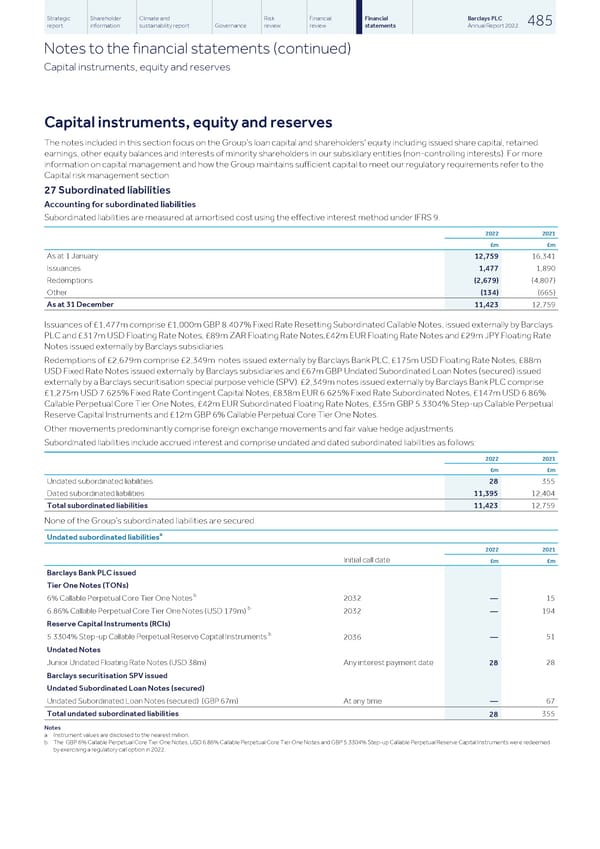

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 485 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Capital instruments, equity and reserves Capital instruments, equity and reserves The notes included in this section focus on the Group’s loan capital and shareholders’ equity including issued share capital, retained earnings, other equity balances and interests of minority shareholders in our subsidiary entities (non-controlling interests). For more information on capital management and how the Group maintains sufficient capital to meet our regulatory requirements refer to the Capital risk management section. 27 Subordinated liabilities Accounting for subordinated liabilities Subordinated liabilities are measured at amortised cost using the effective interest method under IFRS 9. 2022 2021 £m £m As at 1 January 12,759 16,341 Issuances 1,477 1,890 Redemptions (2,679) (4,807) Other (134) (665) As at 31 December 11,423 12,759 Issuances of £1,477m comprise £1,000m GBP 8.407% Fixed Rate Resetting Subordinated Callable Notes, issued externally by Barclays PLC and £317m USD Floating Rate Notes, £89m ZAR Floating Rate Notes,£42m EUR Floating Rate Notes and £29m JPY Floating Rate Notes issued externally by Barclays subsidiaries. Redemptions of £2,679m comprise £2,349m notes issued externally by Barclays Bank PLC, £175m USD Floating Rate Notes, £88m USD Fixed Rate Notes issued externally by Barclays subsidiaries and £67m GBP Undated Subordinated Loan Notes (secured) issued externally by a Barclays securitisation special purpose vehicle (SPV). £2,349m notes issued externally by Barclays Bank PLC comprise £1,275m USD 7.625% Fixed Rate Contingent Capital Notes, £838m EUR 6.625% Fixed Rate Subordinated Notes, £147m USD 6.86% Callable Perpetual Core Tier One Notes, £42m EUR Subordinated Floating Rate Notes, £35m GBP 5.3304% Step-up Callable Perpetual Reserve Capital Instruments and £12m GBP 6% Callable Perpetual Core Tier One Notes. Other movements predominantly comprise foreign exchange movements and fair value hedge adjustments. Subordinated liabilities include accrued interest and comprise undated and dated subordinated liabilities as follows: 2022 2021 £m £m Undated subordinated liabilities 28 355 Dated subordinated liabilities 11,395 12,404 Total subordinated liabilities 11,423 12,759 None of the Group’s subordinated liabilities are secured. a Undated subordinated liabilities 2022 2021 Initial call date £m £m Barclays Bank PLC issued Tier One Notes (TONs) b 6% Callable Perpetual Core Tier One Notes 2032 15 — b 6.86% Callable Perpetual Core Tier One Notes (USD 179m) 2032 194 — Reserve Capital Instruments (RCIs) b 5.3304% Step-up Callable Perpetual Reserve Capital Instruments 51 2036 — Undated Notes Junior Undated Floating Rate Notes (USD 38m) Any interest payment date 28 28 Barclays securitisation SPV issued Undated Subordinated Loan Notes (secured) Undated Subordinated Loan Notes (secured) (GBP 67m) At any time 67 — Total undated subordinated liabilities 355 28 Notes a Instrument values are disclosed to the nearest million. b The GBP 6% Callable Perpetual Core Tier One Notes, USD 6.86% Callable Perpetual Core Tier One Notes and GBP 5.3304% Step-up Callable Perpetual Reserve Capital Instruments were redeemed by exercising a regulatory call option in 2022.

Barclays PLC - Annual Report - 2022 Page 486 Page 488

Barclays PLC - Annual Report - 2022 Page 486 Page 488