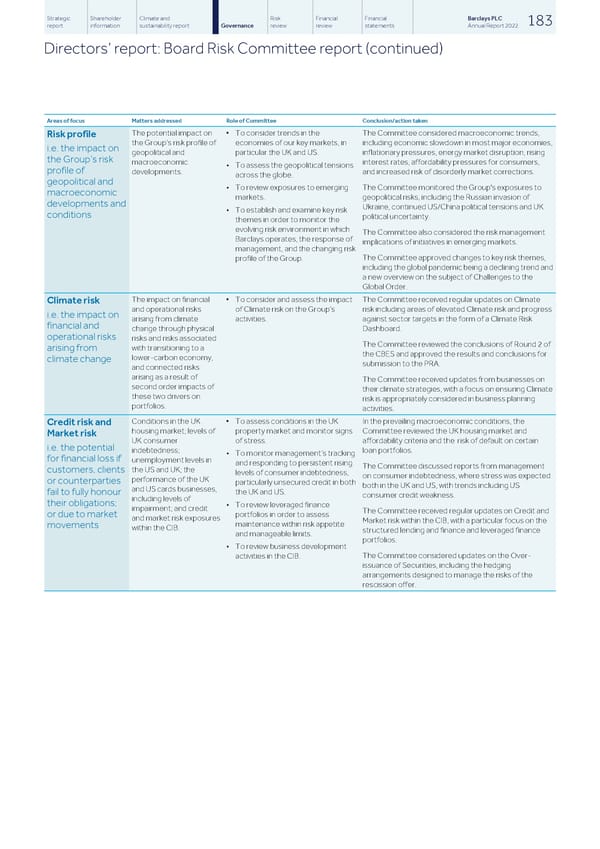

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 183 report information sustainability report Governance review review statements Annual Report 2022 Directors’ report: Board Risk Committee report (continued) Areas of focus Matters addressed Role of Committee Conclusion/action taken The Committee considered macroeconomic trends, The potential impact on ▪ To consider trends in the Risk profile the Group’s risk profile of economies of our key markets, in including economic slowdown in most major economies, i.e. the impact on geopolitical and particular the UK and US. inflationary pressures, energy market disruption, rising the Group’s risk macroeconomic interest rates, affordability pressures for consumers, • To assess the geopolitical tensions profile of developments. and increased risk of disorderly market corrections. across the globe. geopolitical and The Committee monitored the Group's exposures to • To review exposures to emerging macroeconomic markets. geopolitical risks, including the Russian invasion of developments and Ukraine, continued US/China political tensions and UK • To establish and examine key risk conditions political uncertainty. themes in order to monitor the evolving risk environment in which The Committee also considered the risk management Barclays operates, the response of implications of initiatives in emerging markets. management, and the changing risk The Committee approved changes to key risk themes, profile of the Group. including the global pandemic being a declining trend and a new overview on the subject of Challenges to the Global Order. The impact on financial ▪ To consider and assess the impact The Committee received regular updates on Climate Climate risk and operational risks of Climate risk on the Group’s risk including areas of elevated Climate risk and progress i.e. the impact on arising from climate activities. against sector targets in the form of a Climate Risk financial and change through physical Dashboard. operational risks risks and risks associated The Committee reviewed the conclusions of Round 2 of with transitioning to a arising from the CBES and approved the results and conclusions for lower-carbon economy, climate change submission to the PRA. and connected risks arising as a result of The Committee received updates from businesses on second order impacts of their climate strategies, with a focus on ensuring Climate these two drivers on risk is appropriately considered in business planning portfolios. activities. Conditions in the UK ▪ To assess conditions in the UK In the prevailing macroeconomic conditions, the Credit risk and housing market; levels of property market and monitor signs Committee reviewed the UK housing market and Market risk UK consumer of stress. affordability criteria and the risk of default on certain i.e. the potential indebtedness; loan portfolios. • To monitor management’s tracking for financial loss if unemployment levels in and responding to persistent rising The Committee discussed reports from management the US and UK; the customers, clients levels of consumer indebtedness, on consumer indebtedness, where stress was expected performance of the UK or counterparties particularly unsecured credit in both both in the UK and US, with trends including US and US cards businesses, the UK and US. fail to fully honour consumer credit weakness. including levels of their obligations; • To review leveraged finance impairment; and credit The Committee received regular updates on Credit and portfolios in order to assess or due to market and market risk exposures Market risk within the CIB, with a particular focus on the maintenance within risk appetite movements within the CIB. structured lending and finance and leveraged finance and manageable limits. portfolios. • To review business development The Committee considered updates on the Over- activities in the CIB. issuance of Securities, including the hedging arrangements designed to manage the risks of the rescission offer.

Barclays PLC - Annual Report - 2022 Page 184 Page 186

Barclays PLC - Annual Report - 2022 Page 184 Page 186