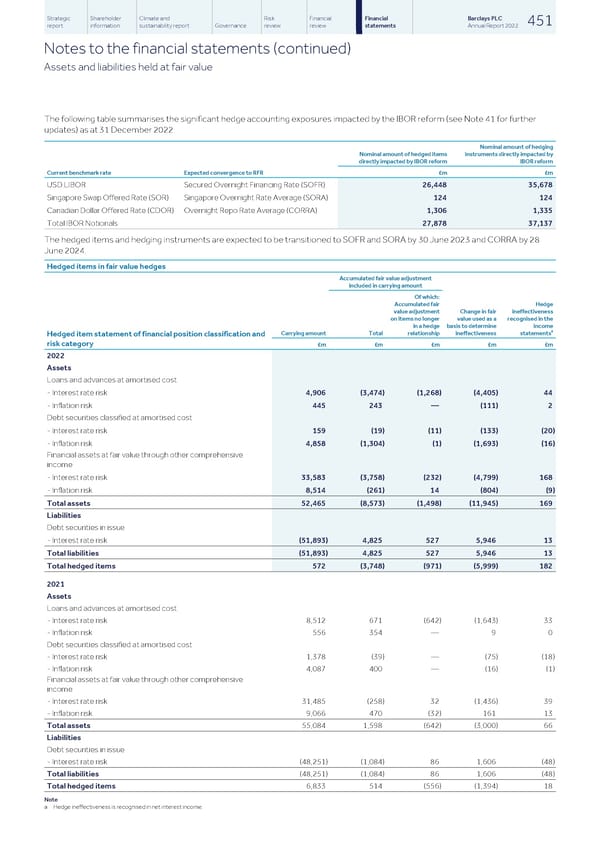

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 451 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Assets and liabilities held at fair value The following table summarises the significant hedge accounting exposures impacted by the IBOR reform (see Note 41 for further updates) as at 31 December 2022: Nominal amount of hedging Nominal amount of hedged items instruments directly impacted by directly impacted by IBOR reform IBOR reform Current benchmark rate Expected convergence to RFR £m £m USD LIBOR Secured Overnight Financing Rate (SOFR) 26,448 35,678 Singapore Swap Offered Rate (SOR) Singapore Overnight Rate Average (SORA) 124 124 Canadian Dollar Offered Rate (CDOR) Overnight Repo Rate Average (CORRA) 1,306 1,335 Total IBOR Notionals 27,878 37,137 The hedged items and hedging instruments are expected to be transitioned to SOFR and SORA by 30 June 2023 and CORRA by 28 June 2024. Hedged items in fair value hedges Accumulated fair value adjustment included in carrying amount Of which: Accumulated fair Hedge value adjustment Change in fair ineffectiveness on items no longer value used as a recognised in the in a hedge basis to determine income a Carrying amount Total relationship ineffectiveness statements Hedged item statement of financial position classification and risk category £m £m £m £m £m 2022 Assets Loans and advances at amortised cost - Interest rate risk 4,906 (3,474) (1,268) (4,405) 44 - Inflation risk 445 243 — (111) 2 Debt securities classified at amortised cost - Interest rate risk 159 (19) (11) (133) (20) - Inflation risk 4,858 (1,304) (1) (1,693) (16) Financial assets at fair value through other comprehensive income - Interest rate risk 33,583 (3,758) (232) (4,799) 168 - Inflation risk 8,514 (261) 14 (804) (9) Total assets 52,465 (8,573) (1,498) (11,945) 169 Liabilities Debt securities in issue - Interest rate risk (51,893) 4,825 527 5,946 13 Total liabilities (51,893) 4,825 527 5,946 13 Total hedged items 572 (3,748) (971) (5,999) 182 2021 Assets Loans and advances at amortised cost - Interest rate risk 8,512 671 (642) (1,643) 33 - Inflation risk 556 354 — 9 0 Debt securities classified at amortised cost - Interest rate risk 1,378 (39) — (75) (18) - Inflation risk 4,087 400 — (16) (1) Financial assets at fair value through other comprehensive income - Interest rate risk 31,485 (258) 32 (1,436) 39 - Inflation risk 9,066 470 (32) 161 13 Total assets 55,084 1,598 (642) (3,000) 66 Liabilities Debt securities in issue - Interest rate risk (48,251) (1,084) 86 1,606 (48) Total liabilities (48,251) (1,084) 86 1,606 (48) Total hedged items 6,833 514 (556) (1,394) 18 Note a Hedge ineffectiveness is recognised in net interest income.

Barclays PLC - Annual Report - 2022 Page 452 Page 454

Barclays PLC - Annual Report - 2022 Page 452 Page 454