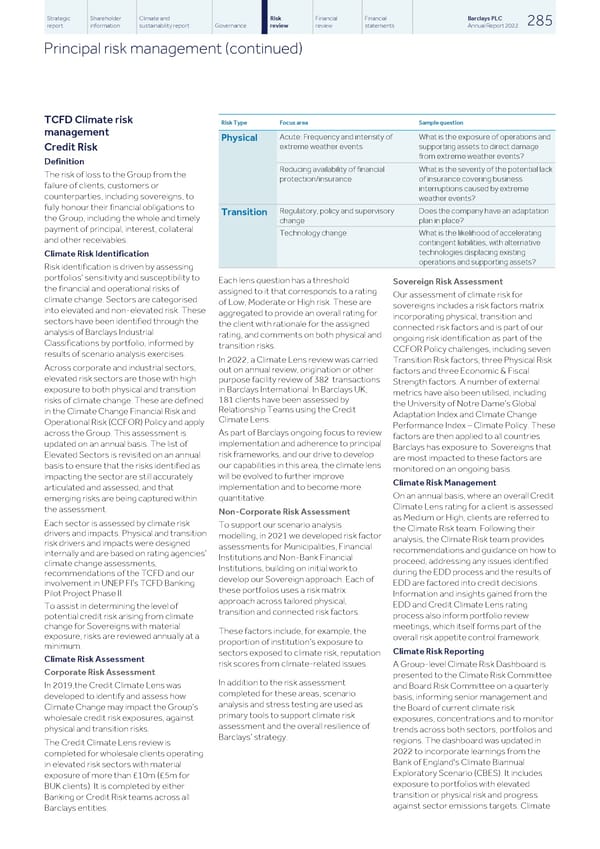

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 285 report information sustainability report Governance review review statements Annual Report 2022 Principal risk management (continued) TCFD Climate risk Risk Type Focus area Sample question management Acute: Frequency and intensity of What is the exposure of operations and Physical extreme weather events supporting assets to direct damage Credit Risk from extreme weather events? Definition Reducing availability of financial What is the severity of the potential lack The risk of loss to the Group from the protection/insurance of insurance covering business failure of clients, customers or interruptions caused by extreme counterparties, including sovereigns, to weather events? fully honour their financial obligations to Regulatory, policy and supervisory Does the company have an adaptation Transition the Group, including the whole and timely change plan in place? payment of principal, interest, collateral Technology change What is the likelihood of accelerating and other receivables. contingent liabilities, with alternative technologies displacing existing Climate Risk Identification operations and supporting assets? Risk identification is driven by assessing portfolios’ sensitivity and susceptibility to Each lens question has a threshold Sovereign Risk Assessment the financial and operational risks of assigned to it that corresponds to a rating Our assessment of climate risk for climate change. Sectors are categorised of Low, Moderate or High risk. These are sovereigns includes a risk factors matrix into elevated and non-elevated risk. These aggregated to provide an overall rating for incorporating physical, transition and sectors have been identified through the the client with rationale for the assigned connected risk factors and is part of our analysis of Barclays Industrial rating, and comments on both physical and ongoing risk identification as part of the Classifications by portfolio, informed by transition risks. CCFOR Policy challenges, including seven results of scenario analysis exercises. In 2022, a Climate Lens review was carried Transition Risk factors, three Physical Risk Across corporate and industrial sectors, out on annual review, origination or other factors and three Economic & Fiscal elevated risk sectors are those with high purpose facility review of 382 transactions Strength factors. A number of external exposure to both physical and transition in Barclays International. In Barclays UK, metrics have also been utilised, including 181 clients have been assessed by risks of climate change. These are defined the University of Notre Dame’s Global Relationship Teams using the Credit in the Climate Change Financial Risk and Adaptation Index and Climate Change Climate Lens. Operational Risk (CCFOR) Policy and apply Performance Index – Climate Policy. These As part of Barclays ongoing focus to review across the Group. This assessment is factors are then applied to all countries implementation and adherence to principal updated on an annual basis. The list of Barclays has exposure to. Sovereigns that risk frameworks, and our drive to develop Elevated Sectors is revisited on an annual are most impacted to these factors are our capabilities in this area, the climate lens basis to ensure that the risks identified as monitored on an ongoing basis. will be evolved to further improve impacting the sector are still accurately Climate Risk Management implementation and to become more articulated and assessed, and that On an annual basis, where an overall Credit quantitative. emerging risks are being captured within Climate Lens rating for a client is assessed the assessment. Non-Corporate Risk Assessment as Medium or High, clients are referred to Each sector is assessed by climate risk To support our scenario analysis the Climate Risk team. Following their drivers and impacts. Physical and transition modelling, in 2021 we developed risk factor analysis, the Climate Risk team provides risk drivers and impacts were designed assessments for Municipalities, Financial recommendations and guidance on how to internally and are based on rating agencies’ Institutions and Non-Bank Financial proceed, addressing any issues identified climate change assessments, Institutions, building on initial work to during the EDD process and the results of recommendations of the TCFD and our develop our Sovereign approach. Each of EDD are factored into credit decisions. involvement in UNEP FI’s TCFD Banking these portfolios uses a risk matrix Pilot Project Phase II. Information and insights gained from the approach across tailored physical, EDD and Credit Climate Lens rating To assist in determining the level of transition and connected risk factors. process also inform portfolio review potential credit risk arising from climate change for Sovereigns with material meetings, which itself forms part of the These factors include, for example, the exposure, risks are reviewed annually at a overall risk appetite control framework. proportion of institution’s exposure to minimum. Climate Risk Reporting sectors exposed to climate risk, reputation Climate Risk Assessment risk scores from climate-related issues. A Group-level Climate Risk Dashboard is Corporate Risk Assessment presented to the Climate Risk Committee In addition to the risk assessment In 2019,the Credit Climate Lens was and Board Risk Committee on a quarterly completed for these areas, scenario developed to identify and assess how basis, informing senior management and analysis and stress testing are used as Climate Change may impact the Group’s the Board of current climate risk primary tools to support climate risk wholesale credit risk exposures, against exposures, concentrations and to monitor assessment and the overall resilience of physical and transition risks. trends across both sectors, portfolios and Barclays’ strategy. regions. The dashboard was updated in The Credit Climate Lens review is 2022 to incorporate learnings from the completed for wholesale clients operating Bank of England's Climate Biannual in elevated risk sectors with material Exploratory Scenario (CBES). It includes exposure of more than £10m (£5m for exposure to portfolios with elevated BUK clients). It is completed by either transition or physical risk and progress Banking or Credit Risk teams across all against sector emissions targets. Climate Barclays entities.

Barclays PLC - Annual Report - 2022 Page 286 Page 288

Barclays PLC - Annual Report - 2022 Page 286 Page 288