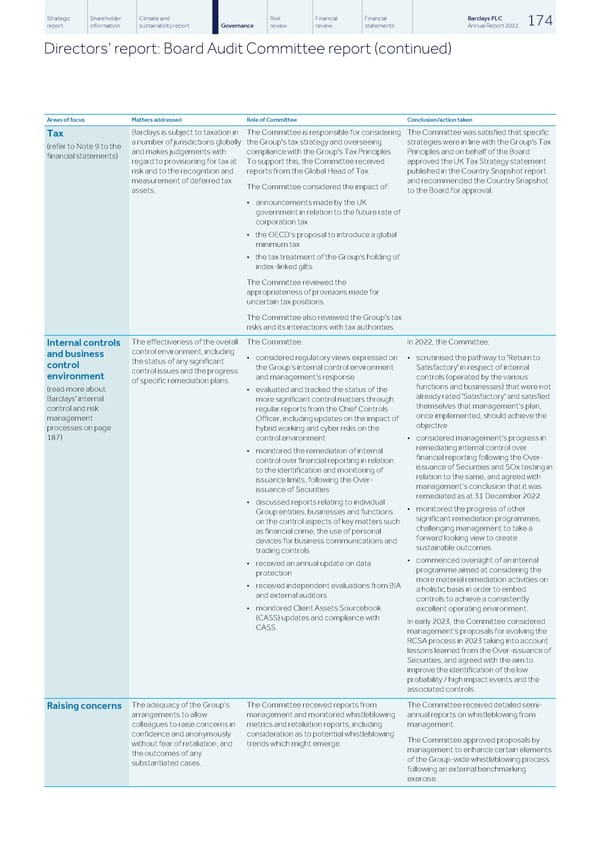

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 174 report information sustainability report Governance review review statements Annual Report 2022 Directors’ report: Board Audit Committee report (continued) Areas of focus Matters addressed Role of Committee Conclusion/action taken The Committee was satisfied that specific Barclays is subject to taxation in The Committee is responsible for considering Tax a number of jurisdictions globally the Group's tax strategy and overseeing strategies were in line with the Group's Tax (refer to Note 9 to the and makes judgements with compliance with the Group's Tax Principles. Principles and on behalf of the Board financial statements) regard to provisioning for tax at To support this, the Committee received approved the UK Tax Strategy statement risk and to the recognition and reports from the Global Head of Tax. published in the Country Snapshot report and recommended the Country Snapshot measurement of deferred tax The Committee considered the impact of: assets. to the Board for approval. • announcements made by the UK government in relation to the future rate of corporation tax • the OECD’s proposal to introduce a global minimum tax • the tax treatment of the Group’s holding of index-linked gilts. The Committee reviewed the appropriateness of provisions made for uncertain tax positions. The Committee also reviewed the Group's tax risks and its interactions with tax authorities. The effectiveness of the overall The Committee: In 2022, the Committee: Internal controls control environment, including and business • considered regulatory views expressed on • scrutinised the pathway to 'Return to the status of any significant control the Group’s internal control environment Satisfactory' in respect of internal control issues and the progress environment and management’s response controls (operated by the various of specific remediation plans. functions and businesses) that were not (read more about • evaluated and tracked the status of the already rated 'Satisfactory' and satisfied Barclays' internal more significant control matters through themselves that management’s plan, control and risk regular reports from the Chief Controls once implemented, should achieve the management Officer, including updates on the impact of objective processes on page hybrid working and cyber risks on the 187) control environment • considered management’s progress in remediating internal control over • monitored the remediation of internal financial reporting following the Over- control over financial reporting in relation issuance of Securities and SOx testing in to the identification and monitoring of relation to the same, and agreed with issuance limits, following the Over- management’s conclusion that it was issuance of Securities remediated as at 31 December 2022 • discussed reports relating to individual • monitored the progress of other Group entities, businesses and functions significant remediation programmes, on the control aspects of key matters such challenging management to take a as financial crime, the use of personal forward looking view to create devices for business communications and sustainable outcomes trading controls • commenced oversight of an internal • received an annual update on data programme aimed at considering the protection more material remediation activities on • received independent evaluations from BIA a holistic basis in order to embed and external auditors controls to achieve a consistently • monitored Client Assets Sourcebook excellent operating environment. (CASS) updates and compliance with In early 2023, the Committee considered CASS. management’s proposals for evolving the RCSA process in 2023 taking into account lessons learned from the Over-issuance of Securities, and agreed with the aim to improve the identification of the low probability / high impact events and the associated controls. The adequacy of the Group’s The Committee received reports from The Committee received detailed semi- Raising concerns arrangements to allow management and monitored whistleblowing annual reports on whistleblowing from colleagues to raise concerns in metrics and retaliation reports, including management. confidence and anonymously consideration as to potential whistleblowing The Committee approved proposals by without fear of retaliation, and trends which might emerge. management to enhance certain elements the outcomes of any of the Group-wide whistleblowing process substantiated cases. following an external benchmarking exercise.

Barclays PLC - Annual Report - 2022 Page 175 Page 177

Barclays PLC - Annual Report - 2022 Page 175 Page 177