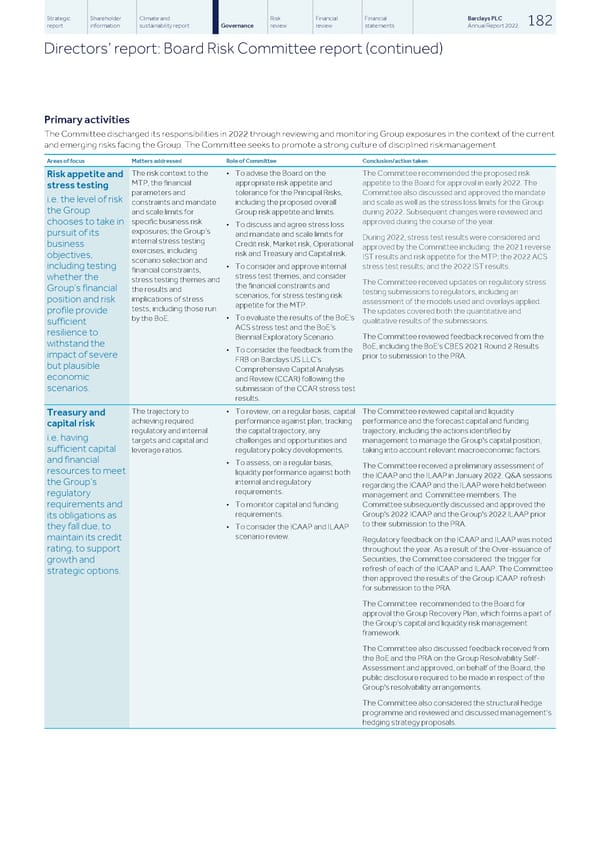

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 182 report information sustainability report Governance review review statements Annual Report 2022 Directors’ report: Board Risk Committee report (continued) Primary activities The Committee discharged its responsibilities in 2022 through reviewing and monitoring Group exposures in the context of the current and emerging risks facing the Group. The Committee seeks to promote a strong culture of disciplined risk management. Areas of focus Matters addressed Role of Committee Conclusion/action taken The risk context to the • To advise the Board on the The Committee recommended the proposed risk Risk appetite and MTP, the financial appropriate risk appetite and appetite to the Board for approval in early 2022. The stress testing parameters and tolerance for the Principal Risks, Committee also discussed and approved the mandate i.e. the level of risk including the proposed overall and scale as well as the stress loss limits for the Group constraints and mandate the Group and scale limits for Group risk appetite and limits. during 2022. Subsequent changes were reviewed and specific business risk approved during the course of the year. chooses to take in • To discuss and agree stress loss exposures; the Group’s pursuit of its and mandate and scale limits for During 2022, stress test results were considered and internal stress testing Credit risk, Market risk, Operational business approved by the Committee including: the 2021 reverse exercises, including risk and Treasury and Capital risk. objectives, IST results and risk appetite for the MTP; the 2022 ACS scenario selection and • To consider and approve internal stress test results; and the 2022 IST results. including testing financial constraints, stress test themes, and consider whether the stress testing themes and The Committee received updates on regulatory stress the financial constraints and Group’s financial the results and testing submissions to regulators, including an scenarios, for stress testing risk implications of stress position and risk assessment of the models used and overlays applied. appetite for the MTP. tests, including those run profile provide The updates covered both the quantitative and • To evaluate the results of the BoE’s by the BoE. qualitative results of the submissions. sufficient ACS stress test and the BoE’s resilience to The Committee reviewed feedback received from the Biennial Exploratory Scenario. withstand the BoE, including the BoE’s CBES 2021 Round 2 Results • To consider the feedback from the impact of severe prior to submission to the PRA. FRB on Barclays US LLC’s but plausible Comprehensive Capital Analysis economic and Review (CCAR) following the scenarios. submission of the CCAR stress test results. The trajectory to • To review, on a regular basis, capital The Committee reviewed capital and liquidity Treasury and achieving required performance against plan, tracking performance and the forecast capital and funding capital risk regulatory and internal the capital trajectory, any trajectory, including the actions identified by i.e. having targets and capital and challenges and opportunities and management to manage the Group's capital position, sufficient capital leverage ratios. regulatory policy developments. taking into account relevant macroeconomic factors. and financial • To assess, on a regular basis, The Committee received a preliminary assessment of resources to meet liquidity performance against both the ICAAP and the ILAAP in January 2022. Q&A sessions internal and regulatory the Group’s regarding the ICAAP and the ILAAP were held between requirements. regulatory management and Committee members. The • To monitor capital and funding Committee subsequently discussed and approved the requirements and requirements. Group's 2022 ICAAP and the Group's 2022 ILAAP prior its obligations as to their submission to the PRA. they fall due, to • To consider the ICAAP and ILAAP scenario review. maintain its credit Regulatory feedback on the ICAAP and ILAAP was noted rating, to support throughout the year. As a result of the Over-issuance of Securities, the Committee considered the trigger for growth and refresh of each of the ICAAP and ILAAP. The Committee strategic options. then approved the results of the Group ICAAP refresh for submission to the PRA. The Committee recommended to the Board for approval the Group Recovery Plan, which forms a part of the Group’s capital and liquidity risk management framework. The Committee also discussed feedback received from the BoE and the PRA on the Group Resolvability Self- Assessment and approved, on behalf of the Board, the public disclosure required to be made in respect of the Group's resolvability arrangements. The Committee also considered the structural hedge programme and reviewed and discussed management’s hedging strategy proposals.

Barclays PLC - Annual Report - 2022 Page 183 Page 185

Barclays PLC - Annual Report - 2022 Page 183 Page 185