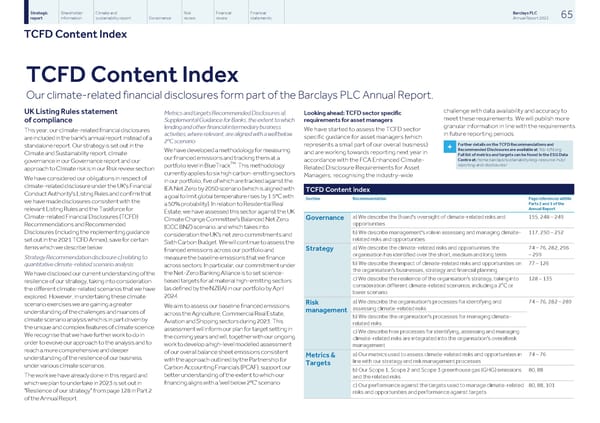

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 65 report information sustainability report Governance review review statements Annual Report 2022 TCFD Content Index TCFD Content Index Our climate-related financial disclosures form part of the Barclays PLC Annual Report. challenge with data availability and accuracy to UK Listing Rules statement Metrics and targets Recommended Disclosures a), Looking ahead: TCFD sector specific meet these requirements. We will publish more Supplemental Guidance for Banks, the extent to which requirements for asset managers of compliance granular information in line with the requirements lending and other financial intermediary business We have started to assess the TCFD sector This year, our climate-related financial disclosures in future reporting periods. activities, where relevant, are aligned with a well below specific guidance for asset managers (which are included in the bank's annual report instead of a 2°C scenario Further details on the TCFD Recommendations and represents a small part of our overall business) standalone report. Our strategy is set out in the + Recommended Disclosures are available at: fsb-tcfd.org We have developed a methodology for measuring and are working towards reporting next year in Climate and Sustainability report, climate Full list of metrics and targets can be found in the ESG Data our financed emissions and tracking them at a Centre at: home.barclays/sustainability/esg-resource-hub/ accordance with the FCA Enhanced Climate- governance in our Governance report and our TM reporting-and-disclosures/ portfolio level in BlueTrack . This methodology Related Disclosure Requirements for Asset approach to Climate risk is in our Risk review section. currently applies to six high carbon-emitting sectors Managers, recognising the industry-wide We have considered our obligations in respect of in our portfolio, five of which are tracked against the climate-related disclosure under the UK's Financial IEA Net Zero by 2050 scenario (which is aligned with TCFD Content index Conduct Authority's Listing Rules and confirm that a goal to limit global temperature rises by 1.5°C with Section Recommendation Page references within we have made disclosures consistent with the Parts 2 and 3 of the a 50% probability). In relation to Residential Real Annual Report relevant Listing Rules and the Taskforce for Estate, we have assessed this sector against the UK a) We describe the Board's oversight of climate-related risks and 155, 248 – 249 Climate-related Financial Disclosures (TCFD) Governance Climate Change Committee's Balanced Net Zero opportunities Recommendations and Recommended (CCC BNZ) scenario, and which takes into Disclosures (including the implementing guidance b) We describe management's role in assessing and managing climate- 117, 250 – 252 consideration the UK's net zero commitments and related risks and opportunities set out in the 2021 TCFD Annex), save for certain Sixth Carbon Budget. We will continue to assess the items which we describe below: a) We describe the climate-related risks and opportunities the 74 – 76, 282, 296 Strategy financed emissions across our portfolio and organisation has identified over the short, medium and long term – 299 Strategy Recommendation disclosure c) relating to measure the baseline emissions that we finance b) We describe the impact of climate-related risks and opportunities on 77 – 126 quantitative climate-related scenario analysis across sectors. In particular, our commitment under the organisation's businesses, strategy and financial planning the Net-Zero Banking Alliance is to set science- We have disclosed our current understanding of the c) We describe the resilience of the organisation's strategy, taking into 128 – 135 based targets for all material high-emitting sectors resilience of our strategy, taking into consideration o consideration different climate-related scenarios, including a 2 C or (as defined by the NZBA) in our portfolio by April the different climate-related scenarios that we have lower scenario 2024. explored. However, in undertaking these climate a) We describe the organisation's processes for identifying and 74 – 76, 282 – 289 Risk scenario exercises we are gaining a greater We aim to assess our baseline financed emissions assessing climate-related risks management understanding of the challenges and nuances of across the Agriculture, Commercial Real Estate, b) We describe the organisation's processes for managing climate- climate scenario analysis which is in part driven by Aviation and Shipping sectors during 2023. This related risks the unique and complex features of climate science. assessment will inform our plan for target setting in c) We describe how processes for identifying, assessing and managing We recognise that we have further work to do in the coming years and will, together with our ongoing climate-related risks are integrated into the organisation's overall risk order to evolve our approach to the analysis and to work to develop a high-level modelled assessment management reach a more comprehensive and deeper of our overall balance sheet emissions consistent a) Our metrics used to assess climate-related risks and opportunities in 74 – 76 Metrics & understanding of the resilience of our business with the approach outlined by the Partnership for line with our strategy and risk management processes Targets under various climate scenarios. Carbon Accounting Financials (PCAF), support our b) Our Scope 1, Scope 2 and Scope 3 greenhouse gas (GHG) emissions 80, 88 better understanding of the extent to which our The work we have already done in this regard and and the related risks financing aligns with a 'well below 2°C' scenario. which we plan to undertake in 2023 is set out in c) Our performance against the targets used to manage climate-related 80, 88, 101 "Resilience of our strategy" from page 128 in Part 2 risks and opportunities and performance against targets of the Annual Report.

Barclays PLC - Annual Report - 2022 Page 66 Page 68

Barclays PLC - Annual Report - 2022 Page 66 Page 68