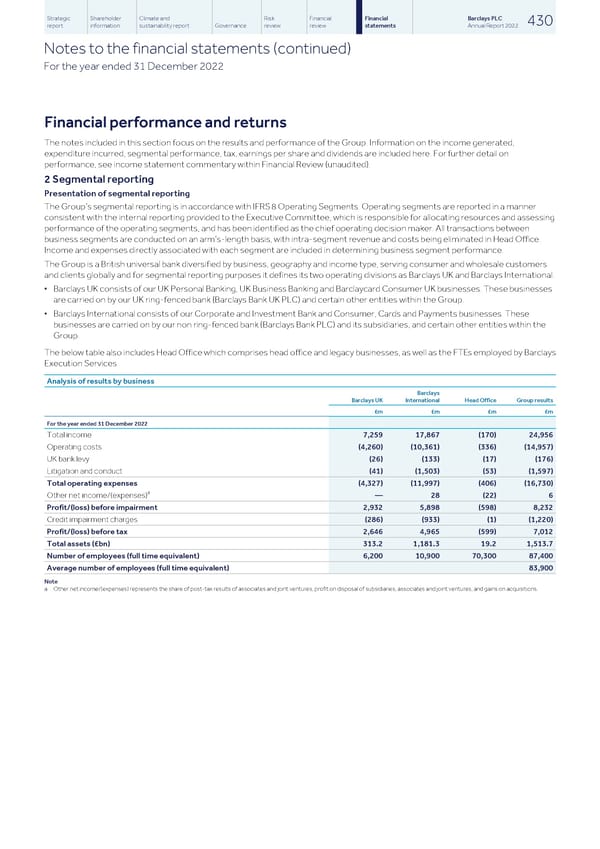

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 430 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) For the year ended 31 December 2022 Financial performance and returns The notes included in this section focus on the results and performance of the Group. Information on the income generated, expenditure incurred, segmental performance, tax, earnings per share and dividends are included here. For further detail on performance, see income statement commentary within Financial Review (unaudited). 2 Segmental reporting Presentation of segmental reporting The Group’s segmental reporting is in accordance with IFRS 8 Operating Segments. Operating segments are reported in a manner consistent with the internal reporting provided to the Executive Committee, which is responsible for allocating resources and assessing performance of the operating segments, and has been identified as the chief operating decision maker. All transactions between business segments are conducted on an arm’s-length basis, with intra-segment revenue and costs being eliminated in Head Office. Income and expenses directly associated with each segment are included in determining business segment performance. The Group is a British universal bank diversified by business, geography and income type, serving consumer and wholesale customers and clients globally and for segmental reporting purposes it defines its two operating divisions as Barclays UK and Barclays International. ▪ Barclays UK consists of our UK Personal Banking, UK Business Banking and Barclaycard Consumer UK businesses. These businesses are carried on by our UK ring-fenced bank (Barclays Bank UK PLC) and certain other entities within the Group. ▪ Barclays International consists of our Corporate and Investment Bank and Consumer, Cards and Payments businesses. These businesses are carried on by our non ring-fenced bank (Barclays Bank PLC) and its subsidiaries, and certain other entities within the Group. The below table also includes Head Office which comprises head office and legacy businesses, as well as the FTEs employed by Barclays Execution Services. Analysis of results by business Barclays Barclays UK International Head Office Group results £m £m £m £m For the year ended 31 December 2022 Total income 7,259 17,867 (170) 24,956 Operating costs (4,260) (10,361) (336) (14,957) UK bank levy (26) (133) (17) (176) Litigation and conduct (41) (1,503) (53) (1,597) Total operating expenses (4,327) (11,997) (406) (16,730) a Other net income/(expenses) — 28 (22) 6 Profit/(loss) before impairment 2,932 5,898 (598) 8,232 Credit impairment charges (286) (933) (1) (1,220) Profit/(loss) before tax 2,646 4,965 (599) 7,012 Total assets (£bn) 313.2 1,181.3 19.2 1,513.7 Number of employees (full time equivalent) 6,200 10,900 70,300 87,400 Average number of employees (full time equivalent) 83,900 Note a Other net income/(expenses) represents the share of post-tax results of associates and joint ventures, profit on disposal of subsidiaries, associates and joint ventures, and gains on acquisitions.

Barclays PLC - Annual Report - 2022 Page 431 Page 433

Barclays PLC - Annual Report - 2022 Page 431 Page 433