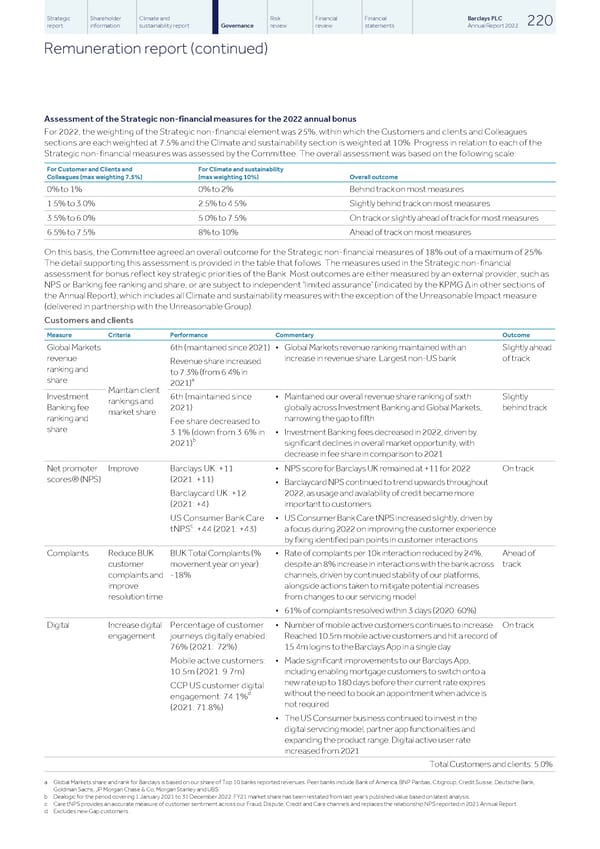

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 220 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Assessment of the Strategic non-financial measures for the 2022 annual bonus For 2022, the weighting of the Strategic non-financial element was 25%, within which the Customers and clients and Colleagues sections are each weighted at 7.5% and the Climate and sustainability section is weighted at 10%. Progress in relation to each of the Strategic non-financial measures was assessed by the Committee. The overall assessment was based on the following scale: For Customer and Clients and For Climate and sustainability Colleagues (max weighting 7.5%) (max weighting 10%) Overall outcome 0% to 1% 0% to 2% Behind track on most measures 1.5% to 3.0% 2.5% to 4.5% Slightly behind track on most measures 3.5% to 6.0% 5.0% to 7.5% On track or slightly ahead of track for most measures 6.5% to 7.5% 8% to 10% Ahead of track on most measures On this basis, the Committee agreed an overall outcome for the Strategic non-financial measures of 18% out of a maximum of 25%. The detail supporting this assessment is provided in the table that follows. The measures used in the Strategic non-financial assessment for bonus reflect key strategic priorities of the Bank. Most outcomes are either measured by an external provider, such as NPS or Banking fee ranking and share, or are subject to independent ‘limited assurance’ (indicated by the KPMG Δ in other sections of the Annual Report), which includes all Climate and sustainability measures with the exception of the Unreasonable Impact measure (delivered in partnership with the Unreasonable Group). Customers and clients Measure Criteria Performance Commentary Outcome Global Markets 6th (maintained since 2021) • Global Markets revenue ranking maintained with an Slightly ahead revenue increase in revenue share. Largest non-US bank of track Revenue share increased ranking and to 7.3% (from 6.4% in a share 2021) Maintain client Investment 6th (maintained since • Maintained our overall revenue share ranking of sixth Slightly rankings and Banking fee 2021) globally across Investment Banking and Global Markets, behind track market share ranking and narrowing the gap to fifth Fee share decreased to share 3.1% (down from 3.6% in • Investment Banking fees decreased in 2022, driven by b 2021) significant declines in overall market opportunity, with decrease in fee share in comparison to 2021 Net promoter Improve Barclays UK: +11 • NPS score for Barclays UK remained at +11 for 2022 On track scores® (NPS) (2021: +11) • Barclaycard NPS continued to trend upwards throughout Barclaycard UK: +12 2022, as usage and availability of credit became more (2021: +4) important to customers US Consumer Bank Care • US Consumer Bank Care tNPS increased slightly, driven by c tNPS : +44 (2021: +43) a focus during 2022 on improving the customer experience by fixing identified pain points in customer interactions • Rate of complaints per 10k interaction reduced by 24%, Ahead of Complaints Reduce BUK BUK Total Complaints (% customer movement year on year): despite an 8% increase in interactions with the bank across track complaints and -18% channels, driven by continued stability of our platforms, improve alongside actions taken to mitigate potential increases resolution time from changes to our servicing model • 61% of complaints resolved within 3 days (2020: 60%) Digital Increase digital Percentage of customer • Number of mobile active customers continues to increase. On track engagement journeys digitally enabled: Reached 10.5m mobile active customers and hit a record of 76% (2021: 72%) 15.4m logins to the Barclays App in a single day Mobile active customers: • Made significant improvements to our Barclays App, 10.5m (2021: 9.7m) including enabling mortgage customers to switch onto a new rate up to 180 days before their current rate expires CCP US customer digital d without the need to book an appointment when advice is engagement: 74.1% not required (2021: 71.8%) • The US Consumer business continued to invest in the digital servicing model, partner app functionalities and expanding the product range. Digital active user rate increased from 2021 Total Customers and clients: 5.0% a Global Markets share and rank for Barclays is based on our share of Top 10 banks reported revenues. Peer banks include Bank of America, BNP Paribas, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, JP Morgan Chase & Co, Morgan Stanley and UBS. b Dealogic for the period covering 1 January 2021 to 31 December 2022. FY21 market share has been restated from last year’s published value based on latest analysis. c Care tNPS provides an accurate measure of customer sentiment across our Fraud, Dispute, Credit and Care channels and replaces the relationship NPS reported in 2021 Annual Report. d Excludes new Gap customers.

Barclays PLC - Annual Report - 2022 Page 221 Page 223

Barclays PLC - Annual Report - 2022 Page 221 Page 223