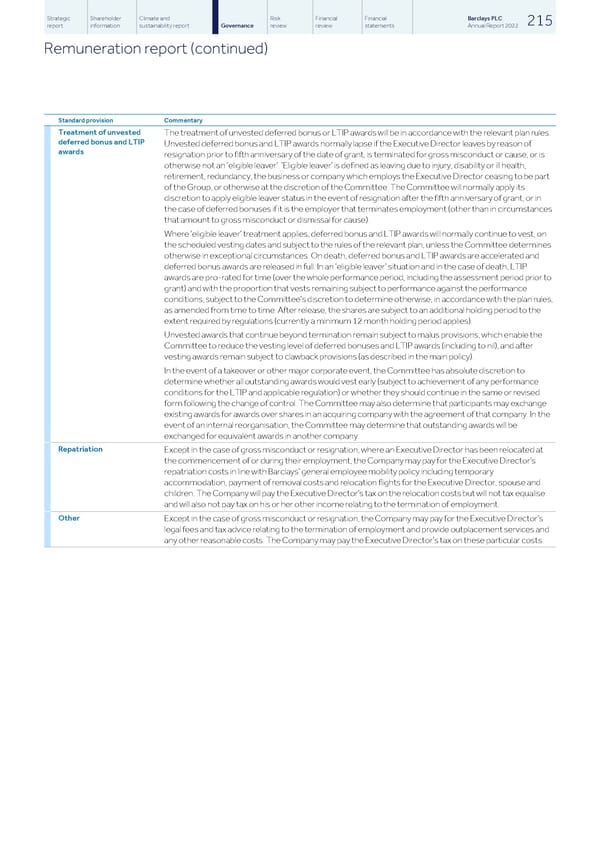

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 215 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Standard provision Commentary Treatment of unvested The treatment of unvested deferred bonus or LTIP awards will be in accordance with the relevant plan rules. deferred bonus and LTIP Unvested deferred bonus and LTIP awards normally lapse if the Executive Director leaves by reason of awards resignation prior to fifth anniversary of the date of grant, is terminated for gross misconduct or cause, or is otherwise not an ‘eligible leaver’. ‘Eligible leaver’ is defined as leaving due to injury, disability or ill health, retirement, redundancy, the business or company which employs the Executive Director ceasing to be part of the Group, or otherwise at the discretion of the Committee. The Committee will normally apply its discretion to apply eligible leaver status in the event of resignation after the fifth anniversary of grant, or in the case of deferred bonuses if it is the employer that terminates employment (other than in circumstances that amount to gross misconduct or dismissal for cause). Where ‘eligible leaver’ treatment applies, deferred bonus and LTIP awards will normally continue to vest, on the scheduled vesting dates and subject to the rules of the relevant plan, unless the Committee determines otherwise in exceptional circumstances. On death, deferred bonus and LTIP awards are accelerated and deferred bonus awards are released in full. In an ‘eligible leaver’ situation and in the case of death, LTIP awards are pro-rated for time (over the whole performance period, including the assessment period prior to grant) and with the proportion that vests remaining subject to performance against the performance conditions, subject to the Committee’s discretion to determine otherwise, in accordance with the plan rules, as amended from time to time. After release, the shares are subject to an additional holding period to the extent required by regulations (currently a minimum 12 month holding period applies). Unvested awards that continue beyond termination remain subject to malus provisions, which enable the Committee to reduce the vesting level of deferred bonuses and LTIP awards (including to nil), and after vesting awards remain subject to clawback provisions (as described in the main policy). In the event of a takeover or other major corporate event, the Committee has absolute discretion to determine whether all outstanding awards would vest early (subject to achievement of any performance conditions for the LTIP and applicable regulation) or whether they should continue in the same or revised form following the change of control. The Committee may also determine that participants may exchange existing awards for awards over shares in an acquiring company with the agreement of that company. In the event of an internal reorganisation, the Committee may determine that outstanding awards will be exchanged for equivalent awards in another company. Repatriation Except in the case of gross misconduct or resignation, where an Executive Director has been relocated at the commencement of or during their employment, the Company may pay for the Executive Director’s repatriation costs in line with Barclays’ general employee mobility policy including temporary accommodation, payment of removal costs and relocation flights for the Executive Director, spouse and children. The Company will pay the Executive Director’s tax on the relocation costs but will not tax equalise and will also not pay tax on his or her other income relating to the termination of employment. Other Except in the case of gross misconduct or resignation, the Company may pay for the Executive Director’s legal fees and tax advice relating to the termination of employment and provide outplacement services and any other reasonable costs. The Company may pay the Executive Director’s tax on these particular costs.

Barclays PLC - Annual Report - 2022 Page 216 Page 218

Barclays PLC - Annual Report - 2022 Page 216 Page 218