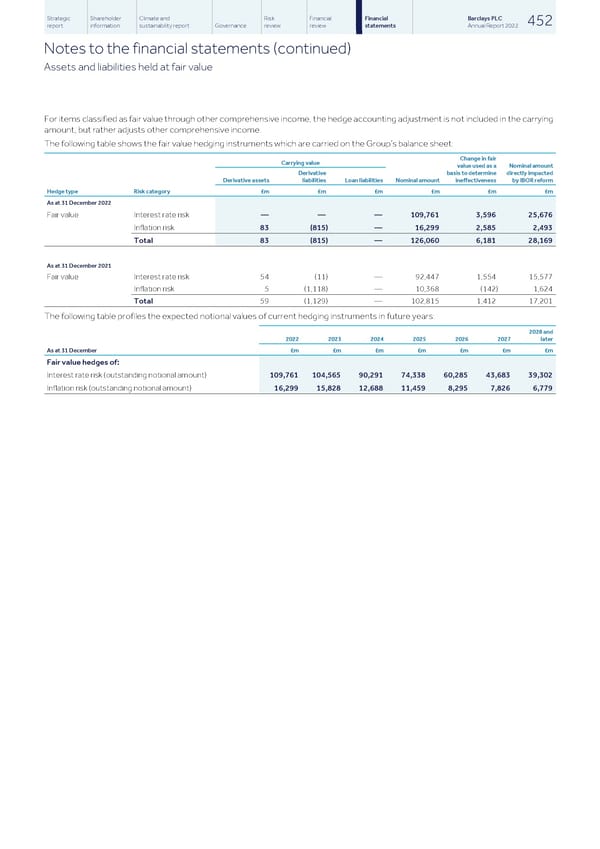

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 452 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Assets and liabilities held at fair value For items classified as fair value through other comprehensive income, the hedge accounting adjustment is not included in the carrying amount, but rather adjusts other comprehensive income. The following table shows the fair value hedging instruments which are carried on the Group’s balance sheet: Change in fair Carrying value value used as a Nominal amount Derivative basis to determine directly impacted Derivative assets liabilities Loan liabilities Nominal amount ineffectiveness by IBOR reform Hedge type Risk category £m £m £m £m £m £m As at 31 December 2022 Fair value Interest rate risk — — — 109,761 3,596 25,676 Inflation risk 83 (815) — 16,299 2,585 2,493 Total 83 (815) — 126,060 6,181 28,169 As at 31 December 2021 Fair value Interest rate risk 54 (11) — 92,447 1,554 15,577 Inflation risk 5 (1,118) — 10,368 (142) 1,624 Total 59 (1,129) — 102,815 1,412 17,201 The following table profiles the expected notional values of current hedging instruments in future years: 2028 and 2022 2023 2024 2025 2026 2027 later As at 31 December £m £m £m £m £m £m £m Fair value hedges of: Interest rate risk (outstanding notional amount) 109,761 104,565 90,291 74,338 60,285 43,683 39,302 Inflation risk (outstanding notional amount) 16,299 15,828 12,688 11,459 8,295 7,826 6,779

Barclays PLC - Annual Report - 2022 Page 453 Page 455

Barclays PLC - Annual Report - 2022 Page 453 Page 455