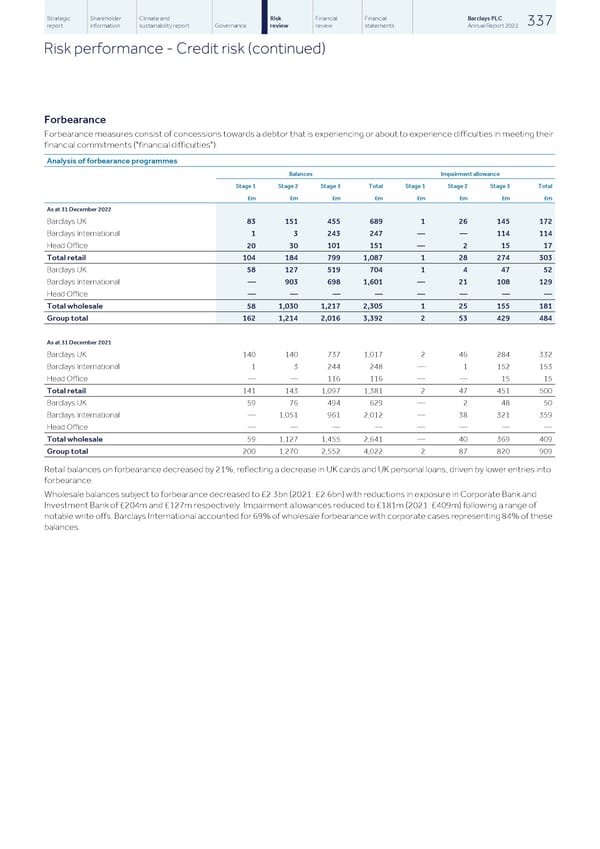

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 337 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Credit risk (continued) Forbearance Forbearance measures consist of concessions towards a debtor that is experiencing or about to experience difficulties in meeting their financial commitments ("financial difficulties"). Analysis of forbearance programmes Balances Impairment allowance Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total £m £m £m £m £m £m £m £m As at 31 December 2022 Barclays UK 83 151 455 689 1 26 145 172 Barclays International 1 3 243 247 — 114 114 — Head Office 101 151 15 17 20 30 — 2 Total retail 104 184 799 1,087 1 28 274 303 Barclays UK 58 127 519 704 1 4 47 52 Barclays International — 903 698 1,601 — 21 108 129 Head Office — — — — — — — — Total wholesale 1,030 1,217 2,305 1 25 155 181 58 Group total 162 1,214 2,016 3,392 2 53 429 484 As at 31 December 2021 Barclays UK 140 140 737 1,017 2 46 284 332 Barclays International 1 3 244 248 — 1 152 153 Head Office — — 116 116 — — 15 15 Total retail 141 143 1,097 1,381 2 47 451 500 Barclays UK 59 76 494 629 — 2 48 50 Barclays International — 1,051 961 2,012 — 38 321 359 Head Office — — — — — — — — Total wholesale 59 1,127 1,455 2,641 — 40 369 409 Group total 200 1,270 2,552 4,022 2 87 820 909 Retail balances on forbearance decreased by 21%, reflecting a decrease in UK cards and UK personal loans, driven by lower entries into forbearance. Wholesale balances subject to forbearance decreased to £2.3bn (2021: £2.6bn) with reductions in exposure in Corporate Bank and Investment Bank of £204m and £127m respectively. Impairment allowances reduced to £181m (2021: £409m) following a range of notable write offs. Barclays International accounted for 69% of wholesale forbearance with corporate cases representing 84% of these balances.

Barclays PLC - Annual Report - 2022 Page 338 Page 340

Barclays PLC - Annual Report - 2022 Page 338 Page 340