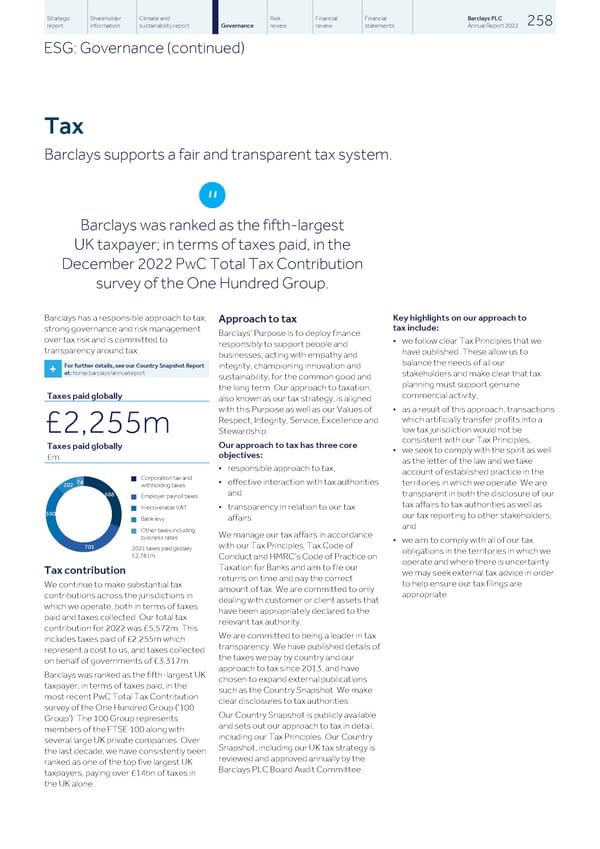

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 258 report information sustainability report Governance review review statements Annual Report 2022 ESG: Governance (continued) Tax Barclays supports a fair and transparent tax system. Barclays was ranked as the fifth-largest UK taxpayer; in terms of taxes paid, in the December 2022 PwC Total Tax Contribution survey of the One Hundred Group. Barclays has a responsible approach to tax, Key highlights on our approach to Approach to tax tax include: strong governance and risk management Barclays’ Purpose is to deploy finance over tax risk and is committed to • we follow clear Tax Principles that we responsibly to support people and transparency around tax. have published. These allow us to businesses, acting with empathy and balance the needs of all our For further details, see our Country Snapshot Report integrity, championing innovation and + at: home.barclays/annualreport stakeholders and make clear that tax sustainability, for the common good and planning must support genuine the long term. Our approach to taxation, commercial activity, Taxes paid globally also known as our tax strategy, is aligned • as a result of this approach, transactions with this Purpose as well as our Values of which artificially transfer profits into a Respect, Integrity, Service, Excellence and low tax jurisdiction would not be £2,255m Stewardship. consistent with our Tax Principles, Our approach to tax has three core Taxes paid globally • we seek to comply with the spirit as well objectives: £m as the letter of the law and we take • responsible approach to tax, account of established practice in the Corporation tax and n 74 • effective interaction with tax authorities territories in which we operate. We are 202 withholding taxes and transparent in both the disclosure of our 688 Employer payroll taxes n tax affairs to tax authorities as well as Irrecoverable VAT • transparency in relation to our tax n 590 our tax reporting to other stakeholders; affairs. Bank levy n and Other taxes including n We manage our tax affairs in accordance business rates • we aim to comply with all of our tax with our Tax Principles, Tax Code of 701 2021 taxes paid globally obligations in the territories in which we £2,781m Conduct and HMRC’s Code of Practice on operate and where there is uncertainty Taxation for Banks and aim to file our Tax contribution we may seek external tax advice in order returns on time and pay the correct to help ensure our tax filings are We continue to make substantial tax amount of tax. We are committed to only appropriate. contributions across the jurisdictions in dealing with customer or client assets that which we operate, both in terms of taxes have been appropriately declared to the paid and taxes collected. Our total tax relevant tax authority. contribution for 2022 was £5,572m. This We are committed to being a leader in tax includes taxes paid of £2,255m which transparency. We have published details of represent a cost to us, and taxes collected the taxes we pay by country and our on behalf of governments of £3,317m. approach to tax since 2013, and have Barclays was ranked as the fifth-largest UK chosen to expand external publications taxpayer, in terms of taxes paid, in the such as the Country Snapshot. We make most recent PwC Total Tax Contribution clear disclosures to tax authorities. survey of the One Hundred Group (‘100 Our Country Snapshot is publicly available Group’). The 100 Group represents and sets out our approach to tax in detail, members of the FTSE 100 along with including our Tax Principles. Our Country several large UK private companies. Over Snapshot, including our UK tax strategy is the last decade, we have consistently been reviewed and approved annually by the ranked as one of the top five largest UK Barclays PLC Board Audit Committee. taxpayers, paying over £14bn of taxes in the UK alone.

Barclays PLC - Annual Report - 2022 Page 259 Page 261

Barclays PLC - Annual Report - 2022 Page 259 Page 261