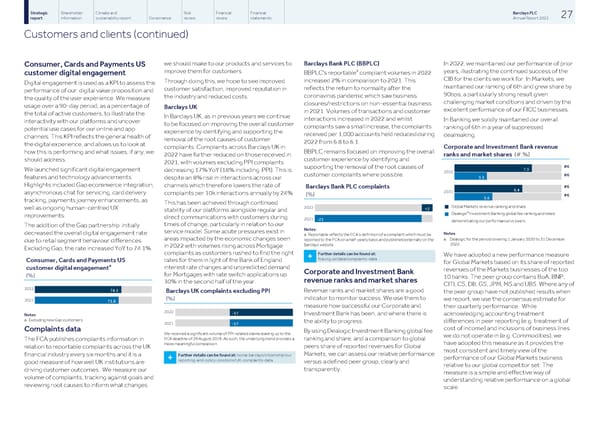

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 27 report information sustainability report Governance review review statements Annual Report 2022 Customers and clients (continued) we should make to our products and services to Barclays Bank PLC (BBPLC) In 2022, we maintained our performance of prior Consumer, Cards and Payments US a improve them for customers. years, illustrating the continued success of the BBPLC's reportable complaint volumes in 2022 customer digital engagement CIB for the clients we work for. In Markets, we increased 2% in comparison to 2021. This Through doing this, we hope to see improved Digital engagement is used as a KPI to assess the maintained our ranking of 6th and grew share by reflects the return to normality after the customer satisfaction, improved reputation in performance of our digital value proposition and 90bps, a particularly strong result given coronavirus pandemic which saw business the industry and reduced costs. the quality of the user experience. We measure challenging market conditions and driven by the closures/restrictions on non-essential business usage over a 90-day period, as a percentage of Barclays UK excellent performance of our FICC businesses. in 2021. Volumes of transactions and customer the total of active customers, to illustrate the In Barclays UK, as in previous years we continue interactions increased in 2022 and whilst In Banking we solidly maintained our overall interactivity with our platforms and uncover to be focused on improving the overall customer complaints saw a small increase, the complaints ranking of 6th in a year of suppressed potential use cases for our online and app experience by identifying and supporting the received per 1,000 accounts held reduced during dealmaking. channels. This KPI reflects the general health of removal of the root causes of customer 2022 from 6.8 to 6.1. the digital experience, and allows us to look at Corporate and Investment Bank revenue complaints. Complaints across Barclays UK in BBPLC remains focused on improving the overall how this is performing and what issues, if any, we ranks and market shares (#,%) 2022 have further reduced on those received in customer experience by identifying and should address. 2021, with volumes excluding PPI complaints #6 supporting the removal of the root causes of 7.3 We launched significant digital engagement decreasing 17% YoY (18% including PPI). This is 2022 #6 customer complaints where possible. 3.1 features and technology advancements. despite an 8% rise in interactions across our Highlights included Gap ecommerce integration, channels which therefore lowers the rate of #6 Barclays Bank PLC complaints 6.4 2021 asynchronous chat for servicing, card delivery complaints per 10k interactions annually by 24%. (%) #6 3.6 tracking, payments journey enhancements, as This has been achieved through continued Global Markets revenue ranking and share 2022 n well as ongoing human-centred UX +2 stability of our platforms alongside regular and a Dealogic Investment Banking global fee ranking and share n improvements. direct communications with customers during 2021 -21 demonstrating our performance vs peers. times of change, particularly in relation to our The addition of the Gap partnership initially Notes: service model. Some acute pressures exist in Notes decreased the overall digital engagement rate a Reportable reflects the FCA’s definition of a complaint which must be a Dealogic for the period covering 1 January 2020 to 31 December areas impacted by the economic changes seen reported to the FCA on a half-yearly basis and published externally on the due to retail segment behaviour differences. 2022. Barclays website. in 2022 with volumes rising across Mortgage Excluding Gap, the rate increased YoY to 74.1%. complaints as customers rushed to find the right Further details can be found at: We have adopted a new performance measure + fca.org.uk/data/complaints-data rates for them in light of the Bank of England Consumer, Cards and Payments US for Global Markets based on its share of reported a interest rate changes and unpredicted demand customer digital engagement revenues of the Markets businesses of the top Corporate and Investment Bank for Mortgages with rate switch applications up (%) 10 banks. The peer group contains BoA, BNP, revenue ranks and market shares 30% in the second half of the year. CITI, CS, DB, GS, JPM, MS and UBS. Where any of 2022 74.1 Revenue ranks and market shares are a good Barclays UK complaints excluding PPI the peer group have not published results when indicator to monitor success. We use them to (%) we report, we use the consensus estimate for 2021 71.8 measure how successful our Corporate and their quarterly performance. While 2022 -17 Investment Bank has been, and where there is acknowledging accounting treatment Notes a Excluding new Gap customers differences in peer reporting (e.g. treatment of the ability to progress. 2021 -17 cost of income) and inclusions of business lines Complaints data By using Dealogic Investment Banking global fee We received a significant volume of PPI-related claims leading up to the we do not operate in (e.g. Commodities), we FCA deadline of 29 August 2019. As such, the underlying trend provides a ranking and share, and a comparison to global The FCA publishes complaints information in have adopted this measure as it provides the more meaningful comparison. peers share of reported revenues for Global relation to reportable complaints across the UK most consistent and timely view of the Markets, we can assess our relative performance financial industry every six months and it is a Further details can be found at: home.barclays/citizenship/our performance of our Global Markets business + reporting-and-policy-positions/UK-complaints-data versus a defined peer group, clearly and good measure of how well UK institutions are relative to our global competitor set. The transparently. driving customer outcomes. We measure our measure is a simple and effective way of volume of complaints, tracking against goals and understanding relative performance on a global reviewing root causes to inform what changes scale.

Barclays PLC - Annual Report - 2022 Page 28 Page 30

Barclays PLC - Annual Report - 2022 Page 28 Page 30