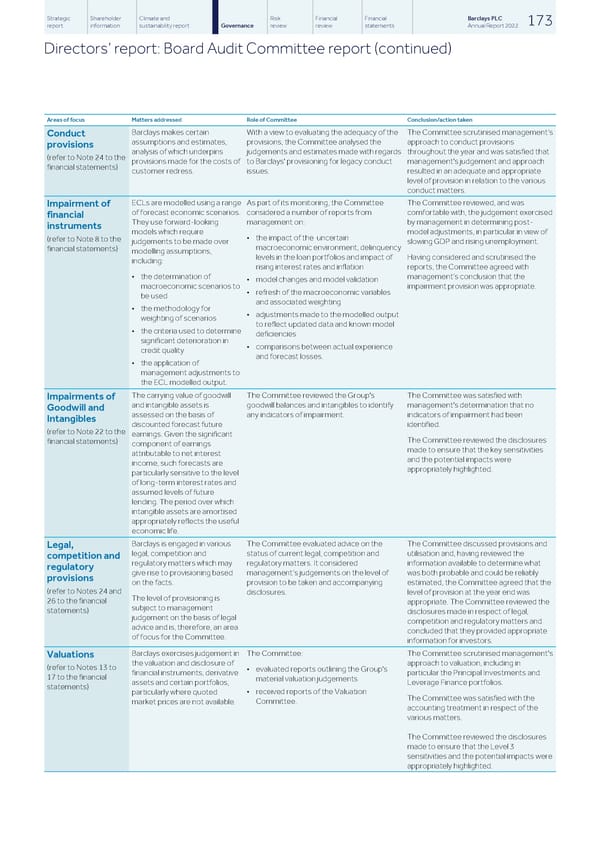

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 173 report information sustainability report Governance review review statements Annual Report 2022 Directors’ report: Board Audit Committee report (continued) Areas of focus Matters addressed Role of Committee Conclusion/action taken Barclays makes certain With a view to evaluating the adequacy of the The Committee scrutinised management’s Conduct assumptions and estimates, provisions, the Committee analysed the approach to conduct provisions provisions analysis of which underpins judgements and estimates made with regards throughout the year and was satisfied that (refer to Note 24 to the provisions made for the costs of to Barclays' provisioning for legacy conduct management's judgement and approach financial statements) customer redress. issues. resulted in an adequate and appropriate level of provision in relation to the various conduct matters. ECLs are modelled using a range As part of its monitoring, the Committee The Committee reviewed, and was Impairment of of forecast economic scenarios. considered a number of reports from comfortable with, the judgement exercised financial They use forward-looking management on: by management in determining post- instruments models which require model adjustments, in particular in view of • the impact of the uncertain (refer to Note 8 to the judgements to be made over slowing GDP and rising unemployment. macroeconomic environment, delinquency financial statements) modelling assumptions, levels in the loan portfolios and impact of Having considered and scrutinised the including: rising interest rates and inflation reports, the Committee agreed with • the determination of management’s conclusion that the • model changes and model validation macroeconomic scenarios to impairment provision was appropriate. • refresh of the macroeconomic variables be used and associated weighting • the methodology for • adjustments made to the modelled output weighting of scenarios to reflect updated data and known model • the criteria used to determine deficiencies significant deterioration in • comparisons between actual experience credit quality and forecast losses. • the application of management adjustments to the ECL modelled output. The carrying value of goodwill The Committee reviewed the Group's The Committee was satisfied with Impairments of and intangible assets is goodwill balances and intangibles to identify management's determination that no Goodwill and assessed on the basis of any indicators of impairment. indicators of impairment had been Intangibles discounted forecast future identified. (refer to Note 22 to the earnings. Given the significant The Committee reviewed the disclosures financial statements) component of earnings made to ensure that the key sensitivities attributable to net interest and the potential impacts were income, such forecasts are appropriately highlighted. particularly sensitive to the level of long-term interest rates and assumed levels of future lending. The period over which intangible assets are amortised appropriately reflects the useful economic life. Barclays is engaged in various The Committee evaluated advice on the The Committee discussed provisions and Legal, legal, competition and status of current legal, competition and utilisation and, having reviewed the competition and regulatory matters which may regulatory matters. It considered information available to determine what regulatory give rise to provisioning based management’s judgements on the level of was both probable and could be reliably provisions on the facts. provision to be taken and accompanying estimated, the Committee agreed that the (refer to Notes 24 and disclosures. level of provision at the year end was The level of provisioning is 26 to the financial appropriate. The Committee reviewed the subject to management statements) disclosures made in respect of legal, judgement on the basis of legal competition and regulatory matters and advice and is, therefore, an area concluded that they provided appropriate of focus for the Committee. information for investors. Barclays exercises judgement in The Committee: The Committee scrutinised management's Valuations the valuation and disclosure of approach to valuation, including in (refer to Notes 13 to • evaluated reports outlining the Group's financial instruments, derivative particular the Principal Investments and 17 to the financial material valuation judgements assets and certain portfolios, Leverage Finance portfolios. statements) • received reports of the Valuation particularly where quoted The Committee was satisfied with the Committee. market prices are not available. accounting treatment in respect of the various matters. The Committee reviewed the disclosures made to ensure that the Level 3 sensitivities and the potential impacts were appropriately highlighted.

Barclays PLC - Annual Report - 2022 Page 174 Page 176

Barclays PLC - Annual Report - 2022 Page 174 Page 176