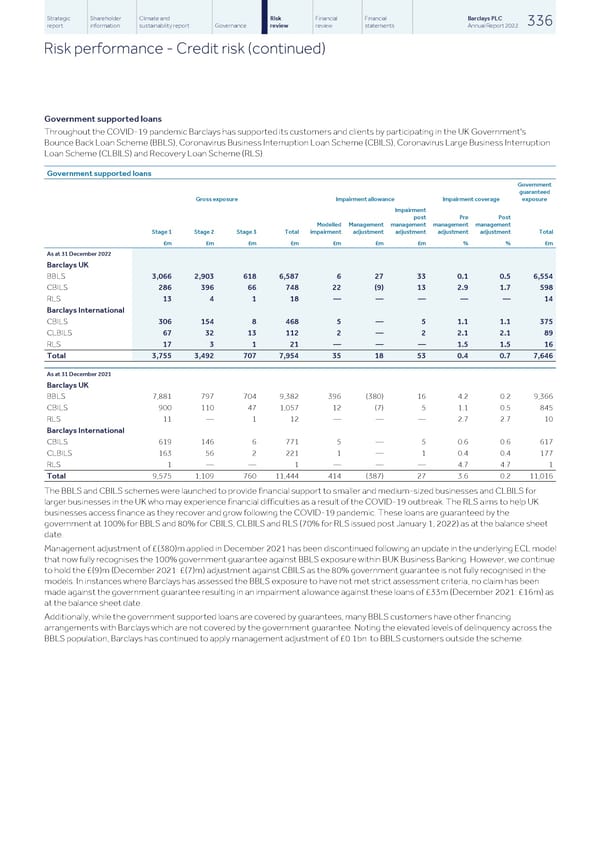

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 336 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Credit risk (continued) Government supported loans Throughout the COVID-19 pandemic Barclays has supported its customers and clients by participating in the UK Government's Bounce Back Loan Scheme (BBLS), Coronavirus Business Interruption Loan Scheme (CBILS), Coronavirus Large Business Interruption Loan Scheme (CLBILS) and Recovery Loan Scheme (RLS). Government supported loans Government guaranteed Gross exposure Impairment allowance Impairment coverage exposure Impairment post Pre Post Modelled Management management management management Stage 1 Stage 2 Stage 3 Total impairment adjustment adjustment adjustment adjustment Total £m £m £m £m £m £m £m % % £m As at 31 December 2022 Barclays UK BBLS 3,066 2,903 618 6,587 6 27 33 0.1 0.5 6,554 CBILS 286 396 66 748 22 (9) 13 2.9 1.7 598 RLS 13 4 1 18 — — — — — 14 Barclays International CBILS 306 154 8 468 5 — 5 1.1 1.1 375 CLBILS 67 32 13 112 2 — 2 2.1 2.1 89 RLS 17 3 1 21 — — — 1.5 1.5 16 Total 3,755 3,492 707 7,954 35 18 53 0.4 0.7 7,646 As at 31 December 2021 Barclays UK BBLS 7,881 797 704 9,382 396 (380) 16 4.2 0.2 9,366 CBILS 900 110 47 1,057 12 (7) 5 1.1 0.5 845 RLS 11 — 1 12 — — — 2.7 2.7 10 Barclays International CBILS 619 146 6 771 5 — 5 0.6 0.6 617 CLBILS 163 56 2 221 1 — 1 0.4 0.4 177 RLS 1 — — 1 — — — 4.7 4.7 1 Total 9,575 1,109 760 11,444 414 (387) 27 3.6 0.2 11,016 The BBLS and CBILS schemes were launched to provide financial support to smaller and medium-sized businesses and CLBILS for larger businesses in the UK who may experience financial difficulties as a result of the COVID-19 outbreak. The RLS aims to help UK businesses access finance as they recover and grow following the COVID-19 pandemic. These loans are guaranteed by the government at 100% for BBLS and 80% for CBILS, CLBILS and RLS (70% for RLS issued post January 1, 2022) as at the balance sheet date. Management adjustment of £(380)m applied in December 2021 has been discontinued following an update in the underlying ECL model that now fully recognises the 100% government guarantee against BBLS exposure within BUK Business Banking. However, we continue to hold the £(9)m (December 2021: £(7)m) adjustment against CBILS as the 80% government guarantee is not fully recognised in the models. In instances where Barclays has assessed the BBLS exposure to have not met strict assessment criteria, no claim has been made against the government guarantee resulting in an impairment allowance against these loans of £33m (December 2021: £16m) as at the balance sheet date. Additionally, while the government supported loans are covered by guarantees, many BBLS customers have other financing arrangements with Barclays which are not covered by the government guarantee. Noting the elevated levels of delinquency across the BBLS population, Barclays has continued to apply management adjustment of £0.1bn to BBLS customers outside the scheme.

Barclays PLC - Annual Report - 2022 Page 337 Page 339

Barclays PLC - Annual Report - 2022 Page 337 Page 339