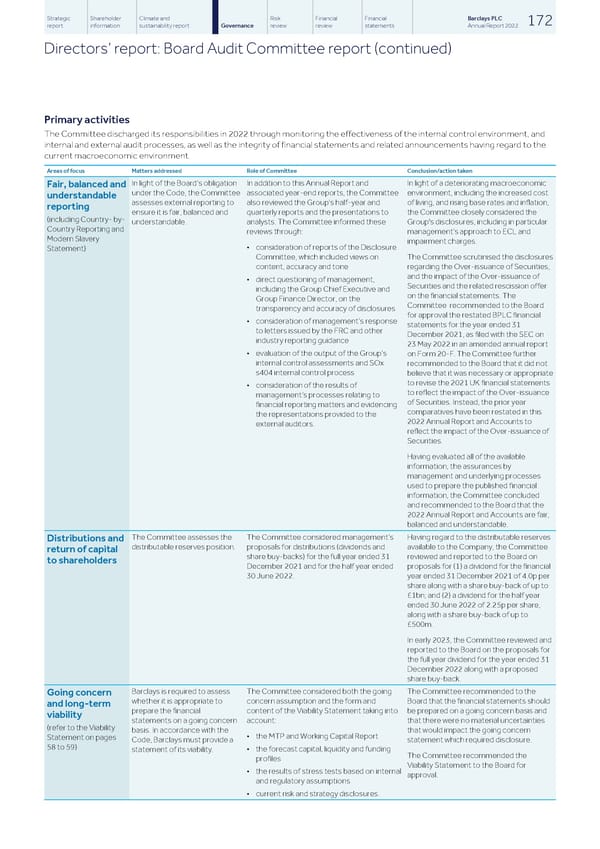

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 172 report information sustainability report Governance review review statements Annual Report 2022 Directors’ report: Board Audit Committee report (continued) Primary activities The Committee discharged its responsibilities in 2022 through monitoring the effectiveness of the internal control environment, and internal and external audit processes, as well as the integrity of financial statements and related announcements having regard to the current macroeconomic environment. Areas of focus Matters addressed Role of Committee Conclusion/action taken In light of a deteriorating macroeconomic In light of the Board’s obligation In addition to this Annual Report and Fair, balanced and under the Code, the Committee associated year-end reports, the Committee environment, including the increased cost understandable assesses external reporting to also reviewed the Group’s half-year and of living, and rising base rates and inflation, reporting ensure it is fair, balanced and quarterly reports and the presentations to the Committee closely considered the (including Country- by- understandable. analysts. The Committee informed these Group's disclosures, including in particular Country Reporting and reviews through: management’s approach to ECL and Modern Slavery impairment charges. • consideration of reports of the Disclosure Statement) Committee, which included views on The Committee scrutinised the disclosures content, accuracy and tone regarding the Over-issuance of Securities, and the impact of the Over-issuance of • direct questioning of management, Securities and the related rescission offer including the Group Chief Executive and on the financial statements. The Group Finance Director, on the Committee recommended to the Board transparency and accuracy of disclosures for approval the restated BPLC financial • consideration of management’s response statements for the year ended 31 to letters issued by the FRC and other December 2021, as filed with the SEC on industry reporting guidance 23 May 2022 in an amended annual report • evaluation of the output of the Group’s on Form 20-F. The Committee further internal control assessments and SOx recommended to the Board that it did not s404 internal control process believe that it was necessary or appropriate to revise the 2021 UK financial statements • consideration of the results of to reflect the impact of the Over-issuance management’s processes relating to of Securities. Instead, the prior year financial reporting matters and evidencing comparatives have been restated in this the representations provided to the 2022 Annual Report and Accounts to external auditors. reflect the impact of the Over-issuance of Securities. Having evaluated all of the available information, the assurances by management and underlying processes used to prepare the published financial information, the Committee concluded and recommended to the Board that the 2022 Annual Report and Accounts are fair, balanced and understandable. The Committee assesses the The Committee considered management’s Having regard to the distributable reserves Distributions and distributable reserves position. proposals for distributions (dividends and available to the Company, the Committee return of capital share buy-backs) for the full year ended 31 reviewed and reported to the Board on to shareholders December 2021 and for the half year ended proposals for (1) a dividend for the financial 30 June 2022. year ended 31 December 2021 of 4.0p per share along with a share buy-back of up to £1bn; and (2) a dividend for the half year ended 30 June 2022 of 2.25p per share, along with a share buy-back of up to £500m. In early 2023, the Committee reviewed and reported to the Board on the proposals for the full year dividend for the year ended 31 December 2022 along with a proposed share buy-back. Barclays is required to assess The Committee considered both the going The Committee recommended to the Going concern whether it is appropriate to concern assumption and the form and Board that the financial statements should and long-term prepare the financial content of the Viability Statement taking into be prepared on a going concern basis and viability statements on a going concern account: that there were no material uncertainties (refer to the Viability basis. In accordance with the that would impact the going concern • the MTP and Working Capital Report Statement on pages Code, Barclays must provide a statement which required disclosure. 58 to 59) • the forecast capital, liquidity and funding statement of its viability. The Committee recommended the profiles Viability Statement to the Board for • the results of stress tests based on internal approval. and regulatory assumptions • current risk and strategy disclosures.

Barclays PLC - Annual Report - 2022 Page 173 Page 175

Barclays PLC - Annual Report - 2022 Page 173 Page 175