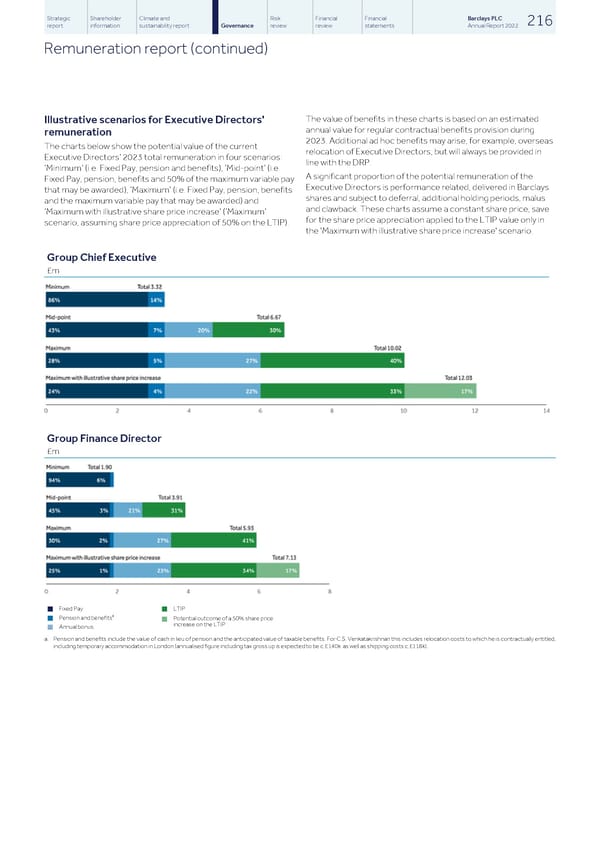

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 216 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) The value of benefits in these charts is based on an estimated Illustrative scenarios for Executive Directors' annual value for regular contractual benefits provision during remuneration 2023. Additional ad hoc benefits may arise, for example, overseas The charts below show the potential value of the current relocation of Executive Directors, but will always be provided in Executive Directors’ 2023 total remuneration in four scenarios: line with the DRP. ‘Minimum’ (i.e. Fixed Pay, pension and benefits), ‘Mid-point’ (i.e. A significant proportion of the potential remuneration of the Fixed Pay, pension, benefits and 50% of the maximum variable pay Executive Directors is performance related, delivered in Barclays that may be awarded), ‘Maximum’ (i.e. Fixed Pay, pension, benefits shares and subject to deferral, additional holding periods, malus and the maximum variable pay that may be awarded) and and clawback. These charts assume a constant share price, save ‘Maximum with illustrative share price increase’ (‘Maximum’ for the share price appreciation applied to the LTIP value only in scenario, assuming share price appreciation of 50% on the LTIP). the 'Maximum with illustrative share price increase' scenario. Group Chief Executive £m Group Finance Director £m Fixed Pay LTIP n n a Pension and benefits Potential outcome of a 50% share price n n increase on the LTIP Annual bonus n a. Pension and benefits include the value of cash in lieu of pension and the anticipated value of taxable benefits. For C.S. Venkatakrishnan this includes relocation costs to which he is contractually entitled, including temporary accommodation in London (annualised figure including tax gross up is expected to be c.£140k as well as shipping costs c.£118k).

Barclays PLC - Annual Report - 2022 Page 217 Page 219

Barclays PLC - Annual Report - 2022 Page 217 Page 219