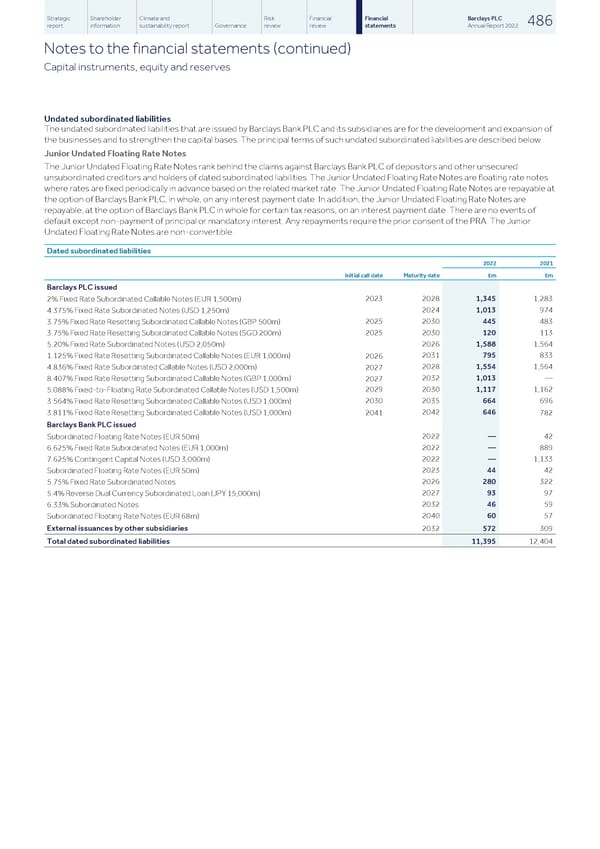

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 486 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Capital instruments, equity and reserves Undated subordinated liabilities The undated subordinated liabilities that are issued by Barclays Bank PLC and its subsidiaries are for the development and expansion of the businesses and to strengthen the capital bases. The principal terms of such undated subordinated liabilities are described below: Junior Undated Floating Rate Notes The Junior Undated Floating Rate Notes rank behind the claims against Barclays Bank PLC of depositors and other unsecured unsubordinated creditors and holders of dated subordinated liabilities. The Junior Undated Floating Rate Notes are floating rate notes where rates are fixed periodically in advance based on the related market rate. The Junior Undated Floating Rate Notes are repayable at the option of Barclays Bank PLC, in whole, on any interest payment date. In addition, the Junior Undated Floating Rate Notes are repayable, at the option of Barclays Bank PLC in whole for certain tax reasons, on an interest payment date. There are no events of default except non-payment of principal or mandatory interest. Any repayments require the prior consent of the PRA. The Junior Undated Floating Rate Notes are non-convertible. Dated subordinated liabilities 2022 2021 Initial call date Maturity date £m £m Barclays PLC issued 2023 2028 1,345 1,283 2% Fixed Rate Subordinated Callable Notes (EUR 1,500m) 2024 1,013 974 4.375% Fixed Rate Subordinated Notes (USD 1,250m) 2025 2030 445 483 3.75% Fixed Rate Resetting Subordinated Callable Notes (GBP 500m) 2025 2030 120 113 3.75% Fixed Rate Resetting Subordinated Callable Notes (SGD 200m) 2026 1,588 1,564 5.20% Fixed Rate Subordinated Notes (USD 2,050m) 2031 795 833 1.125% Fixed Rate Resetting Subordinated Callable Notes (EUR 1,000m) 2026 2028 1,554 1,564 4.836% Fixed Rate Subordinated Callable Notes (USD 2,000m) 2027 2032 1,013 — 8.407% Fixed Rate Resetting Subordinated Callable Notes (GBP 1,000m) 2027 2029 2030 1,117 1,162 5.088% Fixed-to-Floating Rate Subordinated Callable Notes (USD 1,500m) 2030 2035 664 696 3.564% Fixed Rate Resetting Subordinated Callable Notes (USD 1,000m) 2042 646 3.811% Fixed Rate Resetting Subordinated Callable Notes (USD 1,000m) 2041 782 Barclays Bank PLC issued 2022 — 42 Subordinated Floating Rate Notes (EUR 50m) 2022 — 889 6.625% Fixed Rate Subordinated Notes (EUR 1,000m) 2022 — 1,133 7.625% Contingent Capital Notes (USD 3,000m) 2023 44 42 Subordinated Floating Rate Notes (EUR 50m) 2026 280 322 5.75% Fixed Rate Subordinated Notes 2027 93 97 5.4% Reverse Dual Currency Subordinated Loan (JPY 15,000m) 2032 46 59 6.33% Subordinated Notes 2040 60 57 Subordinated Floating Rate Notes (EUR 68m) External issuances by other subsidiaries 2032 572 309 Total dated subordinated liabilities 11,395 12,404

Barclays PLC - Annual Report - 2022 Page 487 Page 489

Barclays PLC - Annual Report - 2022 Page 487 Page 489