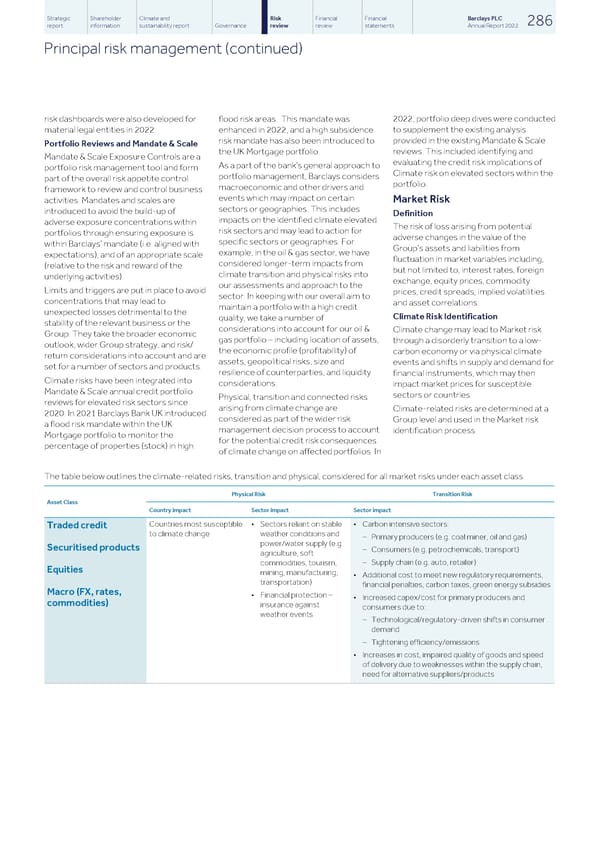

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 286 report information sustainability report Governance review review statements Annual Report 2022 Principal risk management (continued) risk dashboards were also developed for flood risk areas. This mandate was 2022, portfolio deep dives were conducted material legal entities in 2022. enhanced in 2022, and a high subsidence to supplement the existing analysis risk mandate has also been introduced to provided in the existing Mandate & Scale Portfolio Reviews and Mandate & Scale the UK Mortgage portfolio. reviews. This included identifying and Mandate & Scale Exposure Controls are a evaluating the credit risk implications of As a part of the bank’s general approach to portfolio risk management tool and form Climate risk on elevated sectors within the portfolio management, Barclays considers part of the overall risk appetite control portfolio. macroeconomic and other drivers and framework to review and control business events which may impact on certain Market Risk activities. Mandates and scales are sectors or geographies. This includes introduced to avoid the build-up of Definition impacts on the identified climate elevated adverse exposure concentrations within The risk of loss arising from potential risk sectors and may lead to action for portfolios through ensuring exposure is adverse changes in the value of the specific sectors or geographies. For within Barclays’ mandate (i.e. aligned with Group’s assets and liabilities from example, in the oil & gas sector, we have expectations), and of an appropriate scale fluctuation in market variables including, considered longer-term impacts from (relative to the risk and reward of the but not limited to, interest rates, foreign climate transition and physical risks into underlying activities). exchange, equity prices, commodity our assessments and approach to the Limits and triggers are put in place to avoid prices, credit spreads, implied volatilities sector. In keeping with our overall aim to concentrations that may lead to and asset correlations. maintain a portfolio with a high credit unexpected losses detrimental to the Climate Risk Identification quality, we take a number of stability of the relevant business or the considerations into account for our oil & Climate change may lead to Market risk Group. They take the broader economic gas portfolio – including location of assets, through a disorderly transition to a low- outlook, wider Group strategy, and risk/ the economic profile (profitability) of carbon economy or via physical climate return considerations into account and are assets, geopolitical risks, size and events and shifts in supply and demand for set for a number of sectors and products. resilience of counterparties, and liquidity financial instruments, which may then Climate risks have been integrated into considerations. impact market prices for susceptible Mandate & Scale annual credit portfolio sectors or countries. Physical, transition and connected risks reviews for elevated risk sectors since arising from climate change are Climate-related risks are determined at a 2020. In 2021 Barclays Bank UK introduced considered as part of the wider risk Group level and used in the Market risk a flood risk mandate within the UK management decision process to account identification process. Mortgage portfolio to monitor the for the potential credit risk consequences percentage of properties (stock) in high of climate change on affected portfolios. In The table below outlines the climate-related risks, transition and physical, considered for all market risks under each asset class Physical Risk Transition Risk Asset Class Country impact Sector impact Sector impact Countries most susceptible • Sectors reliant on stable • Carbon intensive sectors: Traded credit to climate change weather conditions and – Primary producers (e.g. coal miner, oil and gas) power/water supply (e.g. Securitised products – Consumers (e.g. petrochemicals, transport) agriculture, soft – Supply chain (e.g. auto, retailer) commodities, tourism, Equities mining, manufacturing, • Additional cost to meet new regulatory requirements, transportation) financial penalties, carbon taxes, green energy subsidies Macro (FX, rates, • Financial protection – • Increased capex/cost for primary producers and commodities) insurance against consumers due to: weather events – Technological/regulatory-driven shifts in consumer demand – Tightening efficiency/emissions • Increases in cost, impaired quality of goods and speed of delivery due to weaknesses within the supply chain, need for alternative suppliers/products

Barclays PLC - Annual Report - 2022 Page 287 Page 289

Barclays PLC - Annual Report - 2022 Page 287 Page 289